Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Ashland To Buy Hercules For $3.3 Billion

Deal will create a specialty chemical firm focused on additives, paper technologies, and specialty resins

by Marc S. Reisch

July 11, 2008

Ashland has agreed to buy specialty chemical maker Hercules for $3.3 billion, including assumed debt of $700 million. Hercules stockholders will receive $23.01 per share, 38% more than Hercules' closing price on July 10, through a combination of cash and Ashland stock. The two companies expect to close the deal by the end of this year.

The deal marks the second major chemical industry transaction in as many days. On July 10, Dow Chemical said it will buy Rohm and Haas in a deal valued at $18.8 billion.

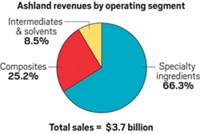

Hercules had sales last year of $2.1 billion. Ashland says the combination of the two firms will create a company with more than $10 billion in annual sales largely from specialty additives and ingredients, paper and water technologies, and thermoset and water-soluble resins. Ashland CEO James J. O'Brien says the acquisition "fulfills our objective to become a leading specialty chemical company."

The acquisition vindicates efforts by Hercules CEO Craig A. Rogerson to build the one-time lagging chemical maker into an "attractive partner for somebody," as he told C&EN in 2004. Now, Rogerson says, "shareholders will receive a significant premium over the current trading price for their shares and, through their ownership of Ashland shares, the opportunity to participate in the upside potential of the combined company."

Chemical industry observers have been waiting for Ashland to make a major acquisition. In 2005, Ashland sold its 38% interest in Marathon Ashland Petroleum to its joint-venture partner, Marathon Oil. Marathon also bought Ashland's maleic anhydride business and 60 Valvoline car oil-change centers. Ashland walked away with $1.1 billion and told investors it intended to make acquisitions in businesses it knew well, such as adhesives, water treatment, and resins.

Ashland made those assertions again in March 2006 when it sold its paving and construction business for $1.3 billion. At the time, O'Brien told investors the sale of the paving business was meant to sharpen the firm's focus on chemicals and enable it to make a multi-billion-dollar acquisition if it found the right opportunity.

Hercules is apparently that opportunity. O'Brien says Ashland will fund the purchase with a combination of cash on hand and debt financing. The new Ashland expects to derive nearly 75% of earnings before taxes and interest from specialty chemicals, versus 45% for the existing firm. Ashland's chemical distribution and Valvoline oil-change business will represent about 25% of the new firm's earnings, compared with 55% for the existing firm.

O'Brien also says Ashland will realize annual savings of at least $50 million by the third year after the transaction by eliminating redundancies and capturing operational efficiencies such as shared raw material procurement and consolidated freight operations.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter