Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Building A Towering Success

Swiss chemical industry focuses on innovation to keep one step ahead of competitors

by Patricia L. Short

March 17, 2008

| A version of this story appeared in

Volume 86, Issue 11

THE SWISS CHEMICAL INDUSTRY owes its start to silk ribbons. Fashionable, fragile, frivolous silk ribbons, it turns out, were the inspiration for one of the most successful pharmaceutical and specialty chemical industries in the modern world.

Specifically, it was dyes and colors for silk that got the industry its serious start in the mid-18th century. The silk textiles industry was a major presence in Switzerland at the time, supplying luxury fabrics throughout the world. And supplying dyes and colorants for these textiles was one of the sexiest industries around.

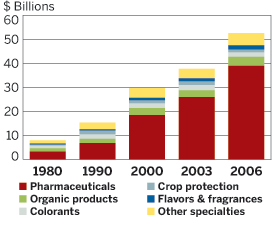

Since then, companies have evolved to form an industry that in 2006, the latest year for which complete data are available, saw its top 10 chemical and pharmaceutical producers ring up sales of $110 billion, according to the Swiss Society of Chemical Industries (SSCI). Some of those companies are products of the convulsive wave of mergers and spin-offs that marked the industry in the mid-1990s, particularly in the city of Basel. The result of this turmoil was the pharmaceutical giant Novartis, specialty chemical producers Ciba and Clariant, and the crop protection and seeds company Syngenta.

In 2006, those 10 companies employed nearly 272,000 people worldwide and 64,400 in Switzerland alone. The SSCI's top 10 includes Novartis, Ciba, Clariant, Syngenta, Givaudan, Roche, Firmenich, and Lonza. At the other end of the scale, the number of start-up biotech companies in Switzerland tripled from 70 to 210 between 1998 and 2003, according to a report from Ernst & Young, employing 11,000 people and generating sales of $3.6 billion in 2003.

Switzerland is solidly among the top 10 countries worldwide in exports of chemicals and pharmaceuticals, proclaims SSCI. And the country's companies have been increasing their R&D spending: In 2006, the top 10 drug and chemical producers spent $13.5 billion on R&D; about $9 billion of that was spent outside Switzerland. In 2003, the firms spent only $10.3 billion total on R&D and a little less than $7 billion of that was spent outside Switzerland.

According to SSCI data, the combined chemical and drug industry has been the fastest growing of all Swiss industries during the past decade. From a base index of 0 in 1995, chemical industry output grew to more than 140 in 2006; the country's next-most dynamic industry was electrical engineering, which came in at a mere 30 in 2006. And the industry's exports of $53 billion in 2006 made up 34% of Switzerland's total exports, second only to metals and machinery.

That's a remarkable performance for a country with two strikes against it: It is landlocked, and it has no petrochemical raw materials. But the nation that entered the 19th century as one of the poorest in the world overcame those problems with a surprising clutch of solutions.

SEVERAL OF THE SOLUTIONS reflect the natural resources that Switzerland possesses. For example, salt deposits near Basel supplied the sodium chloride needed to produce dyes, and the fast-flowing Rhine River provided process water and a place for waste disposal. Hence, big dye and colorants producers were established along the Rhine: Geigy; Sandoz; and Ciba, which is an acronym for Chemical Industry of Basel.

Similarly, Lonza was founded on the Lonza River, a small tributary of the Rhône, to harness hydropower for producing acetylene and carbide for the lighting industry. Subsequently, the firm began using acetylene as a feedstock for chemical production.

Nevertheless, Swiss managers attribute the industry's success not only to the country's modest natural resources but also to a prosaic mix of patents, pensions, education, and the country's confederation of cantons, roughly equivalent to states in the U.S.

Martin Riediker, the chief innovation officer at Ciba, sees much strength coming from the stability of the country's workforce. This stability, he says, can be traced to the Swiss industry's adoption of pension systems that attracted "a huge flow of talent and skills into the Rhine Valley" in the early-20th century.

Because companies had good pension programs, "people stayed for their entire working lives. All of the knowledge that was built up in the companies was kept in the country," he says.

Riediker also cites the country's patent history. Historically, patent law in neighboring Germany covered chemicals, and Swiss patents excluded them, he points out. European entrepreneurs responded by starting up companies across the Rhine, in Switzerland, to circumvent Germany's patent protection. They could start companies and compete from the Swiss side of the Rhine in markets that German competitors had already established.

Switzerland eventually tightened up its patent laws, and the country's industry had to turn to innovation, rather than imitation, to succeed.

According to Christoph Mäder, head of legal and taxes and company secretary at Syngenta, today's focus on innovation is supported "by a tradition of excellent education in natural sciences for many decades. We have a basic pool of people suitable for the industry."

Lukas Utiger, head of Lonza's life sciences ingredients division, also emphasizes the contribution of education, particularly the apprenticeship programs sponsored by the government.

Students completing the equivalent of high school who do not want to pursue a university education can choose commercial schooling or enter an apprenticeship, he explains. Depending upon the training, commercial schooling can run for three to four years and include courses in chemical technology and language, as well as work with companies. Apprenticeships offer training for more specific posts, such as joiners, electricians, lab technicians, chemical workers, and mechanics. The result, Utiger says, is a workforce with "a guaranteed certain basic quality."

PARALLEL TO this technical education is a good collection of universities, he says. The Swiss Federal Institute of Technology in Zurich and Lausanne "is in the top league globally," Utiger maintains. Moreover, "we have very strong local universities," he says. For example, the University of Basel has traditionally been strong in chemistry and is now known for biotech as well, he adds.

And just as the university system breeds Swiss researchers who tend to know each other, the Swiss Army breeds corporate managers who tend to know each other, points out Ian Shott, an Englishman who worked for Lonza, in Visp, earlier in his career. Shott is now chairman of the British technology firm Excelsyn.

Until the 1950s, Shott says, as many as 500,000 Swiss were on active military duty or in reserve at any given time, thanks to the Swiss Army's conscription program. At the time, this was a significant number in a country of fewer than 7 million people.

From his vantage point as a Briton working to develop Lonza's fine chemicals business, Shott says that during his time there "we had at Lonza a lot of colonels in a network where hundreds of people went off to the Army. They communicated with each other-that was their link." Today, the Army's ranks are closer to 200,000, but "the concept of networking is still there," he observes.

Shott also contends that much of the country's success harkens back 700 years to the formation of Switzerland as a confederation. The individual cantons have a great deal of independence in decision-making and tax regimes, and this can benefit strong local companies.

For example, Shott points out, cantons can lower taxes to encourage companies or people to locate there, just as states in the U.S. tailor investment packages to entice employers. "High-level people may have to come into the locality," he says, "but a company needs locals, too"—for example, administration staff, technicians, and facilities management staff.

Utiger would support this point. He notes that Lonza directly employs about 2,800 people at its relatively remote location in Visp. But another 2,500 jobs in the community depend on the company. "Visp and the canton depend on our tax payments and our employees," he says.

Those related jobs and businesses contribute to a strong chemistry network, notes Ciba's Riediker, who cites the "hundreds of companies" supplying the chemical industry with everything from vats and kettles to software and high-throughput screening services. "The clusters aren't just the chemical companies. It is the hundreds of other functions that come together. Once you build up a cluster, you can compete," he says.

Perhaps the most important of these clusters is in Basel, home to Ciba, Syngenta, Clariant, and the drug companies Novartis and Roche.

Syngenta's Mäder says, "We are always amazed a bit" by the staying power of the industrial nucleus in Basel. Germany was once the pharmacy of the world, he points out, but now most of its large pharmaceutical companies have vanished. In contrast, he adds, "we have two of the world's giants within 2 square kilometers" in the middle of Basel. "It is quite remarkable that this cluster of companies is still headquartered here" along with the promising offshoots of companies that are also mushrooming.

Pharmaceuticals make up three-quarters of the industry's sales.

SOURCE:Swiss Society of Chemical Industries

SEEN FROM THE AIR, Syngenta's headquarters site in Basel is a complicated arrangement of offices, labs, manufacturing facilities, and even small seed test plots. In early days, the site was the headquarters of Geigy. Ciba was several tram stops away on the same side of the Rhine, and Sandoz was just downstream on the other bank.

When Ciba and Geigy merged in 1970, the huge Geigy site began to grow. When Ciba-Geigy merged with Sandoz to form Novartis in 1996, the site changed even more: Many of the chemical operations were spun off into Clariant, now based in a Basel suburb, and into Ciba, which retained its old headquarters. Syngenta later emerged from the combination of the agribusiness operations of Novartis and AstraZeneca.

Providing a contrast to lush countryside campuses that have sprung up throughout Europe, the busy city complex has also become an incubator for companies in their start-up and early-growth phases.

A case in point is Solvias, an analytical services provider that traces its roots to Ciba-Geigy. The company started in Basel but outgrew its quarters there and has decided to build a new headquarters in the Basel suburb of Kaiseraugst. The new center, which will incorporate offices and laboratory space, is due to open in mid-2010. The firm's synthesis and catalysis business will remain in the current Basel quarters.

Riediker points out that Basel officials have undertaken a big drive to make life sciences businesses sustainable. But he notes that the city, and by extension the country, also wants to maintain companies in fields such as nanotechnology and information technology. "They don't put all their eggs in one basket," he says.

Swiss executives agree that the country's small domestic market forced companies to have an international outlook from the very beginning. And that, in turn, can encourage a company to look internationally for its people.

That's true even for a traditional area such as agriculture, according to Mäder. "Less than 1% of our sales at Syngenta are in Switzerland," he says. In the small country, "agriculture is not seen as a normal business to be in-it's a small-sized traditional activity," almost a craft, he notes, with the average farm in Switzerland consisting of only about 50 acres.

WHAT THAT MEANS is that few young Swiss people think about going into businesses that support agriculture, such as crop protection. Mäder's role as the only Swiss native on Syngenta's executive committee attests to this. "A lot of those careers happen outside Switzerland," he says. "It is not by coincidence that the nationalities are as mixed as they are. Passports are absolutely irrelevant."

This broad international view is enhanced by the country's location on the globe, Utiger observes. "We are very centrally located," he says. Some 150 years ago, "that wasn't that important, but now it is. We have four plants in China and others in the U.S. To manage them out of Switzerland is ideal," he says.

Switzerland's high living standard attracts good international people, Utiger says. "It is cozy and safe-there is freedom for families." That's one reason, he contends, why many U.S. companies have their European headquarters in Switzerland. The Swiss government's economic development agencies are even having discussions with Indian companies looking for a European base, he adds.

Advertisement

As successful as Switzerland has been at maintaining its chemical and pharma sectors, its managers say they aren't complacent about future competition.

Mäder points to nascent competition from Singapore. Singapore's economic development specialists "are focusing on the people side to start with," he says. "You don't focus on assets to start with. You have to get access to the key talent. But that is easier said than done—it can't be done overnight."

To identify the best people and recruit them, Mäder adds, "you have to build up a reputation for being an attractive location," both for business and quality of life. "In a global view, there are dozens of cities that could be just as attractive. We are not unique."

Shott says that "over the past 120 years, Switzerland has become skilled at working out what its resources are" in order to win any game it plays. And it has done this on its own terms, by staying neutral through the past century's wars and, more recently, by not joining the European Union or adopting its currency.

Shott also sees a willingness to abandon businesses that are no longer viable and to invest heavily in those that are. "There is a mentality in Switzerland of renewal and good infrastructure."

"The Swiss," he adds, "can be very proud of what they've achieved."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter