Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Eastman Exits Polyester Business

Plastics: One-time PET leader will sell unit to DAK Americas

by Michael McCoy

November 1, 2010

| A version of this story appeared in

Volume 88, Issue 44

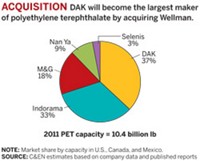

Eastman Chemical has agreed to sell its polyethylene terephthalate (PET) resin business to DAK Americas, a subsidiary of the Mexican conglomerate Alfa, for $600 million.

The sale includes two PET plants and a facility that makes the raw material purified terephthalic acid (PTA), all in Columbia, S.C. Eastman put the site up for sale in April after earlier selling off PET plants in Europe and Latin America.

Once one of the world’s largest PET producers, Eastman enjoyed heady growth in the 1990s and early 2000s as the clear polymer rapidly captured new markets such as those for water bottles and food containers. But the company struggled with the business as it matured. Eastman’s performance polymers division, which is largely the PET business, lost money in 2008, 2009, and the first half of 2010. Its first-half sales were $416 million.

Alfa, meanwhile, created DAK Americas in 2001 to acquire DuPont’s polyester resins and PTA business. DAK later built PET facilities in North and South Carolina and acquired Eastman’s PET plants in Mexico and Argentina. Alfa’s polyester product sales were roughly $1.6 billion in the first half of 2010.

Chase Willett, director of polyester and polyester raw materials at the consulting firm Chemical Market Associates, says the deal will make DAK the U.S.’s PET leader, giving it roughly one-third of the industry’s capacity. The sale will also net Eastman a good price. “Both parties come out looking pretty good,” he says.

The deal will continue the shift of the U.S.’s PET industry to foreign control. In addition to DAK, current manufacturers in the U.S. include Indonesia’s Indorama, Italy’s Mossi & Ghisolfi, and Taiwan’s Nan Ya Plastics. Another producer, U.S.-based Invista, announced over the summer that it is considering the sale of its PET business.

Both existing players and newcomers have expressed interest in the Invista business, Willett says. But even a purchase by a competitor won’t be enough to return the PET industry to financial health, he cautions. “For the industry to improve significantly, there needs to be rationalization of capacity in addition to consolidation,” Willett says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter