Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Asia: Economies are generally buoyant, except in Japan

by Jean-François Tremblay

January 11, 2010

| A version of this story appeared in

Volume 88, Issue 2

In October 2009, a mainland China resident paid $57 million for a 6,000-sq-ft apartment on the island of Hong Kong, a price believed to be a world record. The transaction is an illustration of how little impact the global financial crisis has had on Asia.

When the world economy tanked in late 2008, many predicted that Asia would suffer heavily. Indeed, manufacturers in southern China laid off tens of thousands of workers in early 2009 because of slack demand for their goods in the U.S., Japan, and Europe. In Japan, business confidence plummeted and the economy shrank by about 6% last year.

COVER STORY

Asia: Economies are generally buoyant, except in Japan

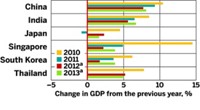

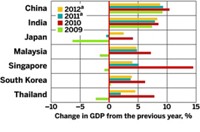

The big surprise is that, with the exception of Japan, Asia ended up losing little ground during the financial turmoil of the past year. China managed to expand its economy by more than 8%, roughly the same as in 2008 and a welcome respite from the blistering 13% it expanded in 2007. India, Asia’s other economic giant, grew 6% last year and is set to expand 7% in 2010.

Asia’s laggard, Japan, will recover in 2010, but slowly. The Bank of Japan’s December 2009 “Tankan,” a survey of business confidence, revealed that although most major Japanese companies remain bearish about the Japanese economy in the short term, they are less pessimistic about the future than they were three months ago. The Asian Development Bank forecasts that the country will grow by a slight 1% this year.

But Japan will be aided in 2010 by the enduring vigor of the Chinese economy. China did not slow down much in 2009, largely because of government actions. Beijing introduced an economic stimulus package early in the year that boosted demand for cars and appliances, particularly in the Chinese countryside. And Shanghai is spending more money getting itself ready to host this year’s World Expo than Beijing spent ahead of the 2008 Olympics.

Like China, India owes much of its resilience during the downturn to government measures. Partly to counter the effects of a bad harvest in 2009, India’s national government has vigorously spent during the past year. India’s central bank has also done its part to support the economy. Over the past year and half, it has lowered its key lending rate by more than 4% and cut in half the amount of cash that banks are required to keep in their books.

The Organization for Economic Cooperation & Development foresees that India’s economy in 2010 will be buoyed by a better harvest and a recovery in the country’s export-oriented manufacturing sector.

For Asia overall, the Asian Development Bank predicts slightly stronger economic growth than the region experienced in 2008. In other words, as 2010 dawns, Asia is positioned to be the world’s economic growth engine.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter