Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Materials

Carbon Nanotubes By The Metric Ton

Anticipating new commercial applications, producers increase capacity

by Ann M. Thayer

November 12, 2007

| A version of this story appeared in

Volume 85, Issue 46

THE RECENT DECISION by electronics retailer Best Buy to stop selling analog televisions confirmed that a new technology had finally displaced an old one. Around the same time, Japanese electronics maker Sony announced that it would launch the first TV using organic light-emitting diode (OLED) technology. It comes with a small 11-inch screen and large $1,700 price tag.

Consumers know all too well that high prices and limited availability are typical for new technologies. Prices decline and consumption grows when manufacturers improve and expand production.

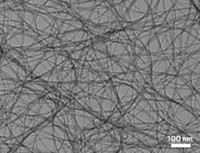

Markets for carbon nanotubes are experiencing these same dynamics. Carbon nanotubes, which are hexagonal lattices of carbon atoms rolled into minuscule single- or multiple-layer tubes, have unique physical properties. Expensive lab curiosities just 15 years ago, they are now moving into real-world uses, and producers are upping capacity to meet demand.

Although nanomaterial providers say Sony's OLED TVs don't contain nanotubes, displays and other electronics devices are key target markets, especially for high-priced single-walled carbon nanotubes (SWNTs) with unique electrical properties. Meanwhile, multiwalled carbon nanotubes (MWNTs) are generally easier to make at large scale and thus less expensive. Product developers are using MWNTs for their high thermal conductivity and to add mechanical strength and electrical conductivity to polymer composites.

A decade ago, carbon nanotubes were sold primarily in tiny research quantities for hundreds or thousands of dollars per gram. Highly purified or functionalized tubes still cost this much. But as more companies entered the market and production levels grew, MWNT prices fell to thousands of dollars per kilogram. By 2005, MWNT prices had come down to several hundred dollars per kilogram, producers tell C&EN, and today, large quantities of tubes can cost half that much or less, depending on their features. Prices are expected to fall even further as capacity continues to rise.

Recent market analyses by Freedonia Group and other firms forecast sales of all nanotubes to reach $1 billion to $2 billion annually within the next four to seven years. In terms of dollar value, electronics devices will be the largest end-use category, although composite materials in automotive applications may account for greater volumes. These volumes are expected to approach several thousand metric tons per year.

"There is going to be a huge business potential in the future that cannot be satisfied with the current production capacity in place," says Martin Schmid, head of global Baytubes operations at Bayer MaterialScience. Over a two-year period, Bayer's research efforts in MWNTs have grown into a commercial business based on a cost-efficient method for producing high-quality tubes. In September, Bayer opened a 30-metric-ton-per-year plant in Germany, bringing its total capacity to about 60 metric tons.

Much of large-scale production, such as Bayer's, uses catalytic chemical vapor deposition (CVD), a well-established process in which a carbon-containing gas is broken down, freeing the carbon atoms to reform as nanotubes in the presence of a catalyst. Other nanotube production methods, which vary in the quantity and purity of the tubes they can produce, include laser ablation, arc discharge, and high-pressure carbon monoxide processes.

DEPENDING ON the catalyst and processing conditions, materials made by CVD may vary in morphology and properties, often by design to meet specific customer needs. Beyond reasonable costs, manufacturers say customers want reproducibility and consistent purity. And newer processes are not only lowering production costs but also reducing large quantities of unwanted impurities that previously had plagued some commercial production.

"We are in the process of planning a new production line of 200 metric tons that we expect to be on-stream by 2009," Schmid says. "Depending on the success of that operation, our vision is to have 3,000 metric tons of capacity in place by 2012." Bayer's strategy, he explains, is to expand the market by making product available "in industrial quantities at reasonable, industrially viable prices and thereby open up possibilities for new applications."

"We work very closely with present and potential customers," Schmid says, helping them incorporate the materials in their products. He says Bayer's approach is to sell nanotubes essentially "out of the reactor," rather than as compounded products or as premixed materials, known as masterbatches, intended to be incorporated into plastics.

The company has partnered with Nanoledge in Germany to add Baytubes to epoxy resins used in sporting equipment. Bayer also has a supply agreement with FutureCarbon, which makes solvent-based nanodispersions and concentrates for processing into other materials.

Hyperion Catalysis International of Cambridge, Mass., has taken a different approach, selling masterbatches and compounded materials, explains marketing manager Patrick Collins. Binding or encapsulating the material, which is part of the company's compounding processes, also helps address environmental, health, and safety concerns regarding exposure to free nanotubes.

"We have done the dispersion step and sell concentrates or plastics containing the nanotubes, typically in concentrations of 15–20% by weight," Collins says. Because nanotubes are strong, but extremely lightweight, and can be highly electrically conductive, the final loading in a plastic part may be just 2–5%, or even less.

OUT OF THE REACTOR, carbon nanotubes may be intertwined or agglomerated, and subsequently dispersing them in another medium is critical to making them useful. Many nanotube producers and nanomaterial developers have proprietary dispersion processes. Nevertheless, "we're not a drop-in product," Collins emphasizes. "When people start to use nanotubes, they are quite likely using them in an advanced product for the first time, so we have to work closely with them." Hyperion's customers have included Degussa (now Evonik) and GE Plastics for polymer composite applications.

According to Collins, Hyperion was the first large-scale MWNT manufacturer and is now the largest, with "tens of tons" of capacity. The company started producing what it called carbon fibrils in 1983, patented its process in 1987, and launched its first commercial application in 1991.

Automotive uses include static-dissipative fuel-handling components and conductive body panels for electrostatic painting. In electronics fabrication, Hyperion nanotubes find use in ultrasmooth and hyperclean antistatic plastic containers for transporting, handling, or housing components. The company is exploring applications in elastomers and in flame retardant systems, Collins says.

In its more than 20 years, Hyperion has seen small- and large-scale competitors emerge; about 35 MWNT suppliers can be found on supplier lists. Along with Bayer and Hyperion, other leading producers include France's Arkema, Belgium's Nanocyl, Iljin Nanotech in South Korea, and Shenzhen Nanotech Port in China. Japan's Mitsui has a joint venture with Hodogaya Chemical for nanotube R&D, production, and distribution.

"Nanotubes are not yet a commodity, and it's not enough just to 'buy nanotubes,'" Collins remarks in reference to the emergence of importers that sell inexpensive tubes from other sources. "We manufacture and sell at an attractive price based on the volume that is purchased. It's not our intent—and we hope it's not our competitors'—to sell product based on price. It should be based on performance."

Price and performance are strategic for Cnano Technology. The Menlo Park, Calif., company was founded in 2006 with a plan to change the economics of nanotube production and advance applications using extremely pure nanotubes. Cnano has what it calls a "novel hybrid technology" for low-cost MWNT production and a manufacturing site in China. In July, CMEA Ventures, Pangaea Ventures, and WI Harper invested a combined $6 million in the company.

Similarly, Catalytic Materials of Pittsboro, N.C., touts a patented process for making high-purity MWNTs. And San Jose, Calif.-based Ahwahnee Technology claims it can supply large-scale quantities of raw, treated, or premixed MWNTs. It offers MWNT kits to enable end users to test materials.

Among the leading large-scale producers is Nanocyl, formed five years ago as a spin-off of Belgium's University of Namur. In mid-2005, it started up a 15-kg-per-day reactor, and today it has an annual capacity of 40 metric tons for industrial, specialty, and research nanotubes. The company sells industrial-grade MWNTs as liquid dispersions or epoxy and thermoplastic solid forms. Earlier this year, it joined with the German distribution company Velox to help increase its European market presence.

Nanocyl says it plans to ramp up its catalytic CVD process further to meet growing demand. It opened a U.S. subsidiary in 2006 and works in Asia through partners. It also is involved in several European collaborations to develop applications, among them Nanofire, targeting flame-retardant materials, and Nanohybrid, for nanostructured polyolefin materials.

Nearly two years ago, Arkema started up a pilot-scale MWNT facility in Lacq, France, and now can produce between 10 and 30 metric tons per year, says Jean-Marc Corpart, director of new business development within Arkema's corporate R&D division. Interest has been strong worldwide, he says, and the company is working on an expansion that may be in place by 2010. Although the exact capacity has not been determined, Corpart estimates it will be "hundreds of tons."

Arkema began by selling nanotube powders made by catalytic CVD methods. "While the powders are still available, we have become very active in developing more products where the nanotubes are already dispersed," he says. These include the firm's Graphistrength nanotubes, which can be added to plastics to enhance mechanical or electrical properties.

Like many of its competitors, Arkema has supply relationships with product developers and is exploring other collaborations. "There are now some real markets, although they are still small and it is still an emerging technology," Corpart says. But an increasing number of potential users are studying and qualifying nanotube-containing materials. "There are real improvements in using nanotubes, and with the proper price positioning, the market will definitely develop," he adds.

Arkema has a partnership with Zyvex Performance Materials, a Columbus, Ohio, developer of nanomaterials. ZPM purchases single-, double-, or multiwalled tubes and produces dispersed additives and concentrates for various applications. Its products are used by sport equipment makers Aldila and Easton Sports, as well as by aerospace, defense, health care, and electronics customers in a range of resin systems.

"We have a proprietary technology that debundles the nanotubes, treats the surface, and then allows them to bond to the host matrix," explains Lance Criscuolo, ZPM's vice president of global sales. In the best cases, nanotubes will simultaneously offer more than one property. Besides electrical, thermal, or structural improvements, nanotubes can beneficially affect material processing and reduce manufacturing costs, Criscuolo says.

Although SWNTs are not yet available in quantities near those of MWNTs, the often more complex production process is being scaled up by dedicated producers as well as those making a variety of tubes. For example, Nanocyl and the British firm Thomas Swan offer both MWNTs and SWNTs. Swan launched its business in 2004, using a CVD process developed with the University of Cambridge.

THE SWNT MARKET is not as populated as that for MWNTs, although it includes as many as two dozen companies, such as Norman, Oklahoma-based SouthWest NanoTechnologies (SWeNT), Carbolex in Pennsylvania, and Canada's Raymor Industries. In March, Raymor said it would offer three high-purity grades of SWNT based on new purification capabilities. It produces SWNTs by a plasma-torch process that it describes as a hybrid of CVD and arc methods.

The National Aeronautics & Space Administration, meanwhile, has been licensing an arc-discharge technology it developed for producing low-cost, high-quality SWNTs. In 2005, Idaho Space Materials in Boise was created around the lab-scale process. The company claims that it has scaled up the technique to make SWNTs at the high rate of 50 g per hour without metal contaminants. Because the process doesn't use catalysts, there are no catalyst costs or costs associated with metal removal. Another company, Nanotailor of Austin, Texas, was created around the same NASA technology earlier this year.

Westwood, Mass.-based Nano-C recently was selected by the National Institute of Standards & Technology to develop a new manufacturing process for nanostructured carbon materials, including fullerenes and SWNTs. The company was founded in 2001 by Jack B. Howard, an emeritus professor of chemical engineering at the Massachusetts Institute of Technology who invented a combustion process for making fullerenes.

Advertisement

Under this NIST Advanced Technology Program grant, Nano-C will get about $2 million over three years and pay about 30% of the costs. The goal is to increase yields 10-fold, reduce production costs, and enable wider use in energy, electronics, medical therapies, and advanced materials.

Meanwhile, SWeNT has raised $5 million and broken ground on a $3.9 million facility. The plant will use a catalytic CO disproportionation process, called CoMoCAT, developed by University of Oklahoma chemical engineering professor Daniel Resasco, who founded SWeNT in 2001 and is its chief scientist. The process decomposes pure CO at 1 to 10 atm and 700–950 ??C into C and CO2. By optimizing the catalyst and reaction conditions, the process can selectively grow significant amounts of SWNT in less than an hour.

"The first manufacturing platform will produce a kilogram per day of SWNTs, and we expect to be operating in the second quarter of 2008," says Chief Executive Officer David J. Arthur. The facility is designed to allow further expansion. The company will produce specialty SWNT grades, priced at about $500 per g, having ultrafine diameters and highly controlled chirality. It also will make high-purity commercial grades with slighter larger diameters and broader chirality distributions for about $50 per g in 1 kg quantities.

According to SWeNT, its process benefits from being very scaleable yet highly selective at larger reactor sizes. "The ability to design materials at the molecular scale for a specific purpose is unique to SWNTs versus MWNTs," Arthur says. "SWNTs are attractive because you can control the structure of the nanotube and tailor it for a specific application." This tailoring can include controlled optoelectrical responses or electrical properties ranging from high conductivity to semiconducting behavior.

TARGET MARKETS for SWNTs include transparent electrodes in displays, photovoltaics, molecular wiring in energy applications, biosensors, drug delivery, and semiconductors. As companies expand and others enter the market, many observers suggest that prices for standard SWNTs could drop by a factor of 10.

"People are not even going to start the product development journey unless they know that they can eventually get the quantities they need in consistent quality at a reasonable price," Arthur says. SWeNT positions itself as a SWNT manufacturer and nothing more. "The market is big enough, and we will be profitable enough, that we don't need to move up the value chain," he adds.

A few years ago, Carbon Nanotechnologies Inc. (CNI), the Houston company formed in 2000 by the late nanotechnology pioneer Richard E. Smalley, constructed a SWNT pilot plant. In 2005, it also began offering double-walled nanotubes in up to kilogram amounts. DWNTs behave similarly to SWNTs but have some unique properties and can be produced by CVD methods; CNI uses Smalley's high-pressure CO (HiPCO) process for SWNTs.

Earlier this year, Unidym, a developer of nanotube-based products for the electronics industry, acquired CNI. The combination gives Unidym a large patent estate for nanotube production and applications. The company's first product for the flat-panel display market is a transparent electrode to replace ones made of indium tin oxide. It also is developing nanotube-based thin-film transistors for flexible electronics.

Demand for transparent conductors is increasing and nearly every major display company is developing flexible displays, according to Paul Drzaic, Unidym's chief technology officer. He believes that nanotube-based materials will provide improved performance at lower cost. "Carbon nanotube technology has taken a while to develop, and market conditions also need to be ready," he says, "but we're delighted with how the demand side seems to be ramping up."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter