Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Colombian Oil Company Pushes Downstream Into Chemicals

by Alexander H. Tullo

January 7, 2008

| A version of this story appeared in

Volume 86, Issue 1

Another Latin America petroleum firm is on the offensive in the chemical business. Colombian state oil company Ecopetrol is buying Colombia's leading polypropylene firm, Propilco, for $690 million.

Propilco generates annual sales of more than $600 million. It has 380,000 metric tons of polypropylene capacity, making it the largest petrochemical producer in Colombia and the largest plastics company in the Andean region.

Though Ecopetrol is a sizable oil company, its involvement in petrochemicals has been modest. The company's annual output of about 87,000 metric tons of ethylene and 57,000 metric tons of polyethylene makes it orders of magnitude smaller than the global petrochemical giants.

The company expects the acquisition to help bridge that gap. It sees synergies between its oil operations and Propilco, which already is an Ecopetrol customer. The company also hopes Propilco will give it the critical mass to advance new petrochemical projects in the country.

"This acquisition has enormous strategic value for Ecopetrol because it will take advantage of the synergies between exploration, production, refining, and the rest of the petrochemical chain," says Ecopetrol President Javier Gutiérrez.

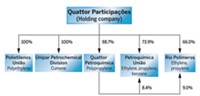

Ecopetrol joins Petrobras, Brazil's state oil company, in seeking to boost its petrochemical presence. Last year, Petrobras purchased Suzano Petroquímica and took part in a consortium that bought out oil and chemical firm Ipiranga. Petrobras is using some of these chemical assets to form a new company with Brazilian industrial group Unipar. It is also planning an $8.5 billion petrochemical complex for Rio de Janeiro.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter