Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Stocks Do Well Overall

Meanwhile, Shares of drug firms rose modestly in the first quarter, and biotech companies fell slightly

by William J. Storck

April 16, 2007

| A version of this story appeared in

Volume 85, Issue 16

THE FIRST QUARTER of the new year was good for chemical company stock prices, which once again outperformed not only shares of the pharmaceutical and biotechnology companies that C&EN sampled, but also the major stock market indexes such as the Dow Jones industrial average and the Standard & Poor's and NASDAQ indexes.

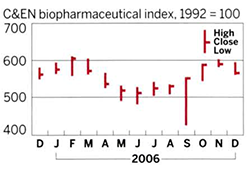

By the end of March, C&EN's index of 25 chemical company stocks had grown 5.2% from the close of 2006, to 248.1 (all C&EN indexes are relative to 1992 = 100). C&EN's index of nine drug companies increased 3.0% to 405.3, while the 13-company biotechnology index fell 1.5% to 558.8.

During the same period, the Dow Jones declined 0.9%, the S&P 500 increased 0.2%, and the NASDAQ was up 0.3%.

It is somewhat surprising that chemicals held up so well, considering that on Feb. 27 the Dow Jones fell a steep 3.2% from the previous day and the S&P 500 dropped 3.5%. The chemical index declined a slightly greater 3.6% on that date, but it had built up enough prior momentum that it finished the quarter in better shape overall.

The improvement in chemical stocks was widespread among the 25 companies, 20 of which showed increases in the quarter. The two strongest companies were fertilizer producers Mosaic and Terra Industries. Both benefited from forecasts by the Department of Agriculture and consultants that corn planting in 2007 would be up strongly because of greater demand for corn to make ethanol for gasoline and higher prices for the grain.

Terra's stock registered the strongest performance among the 25 firms, rising 46.1% to $17.50 per share. This rise followed a 58.4% increase for the firm in the final quarter of last year over the previous quarter and a 113.9% surge in all of 2006 compared with 2005.

Mosaic's stock showed the second largest quarterly growth, increasing 24.8% to $26.66 per share, continuing a trend seen in 2006. At the end of the fourth quarter last year, its stock price was 29.8% higher than it had been at the end of the previous three-month period and 46.0% higher than its 2005 closing price.

The two largest chemical companies, Dow Chemical and DuPont, both showed increases in the quarter, but by very different percentages. Dow's stock price rose 14.8%, at least partly on rumors that a private equity company was going to buy the firm, to close the period at $45.86 per share. DuPont eked out a 1.5% rise to $49.43 per share.

Two of the companies in the C&EN chemical company index, Albemarle and Sigma-Aldrich, had two-for-one stock splits in the first quarter. Stock splits usually mean above-average share-price growth, and these were no exception. Albemarle's stock price rose 15.2% to close March at a split-adjusted $41.34 per share, and Sigma-Aldrich's stock improved a smaller 6.8% to $41.52 per share.

Only five firms showed declines in the quarter. Chief among these was Stepan, whose shares began to fall after its fourth-quarter earnings results were released on Feb. 13 and showed a $5.5 million loss. The company's stock ended the quarter down 17.1% to $26.25 per share.

Stepan was closely followed by Georgia Gulf with a 16.1% decline in its stock price to $16.21 per share. Georgia Gulf made investors uneasy when, because of problems caused by write-downs and an acquisition, the company could not get its fourth-quarter 2006 results out in a timely manner.

The drug companies that C&EN tracks were not as fortunate as chemical makers in the fourth quarter, posting much smaller gains in share prices overall. Three firms reported declines, and six had advances.

The two companies at the top of the alphabetical listing, Abbott Laboratories and Baxter International, coincidentally led the gains in stock price.

Abbott's stock increased 14.6% to close the quarter at $55.80 per share. Most of the gain came late in the quarter after the company released results of clinical studies showing that its new coronary stent Xience outperformed Boston Scientific's Taxus stent in some respects. The studies showed that patients who received Abbott's stent had a somewhat lower rate of such major complications as heart attack, the need for a repeat procedure, and death.

Baxter's stock price increase of 13.5% to $52.67 per share came as the company saw large earnings growth. The firm's fourth-quarter earnings from continuing operations increased 47% over the same period in 2006 to $433 million.

Among the 13 biotech companies that C&EN surveyed, eight had improved stock performance in the quarter, while five saw their share prices decline. Xoma had the largest percentage gain, 31.4% to $2.89 per share, but it doesn't take much to move prices up or down at firms with low stock prices. The reverse of this phenomenon was seen at Cytogen, whose stock price fell 10.3% to finish the quarter at $2.09 per share.

The largest decline in a biotech stock, 25.1% to $28.04, occurred at Vertex Pharmaceuticals. The decline came after company executives predicted a loss of $360 million to $390 million in 2007, far greater than the $207 million loss seen in 2006.

The second largest decline came at industry leader Amgen, where the share price fell 18.2% to $55.88 per share. The decline began moderately in late January when the company announced its fourth-quarter and full-year earnings. But the price drop accelerated in mid-March, when studies showed that Amgen's colon cancer drug Vectibix actually accelerated the development of colon cancer when used with Genentech's Avastin.

By the end of the first week of the second quarter, major stock indexes had improved. Compared with the end of the first quarter, the Dow Jones rose 1.7%, the S&P 500 was up 1.6%, and the NASDAQ jumped 2.0%.

Meanwhile, C&EN's chemical company index was up 1.2% compared with the last trading day in March, while the biotech index improved 2.1%, and pharmaceuticals rose 2.2%.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter