Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Agriculture Saves Chemical Earnings

In the second quarter, high costs take their toll on chemical industry earnings and profits

by Melody Voith

August 18, 2008

| A version of this story appeared in

Volume 86, Issue 33

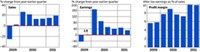

THE U.S. CHEMICAL INDUSTRY experienced a difficult second quarter for earnings and profit margins. Combined, the 25 firms tracked by C&EN posted a solid 17.6% gain in earnings compared with last year. But take out the two pure-play fertilizer companies—Mosaic and Terra Industries—and earnings for the rest of the group were down by 1.3%.

Moreover, second-quarter earnings announcements highlighted a growing consensus that high costs for fuel, raw materials, and food commodities will be long-term trends. In the U.S., housing, construction, and auto demand remained weak, as the subprime mortgage crisis continued to be a drag on the economy.

For the fertilizer makers, higher food and ethanol prices drove earnings to new heights. At Mosaic earnings more than tripled on substantially higher selling prices. Terra reported to investors that high prices made up for weak volumes: This year’s planting season was cool and rainy, and U.S. farmers grew 6% fewer acres of corn than last year.

Agriculture was a needed bright spot for some of the nonfertilizer makers as well. Dow Chemical saw overall earnings fall by 26.7% but posted record sales in its agriculture segment. Dow AgroScience’s portfolio of chemicals and seeds brought in $1.4 billion, helped by strong demand for new herbicides and insecticides. Dow has been building a larger agriculture footprint through recent acquisitions of seed companies such as Duo Maize and Triumph Seeds.

Meanwhile, DuPont raked in $2.5 billion in its agriculture and nutrition business, an increase of 23% from the year-ago quarter. Chief Executive Officer Charles O. Holliday Jr. stressed the company’s attention to “everything that comes from the earth.” In a conference call with investors, he said: “Agriculture is an area where we have been focused for over five years, with commercial payoffs.”

Outside of agriculture, diversified firms continued to rely on price increases and overseas demand for growth. Some companies were able to increase earnings in the second quarter, but almost two-thirds saw their profit margins decrease.

Cytec Industries reported a modest 3.6% increase in earnings compared with the year-ago quarter, primarily because of increased volumes in its engineered materials business. However, volume and price increases were not enough to prevent a dent in the firm’s profit margin, which decreased to 5.7% from last year’s 6.4%.

The description of the quarter by Cytec CEO David Lilley hit on many of the major themes shared by his industry cohorts. He reported to investors that “in the specialty chemicals segments, we continue to grow volumes, except in North America where we are still experiencing lower demand. In addition, we are incurring significantly higher raw material, energy, and freight costs, which are impacting our earnings.” Like many other companies, Cytec is “committed to raising prices in a selective way to offset the rising costs and allow a reasonable return,” Lilley said.

At Dow, price hikes were not enough to cover higher costs. In his report to investors, CEO Andrew N. Liveris outlined the challenge of recouping $1 billion in increased expense in the quarter. The company increased prices across the board by an average of 18%, thereby limiting the margin damage to $130 million.

In addition to Dow, several other firms reported to investors that their price increases have yet to match their accelerating costs. Arch Chemical, H.B. Fuller, W.R. Grace, Chemtura, Hercules, and Rohm and Haas are all still trying to catch up after two quarters.

According to Dmitry Silversteyn, senior research analyst for specialty chemicals at the investment firm Longbow Research, the catch-up will continue for a while. “At the end of last year, there was a feeling that 2008 would be a more benign raw materials environment from 2005–06,” when costs last swung upward, he says. “Because costs flattened in 2007, many thought 2008 would be better. Companies relaxed their pricing discipline. The work is nowhere near done, and they will have to keep raising prices through this year and early next year.”

For some companies, that work has focused on managing customer relationships. As the second quarter was getting under way, Rohm and Haas announced a new indexed raw material and energy surcharge for specialty chemicals, adjusted monthly in anticipation of increasing costs.

IN JULY, Rohm and Haas agreed to be acquired by Dow, proving that hard times have not prevented strategic buying and selling. Two other companies on C&EN’s list—Hercules and Huntsman Corp.—are also in the process of being acquired, and one, Chemtura, put itself up for sale for a while. Huntsman, which has filed suit against acquirer Hexion to force completion of the deal, saw earnings decrease 76.1%, the largest negative of the group. The company blamed higher raw material and energy costs and a $29 million increase in income tax from second-quarter 2007.

According to Longbow’s Silversteyn, the acquisitions are occurring amid a five-year trend toward clean balance sheets and a decreased focus on U.S. markets. Some companies are still scrubbing. This quarter, Chemtura wrote off $320 million of goodwill in its consumer products business. Air Products & Chemicals took an impairment charge of $294 million in advance of divesting its U.S. health care business, and Lubrizol took a $9 million restructuring charge to close North American coatings facilities.

Geographic transformation is already paying off for PPG Industries and Celanese; both beat expectations for this quarter. Lehman Brothers stock analyst Sergey Vasnetsov wrote in a report to investors that PPG’s performance “was a nice beat versus our estimates, as regional and end-market diversification helped to offset a weak U.S. economy and higher raw materials costs.” At Celanese strong demand and strategic expansion in Asia raised earnings 36.5%, making the firm Vasnetsov’s “best stock idea in the commodity intermediate space in 2008.”

Although the quarter’s wide-ranging financial results are a reminder that the markets served by the chemical industry are diverse, corporate outlooks for the second half of the year show remarkable convergence. Industry executives across the board predict that energy and raw material costs will continue to escalate and that the U.S. economy will not recover in the foreseeable future.

Albemarle is focused on managing runaway inflation, which it predicts will accelerate in the second half of the year, reaching $220 million in additional costs compared with last year. In its report to investors, the company warns, “Margin compression due to the rampant input cost inflation has been the most challenging issue facing our businesses and remains our most important area of focus for the remainder of 2008.”

Adding to concerns about further erosion in profits, some executives are beginning to see a global economic slowdown. Dow’s Liveris shared his sober outlook with investors: “The surge in oil prices, which has further weakened the U.S. economy, has created new uncertainties in demand around the world.”

- » Agriculture Saves Chemical Earnings

- In the second quarter, high costs take their toll on chemical industry earnings and profits

- » Cloudy Forecast For Big Pharma

- Second-quarter results are good, but companies’ ability to maintain growth is uncertain

- » Productivity Lag Hits Biotech Results

- Second-quarter sales reflected the lack of new products from big firms

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter