Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada

With an unhappy ending to 2008, Canadian producers aren't eager about beginning 2009

by Alexander H. Tullo

January 12, 2009

| A version of this story appeared in

Volume 87, Issue 2

FOR THE CANADIAN chemical industry, 2008 was a bit like the cartoon character that rides a raft down a quiet river and realizes too late that it is heading for the falls. The first nine months of the year were calm, but the final three were terrible enough to put a damper on the entire year. With such a finish to 2008, Canadian chemical industry watchers don't expect 2009 to begin particularly well.

Largely because they took the last three months of 2008 to be the beginning of a downturn in industry performance, Canadian chemical producers expect 2009 to start off dismally. They forecast steep drops in sales and profits for the year. A possible bright spot, however, may come in the form of a weaker Canadian dollar, which makes the industry in Canada more competitive. Canadian producers also hope for a turnaround in performance by the end of the year.

C&EN projections show that 2008 wasn't so bad. Canadian chemical shipments were fairly strong, increasing by some 6% to $49.6 billion. Sales of basic chemicals and fertilizer were up. One negative, however, was a 2% decline in sales of resins, synthetic rubber, and fibers, largely owing to lackluster results in October, the most recent month for which Statistics Canada reported data.

The higher sales figures were primarily the result of increased prices. Buoyed by a spike in oil prices to as high as $147 per barrel in July, average chemical prices were up nearly 10% for the year.

Production volumes for a few basic chemicals such as chlorine, ethylene, and propylene were down. This is hardly surprising given the decline during 2008 of the North American housing and auto industries, major consumers of derivatives of these chemicals, such as polyvinyl chloride and polypropylene.

Moreover, Pétromont, an ethylene cracker joint venture between Dow Chemical and the Quebec provincial government arm Société Générale de Financement du Quebec, closed at the end of April, hitting Canadian ethylene output. LyondellBasell shuttered two polypropylene plants—one in Quebec and another in Ontario—during the year as well.

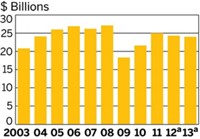

Projections from the Canadian Chemical Producers' Association paint a more middling evaluation of chemical industry performance in 2008. According to CCPA, chemical sales increased 2% in 2008, to $24 billion, for the basic chemicals and resins that the organization tracks. In constant 1997 Canadian dollars, a proxy for volumes because it eliminates the effects of pricing on sales data, sales declined by 7%.

CCPA's outlook for 2009, based on a membership survey, is bleak. Canadian chemical producers expect sales to plummet by 27%, or 13% in 1997 dollars. "We are looking at a recession period that may not see a recovery until the third quarter," says David Podruzny, the trade association's vice president of business and economics.

According to Podruzny, even if the economy recovers at that time, the recession will be one of the longest and most severe on record. He blames its duration and depth on high oil prices as much as on the burst of the housing bubble. "A very rapid run-up in energy prices is probably one of the key underlying players in why this particular downturn has been so severe," he says. "You can't have advanced economies see large net increases in energy and expect them to continue to grow."

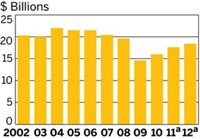

Profits for Canadian chemical makers have soured. In 2007, they saw their highest profits since 2000. In contrast, CCPA projects that profits in 2008 will have declined by 19%. Podruzny says profitability took a hit after the third quarter as prices and demand dropped precipitously.

Back at the beginning of 2008, Canadian chemical makers expected profits to decrease by 10%. Podruzny says profits increased strongly for the first three quarters of the year. In fact, he says he wouldn't have foreseen, even in September, profits declining enough in the last quarter to bring the average below that negative 10% mark.

Profits are shaping up to be so dismal in the last three months of the year that the entire year will see a substantial decrease, Podruzny says. Chemical makers, he says, are struggling just to tread water. "It is a far cry from even three months ago," he says.

Canadian chemical producers believe they are in for a greater decline in 2009: a 35% decrease to about $1 billion in profits industry-wide. That would be the worst the Canadian industry has seen since 2003, the last trough of the chemical business cycle.

Earnings of individual chemical companies through the first nine months of 2008 reveal few clues of the coming downturn. Imperial Oil, the Canadian affiliate of ExxonMobil, reported a 58% increase in profits for the third quarter, to $36 million, on $374 million in sales. For the first three quarters, the company reported a 3% decline in profits on a 15% increase in sales.

Earnings at Nova Chemicals' ethylene and polyethylene business, which operates plants solely in Canada, also remained strong through the first nine months. Sales in the segment increased 39% versus the same period in 2007, hitting $4.5 billion. Meanwhile, operating income climbed 18% to $627 million. Production of polyethylene was up about 9% during the period while selling prices increased 38%.

But Grant Thomson, president of olefins and feedstocks at Nova, says business went downhill after the third quarter. "It was almost like two years in one," he says. "The first year was the first nine months up through September, and the second year started on Oct. 1."

Because of high oil prices worldwide relative to natural gas prices in Canada, plants in Alberta, which use natural gas-derived feedstocks, were enjoying record profits. The "Alberta Advantage"—the difference in the cost of making ethylene in Alberta versus the U.S. Gulf Coast—hit 28 cents per lb in the third quarter, when ethylene was selling for roughly 70 cents per lb. "We were running absolutely as hard as we could," Thomson says.

But soon after, "a significant downturn in demand and prices happened," Thomson recalls, "as people realized that we were into this economic crisis." Ethylene prices tumbled by 40% over the months of October and November. The decline in oil prices, he notes, has also cut into the Alberta Advantage.

The last three months of 2008 weren't entirely bad, however, Thomson says. "We are actually seeing good demand in December," he observes. "It may be that customers have run their inventories down to zero and are in the position that they have to come into the market again."

Nevertheless, Thomson doesn't expect 2009 to be particularly strong. "It wouldn't surprise me if the first and second quarters were difficult," he says. "I am hopeful that we will start to see some general economic recovery in the second half of 2009."

Thomson notes that Nova hasn't been as pessimistic as other industry players about the buildup of petrochemical capacity in the Middle East, a concern that predates the financial crisis. Nova executives have expected big plant start-ups to be spread out instead of starting all at once and inundating the market. "We had a very positive outlook in terms of where we were going in 2009 and 2010," he says. "An outlook that we would see as positive is being strained by economic issues."

THE SUDDEN DOWNTURN also put a damper on the strong year Canadian fertilizer makers were having. Agrium idled production at its Fort Saskatchewan, Alberta, plant because of declining demand owing to high inventories, tight credit, a late North American harvest, and lower crop and nutrient prices. PotashCorp is curtailing some 2 million metric tons of annual potash production this year because of lower demand. "Farmers, like any other consumer, are feeling the impact of the global financial crisis," the company said in a statement.

Even so, the industry has a few bright spots, including Canexus, a major producer of sodium chlorate, a precursor to the paper-bleaching chemical chlorine dioxide. The company has a positive outlook because of the decline in the Canadian dollar from unusually high levels—at par with the U.S. dollar in the middle of 2008—to historic norms of about 80 cents on the U.S. dollar by year's end.

Gary L. Kubera, Canexus' chief executive officer, explains that his company's costs are in Canadian dollars but that some 70% of his sales are exports from Canada paid in U.S. dollars. "We had been fighting an appreciating Canadian dollar for the last three years," he says. "And the rapid and significant revaluation of late gives us quite a significant cushion to deal with uncertainty."

Kubera expects sales volumes to decline. Paper markets such as toilet paper and paper towels aren't sensitive to economic downturns, but packaging and writing paper are. He also expects sodium chlorate prices to fall. But he anticipates that these lower volumes and prices will be offset by the cheaper dollar, leaving more money in Canexus' coffers.

Nova's Thomson says his company will also benefit from the currency situation. He notes that an 80-cent Canadian dollar means about $100 million more income to his company than when the two currencies are at par.

For Canadian chemical makers, the currency situation should provide some comfort in a year that, at the very least, is showing every sign it will begin dismally.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter