Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada: Hard hit in the downturn, the country eyes recovery in 2010

by Alexander H. Tullo

January 11, 2010

| A version of this story appeared in

Volume 88, Issue 2

Highly dependent on exports to the U.S., the Canadian chemical industry was knocked to the mat in 2009. Executives expect it will get back on its feet slowly and with wobbly knees in 2010.

COVER STORY

Canada: Hard hit in the downturn, the country eyes recovery in 2010

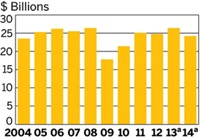

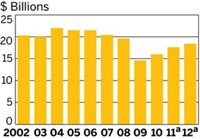

Canadian sales of basic chemicals and resins declined 35% in 2009 to $14.4 billion, according to the Chemistry Industry Association of Canada (CIAC). Taking out the effects of inflation, the decline was 27%. The 2009 inflation-adjusted level of $11.0 billion was off 37% from its 2004 peak of $17.8 billion.

The Canadian industry has been hit hard by a decline in global trade. About three-quarters of Canadian chemical sales come from exports, says David Podruzny, CIAC’s vice president of business and economics, and exports declined 31% in 2009.

Podruzny points out that the closures of chemical plants also contributed to the decline in volumes in recent years. For example, Pétromont, a joint venture between Dow Chemical and an arm of the Quebec government, shut its doors in 2008.

Chemical producers surveyed by CIAC expect a modest 2% improvement in sales in 2010. “The numbers point to a fragile recovery,” Podruzny says. “It is going to take a while to get back to where we were.”

One bright spot, CIAC says, has been industry profits, which managed to grow 2% in 2009 to $1.2 billion. Podruzny credits low natural gas prices, which gave Alberta’s ethylene crackers an advantage over petroleum-based capacity around the world.

But the advantage may not last. Podruzny cautions that natural gas extraction has been declining in Alberta and that ethane will be in short supply if the government doesn’t create incentives to find more.

Grant Thomson, president of olefins and feedstocks at Nova Chemicals, says supplies of ethane are balanced in Alberta. But, he notes, “if we are looking at expanding our facilities in Joffre, we have got to find new sources of ethane.”

Alberta assets were a big reason why the International Petroleum Investment Co., in Abu Dhabi, United Arab Emirates, purchased Nova earlier this year for $2.3 billion. Thomson still sees the potential to eventually expand in the province. “Alberta may be the only place in North America where there can be sustained growth in petrochemicals,” he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter