Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Stocks Outperform Again

Index of 25 chemical companies continues to beat other industry sectors

by William J. Storck

October 15, 2007

| A version of this story appeared in

Volume 85, Issue 42

SPURRED BY OPTIMISM among investors and security analysts, chemical stocks continue to beat not only the major market indicators such as the Dow Jones industrial average, the Standard & Poor's 500 stock index, and the NASDAQ, but also the pharmaceutical and biopharmaceutical indexes.

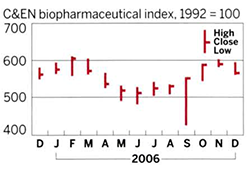

In fact, C&EN's chemical stock index has risen faster than its indexes for drugs and biotech stocks as well as the major indicators for four straight quarters. While the C&EN index of the aggregate average stock price for 25 chemical companies at the end of the third quarter was 6.4% ahead of the second-quarter close at 293.2 (all C&EN measures are indexed from the average stock price in 1992), the index for 12 biotech firms rose 3.9% to 586.8, and the closing index for eight pharmaceutical companies was down 2.3% to 417.0.

For the broader indexes, the Dow Jones increased 3.6%, the S&P 500 managed a 1.6% rise, and the NASDAQ was up 3.8%.

A comparison of the third-quarter closing indexes with those at the end of last year shows the same pattern. The chemical index was up 24.3%, while that for pharmaceuticals rose 6.0%, and the biopharmaceutical index increased only 3.4%. The Dow Jones was up 11.5%; the S&P, 7.6%; and the NASDAQ, 11.8%.

Although the overall chemical index showed significant improvement from both the end of the second quarter and the end of the year, there was a great disparity among the companies, ranging from double-digit rises in stock price to double-digit declines. The best quarter-to-quarter percentage increase was at Mosaic. Driven by greater demand for nutrients for corn and other crops, the fertilizer producer's stock price increased 37.2% from the end of the second quarter to close at $53.52 per share. Compared with the end of 2006, the company's stock price was up 150.6%.

This was not the greatest increase from the end of last year among the chemical companies, however. Terra Industries, the other fertilizer maker on the list, saw its stock price jump 160.9% over the final trading day of 2006 to $31.26. From the end of the second quarter, its share value was up a healthy 23.0%.

Other chemical companies have seen very good stock performance on the basis of underlying financial moves. For instance, Air Products & Chemicals' stock, which throughout the year had been doing pretty well, rose 21.6% from the end of the second quarter to close at the end of September at $97.76 per share. On Sept. 24, Air Products' stock price was bolstered by an announced $1 billion stock buy-back. In the following five days, the stock rose 5.7%.

FMC, during the quarter, announced a 2-for-1 stock split, which helped its share price increase 16.4% to a split-adjusted $52.02 per share. And Huntsman Corp. saw a 9.0% increase for the quarter to $26.49 per share as a result of Hexion Specialty Chemicals' $27.75 per share offer for the company.

On the other hand, there were some large declines in the third quarter from the second-period close. Cabot's stock price fell 25.5% to close on the last trading day in September at $35.53 per share; Georgia Gulf fell 23.2% to $13.90 per share; Chemtura was down 20.0% to $8.89 per share; and Ferro dropped 19.9%, with a closing third-quarter share price of $19.98.

The two industry leaders, Dow Chemical and DuPont, had slight declines for the quarter. Dow's stock fell 2.6% to $43.06 per share, while shares of DuPont were off 2.5% from the end of the second quarter to $49.56 per share.

STOCK PRICES among the drug companies that make up C&EN's pharmaceutical index were fairly stable, except for Wyeth. That company's stock price was down 22.3%, compared with the end of the second quarter, to close at $44.55 per share. Throughout the quarter, Wyeth stock was hit by a number of adverse announcements relating to drugs the company has been developing.

Bristol-Myers Squibb and Pfizer had more modest declines for the quarter. Bristol-Myers was off 8.7% to $28.82 per share, and Pfizer's share price declined 4.5% to $24.43.

Among the remaining five companies, the share price increased from 0.1% at Abbott Laboratories to 6.6% at Johnson & Johnson.

Biotech companies also were relatively stable for the quarter, as indicated by the 3.9% increase in the biopharmaceutical index from the second-quarter close. The largest gains were 34.5% at Vertex Pharmaceuticals to $38.41 per share and 24.0% at Biogen Idec to $66.33 per share. Vertex' price has been rising on hopes for an experimental drug for hepatitis C. Biogen Idec's increase comes from a stock buy-back and speculation about a takeover, according to analysts. Celera Genomics also saw a healthy increase of 13.4% to $14.06 per share.

Amgen, the largest biotechnology company, saw its stock price rise 2.3% to $56.57 per share. And Genentech, the number two company, rose 3.1% to $78.02 per share.

In the first week of the fourth quarter, chemicals lost some of their luster compared with other sectors and the major indexes. By Friday of that week, the chemical index rose just 0.9%, while the indexes for pharmaceuticals and biopharmaceuticals increased from the end of September 3.5% and 3.6%, respectively.

Meanwhile, for the broader market indicators, the Dow Jones increased 1.2%, the S&P rose 2.0%, and the NASDAQ improved by 2.9%.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter