Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Japanese Earnings Surprise

Fiscal First Half: Firms performed better than feared

by Jean-François Tremblay

November 9, 2009

| A version of this story appeared in

Volume 87, Issue 45

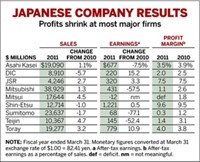

The flow of red ink at many Japanese chemical companies in the fiscal first half was not the tsunami predicted six months ago. Losses weren’t as bad as expected, and as a result most Japanese firms have raised their profit predictions for the full fiscal year.

“The companies were overconservative at the beginning of the financial year, when things were at their darkest,” says Joel Scheiman, a Tokyo-based chemical analyst at brokerage firm MF Global. “Many have revised those dark predictions.”

When they made their earnings forecasts in the spring, Japanese companies foresaw that they would have to absorb substantial inventory write-offs because oil prices were plunging. “Most of the chemical companies have some very expensive inventories,” Mitsunobu Koshiba, president of JSR Corp., told C&EN in July (C&EN, Aug. 3, page 20). “We will lose some money while selling those inventories.”

JSR, a producer of synthetic rubber and electronics materials, posted a $19 million inventory write-off in the first half and finished with a $5 million net loss for the period, which ended Sept. 30. That’s better than the $16 million it had expected to lose but a disappointment for a company that has a track record of high profitability. For the full fiscal year, JSR continues to forecast net earnings of $112 million.

Mitsui Chemicals, a commodity chemical maker that is particularly exposed to the Japanese petrochemical market, posted a staggering net loss of $351 million in the fiscal first half. But the result was good news because Mitsui had earlier expected to lose $535 million in the period. For the full year, it now forecasts a loss of only $346 million instead of the $625 million it predicted in the spring.

It’s a similar story at Mitsubishi Chemical. The diversified chemical producer had expected to lose $280 million in the first half but instead came close to profitability with a mere $29 million loss. For the full year, the company now expects to break even instead of losing $100 million.

Shin-Etsu Chemical, claiming that business conditions remain too unpredictable, refrained from issuing a forecast for the rest of the fiscal year. The firm achieved a remarkable profit margin of 8.5% in the fiscal first half, but this success did not come easy. Sales of electronics materials plummeted 50% from a year ago, and sales of polyvinyl chloride shrank by 40%. The company is the world’s largest producer of both silicon wafers and PVC.

Japanese firms supported their bottom lines by aggressively cutting costs, Scheiman says. A few players quietly reduced salary expenses by not renewing the contracts of temporary workers. And some firms took the unsustainable step of paring down their capital expenditure budgets, he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter