Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Finance: Credit Returns, But Overcapacity Casts A Shadow

by Melody Voith

January 11, 2010

| A version of this story appeared in

Volume 88, Issue 2

For highly leveraged chemical companies, 2009 was a frightening year. U.S. firms LyondellBasell Industries, Tronox, and Chemtura filed for bankruptcy when they could not refinance debt in the frozen credit markets. Even DuPont, with its solid balance sheet, put the whole company to work finding ways to increase free cash flow.

COVER STORY

Finance: Credit Returns, But Overcapacity Casts A Shadow

“Free cash flow—what management can control—improved in 2009 compared with 2008. It’s one of the things that went right to preserve credit quality during a grim period in the industry,” reflects Kyle Loughlin, credit analyst at Standard & Poor’s. Although the crisis in the financial markets has eased, the focus on cash and debt repayment will continue in 2010.

And the industry will have to pay more to borrow money than it did in the boom years of 2006–07. During that time, many companies let their credit ratings slip, and for them the cost of capital will remain high. But Loughlin reports that sequential earnings gains have prompted S&P to raise many credit ratings.

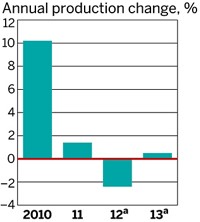

With slow volume growth expected in 2010, the new problem is lingering overcapacity. According to the European Chemical Industry Council (CEFIC), “The industry is operating far below its optimal capacity utilization levels, which in turn means lower production efficiency and reduced margins.” Industry watchers agree that companies will preserve cash by cutting capital spending further in 2010.

Rather than wait for demand to return, “many of our clients really have to rethink their business models,” advises Tim Hanley, global chemical group leader at business consultancy Deloitte. “They have to make sure the cost structure matches current demand. They’ll be looking at supply chains, what and where they manufacture, and administrative costs.”

Hanley puts a high value on the flexibility of chemical firms to respond to different growth scenarios. “They see much stronger demand in the developing world—Asia and Latin America—and constrained demand in the U.S. and Western Europe,” he says, but they have to have a plan to capture it.

Loughlin and Hanley expect acquisitions to play an important role in the industry’s restructuring. “With renewed growth in the economies of the world, you’ll see the focus turn back to strategies for growth and profitability,” Loughlin predicts. A Deloitte report suggests attractive U.S. chemical markets will be pharmaceuticals, heavy construction, and municipal water treatment. In Europe, personal care and pharmaceuticals will grow the most through 2014.

Worldwide, much of the economic growth in 2010 will be spurred by stimulus spending. But industry economists are concerned about what happens when the spending inevitably slows. The timing of any change in policies “will need to be finely judged in order that the recovery is not put in jeopardy,” CEFIC warns.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter