Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Sales And Earnings Turn Positive

Fourth-quarter results suggest a slow recovery is taking hold for the chemical industry

by Melody Voith

February 22, 2010

| A version of this story appeared in

Volume 88, Issue 8

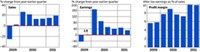

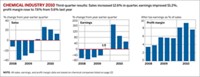

Fourth-quarter earnings reports show that the chemical industry has begun to emerge from the wreckage of the worldwide economic collapse. Compared with the disastrous fourth quarter of 2008, companies in C&EN’s earnings index increased sales by an average of 2.1% and earnings by 1.9%. Of the 20 companies on the list, nine increased quarterly earnings by more than 100%.

But the reports were not uniformly positive. Three firms—FMC Corp., Mosaic, and Nalco—saw earnings decline compared with last year’s quarter. And nine firms, or almost half of those in the index, saw quarterly sales decline year over year. As the worldwide economy began its slow, fragile rebound, many companies paid close attention to quarter-to-quarter sales figures. Compared with the third quarter, only 12 of the 20 firms saw sales go up.

Executives at the chemical firms say they see signs of strengthening demand. Both Dow Chemical and DuPont reported that sales volumes increased 10% from the year-ago quarter. However, the boost came from outside the U.S. and European markets. DuPont says sales in Asia-Pacific shot up 34%, exceeding prerecession levels, and Dow enjoyed a 33% rise in sales volumes in emerging markets. In North America, however, Dow saw sales volumes decrease by 1% compared with the third quarter of 2009.

“The power of our strong geographic footprint manifested itself once again, specifically in the emerging geographies of Asia-Pacific, Latin America, Eastern Europe, India, and the Middle East, which all had double-digit volume growth over the fourth quarter of last year,” Dow Chief Executive Officer Andrew N. Liveris said in a conference call with analysts.

Dow earned $195 million in profits on $12.5 billion in sales during the quarter, a sales increase of 14.9% from the year-ago period. The earnings and the company’s focus on cost cutting helped it pay off a $9 billion bridge loan, debt the firm took on to finance its acquisition of Rohm and Haas. Liveris said Dow had completed 70% of its cost-cutting goal of $2.5 billion over two years.

Similarly, DuPont CEO Ellen J. Kullman emphasized cost cutting and a demand turnaround in her company’s earnings report. She said that the largest increases in demand were for titanium dioxide, electronics materials, performance polymers, and seed products. Overall, DuPont increased its quarterly sales by 10.3% to $6.4 billion, and its earnings swung positive to $402 million, compared with a $249 million loss in last year’s fourth quarter.

The ongoing efforts to cut costs enabled DuPont to beat earnings expectations, according to Citigroup analyst P. J. Juvekar. But the top line is still struggling, he warned.

The continuing struggle reflects the huge demand decline wrought by the recession that hit the chemical industry beginning in last year’s fourth quarter. The full-year financial results of the firms in C&EN’s list show the magnitude of the hole the industry is still trying to climb out of. On average, the companies have reported that sales in 2009 were 22.4% lower than in 2008 and that earnings declined by 39.5%.

At Nalco, sales fell 11.0% partially because of a 2008 divestment. The company saw organic sales decline in its paper, water, and energy service businesses. FMC saw revenue from industrial chemicals shrink 16% in the fourth quarter, even though it saw a boost in sales of its agricultural products because of strong demand in Brazil. The agricultural boom, however, did not help Mosaic. The pure-play fertilizer company suffered from low prices for potash and phosphate combined with low potash sales volumes. Mosaic’s sales for the year fell 52.6% compared with 2008.

To cope with what could be a long-term lower level of demand, the chemical industry has been in a race to slash costs in order to maintain profitability. “The steps they’ve taken were to get their cost structure realigned to the new lower revenue potential. For example, many had to do headcount reductions,” observes Tim Hanley, global chemical group leader at business consultancy Deloitte. The trend is unlikely to change, he says, adding that “most are anticipating that revenue will grow slowly, and they are very careful about adding costs back.”

Spending cuts enabled the chemical industry to generate a profit margin of 5.8% in the third quarter of 2009. However, capital spending for maintenance and spending to support sales cannot be held down forever. In the fourth quarter, although sales increased, profit margins decreased to 5.5%.

Weak pricing power offset the rise in sales volumes at companies such as Cytec Industries, Air Products & Chemicals, Celanese, and Eastman Chemical. Profits were thus dragged down by decreasing costs for raw materials and energy.

As sales continue to recover, Hanley says, companies will expand production in emerging markets, rather than in developed economies. Cabot was one of the few companies that addressed capacity additions in its fourth-quarter earnings report. CEO Patrick M. Prevost wrote, “Through the economic crisis, we maintained focus on the long-term, including the commissioning of a 150,000-metric-ton expansion at our carbon black facility in Tianjin, China, last September and the recent announcement of our intention to triple fumed silica capacity at our facility in Jiangxi, China.”

The fourth-quarter results also confirm that the recovery has not come to all end markets. PPG Industries has seen an improvement in sales of automotive coatings but sold less architectural coatings than last year. And at Eastman, coatings, adhesives, specialty polymers, performance chemicals, and specialty plastics saw higher demand; fibers and performance polymers, however, declined.

According to J.D. Power & Associates, materials makers can look forward to increases in automobile production in the first quarter of 2010. In its January report, the company forecast that “production is expected to increase by nearly 70% to 2.8 million units during the first three months of 2010, compared with 1.7 million units during the same period last year.”

In contrast, the forecast for the construction industry is not as rosy. According to a January report from the National Association of Home Builders, the industry’s confidence in the market for new homes in the U.S. has declined because of concerns about the poor job market and the large number of foreclosed homes for sale. The confidence index, at only 15, is significantly below 50, which marks the mid-point between good and poor conditions.

After several months of inventory destocking, a symptom of the economic crisis, the overall manufacturing sector is seeing an uptick in production. According to the Institute for Supply Management, growth in manufacturing accelerated in January after being on an upswing for five months. ISM’s Purchasing Managers Index increased 3.5% to 58.4% compared with December. The chemical industry was one of 14 manufacturing sectors that reported growth in new orders in January.

Deloitte’s Hanley says that as chemical firms look for ways to capture growth, they will likely turn to acquisitions rather than build new plants themselves. Air Products’ recent $7 billion bid for rival Airgas suggests that the market for mergers and acquisitions could be coming out of a yearlong slumber. Jefferies & Co. analyst Laurence Alexander wrote in a note to investors that Penford, Ashland, and Solutia might be buy-out targets.

Looking past the fourth-quarter results, chemical executives have been unanimous: Recovery will be slow and uneven both geographically and by end market. What growth does occur will be propelled by emerging markets, particularly in Asia. And the promises to cut costs continue.

Aside from the economic recovery, other factors could impinge on earnings. Albemarle’s investors were warned in an earnings report that “rising raw material, energy, and other costs such as pension expense may provide headwinds in 2010 that were not present in 2009.” But the company has plans in place that it believes will bear fruit. According to the firm, “We expect operating efficiency gains, new product sales—particularly in alternative fuels—and improving consumer appetite for electronics to help us overcome the headwinds.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter