Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

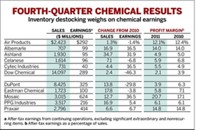

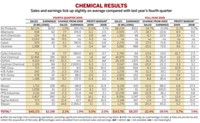

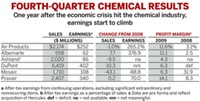

Pricing Boosts Chemical Earnings

First Quarter: Strong demand helps firms stay far ahead of rising costs

by Melody M. Bomgardner

April 29, 2011

| A version of this story appeared in

Volume 89, Issue 18

Chemical companies are beginning 2011 with strong earnings, and many are beating positive analyst expectations by a wide margin. In addition, demand continues to strengthen across most product categories, allowing firms to raise prices while also enjoying volume growth.

Dow Chemical raked in $14.7 billion in sales during the quarter, an increase of 9.8% from the first quarter of 2010. The company raised prices by an average of 12% and still sold 8% more of the costlier goods. The steep price hike more than offsets the $700 million in higher feedstock costs the firm absorbed in the quarter and pushed earnings to $957 million, 66.1% higher than in the same quarter last year. Dow devoted more than a third of its earnings to speeding up debt repayments.

Dow’s earnings per share of 82 cents beat Wall Street expectations by 15 cents as the result of surprisingly healthy returns from the commodity chemicals business, observed Andrew W. Cash, a chemicals stock analyst at UBS. “Customers must have accepted price increases much faster than we had thought,” Cash wrote in a note to investors.

Higher prices for electronic and performance chemicals helped DuPont expand earnings by 26.7% compared with the year-ago quarter. DuPont’s earnings per share of $1.52 was 16 cents above consensus. Strong demand and tightening supplies of titanium dioxide, refrigerants, and fluorochemicals supported 21% higher selling prices in DuPont’s performance chemicals segment. The firm reported its best volume gains in both its safety and protection business and its agriculture and nutrition business.

PPG Industries almost doubled earnings compared with the first quarter of 2010 on a 13% increase in sales. “In addition to demand improvements, higher pricing in each of our coatings businesses and continued aggressive cost management have buffered the impact of persistent raw material cost increases,” said CEO Charles E. Bunch.

At Cabot, production volumes have rebounded to 2008 levels, due primarily to demand from automotive and electronics customers. Cabot said it will take advantage of the recovery in sales to expand capacity for carbon black, fumed silica, and masterbatch products over the next six months. The disaster in Japan, however, cut sales of carbon black there by 3%, the firm reported.

Chemical companies can expect a stormy ride through the rest of the year, forecasts Laurence Alexander, chemicals analyst at Jefferies & Co. “We expect outlooks to remain cautious as pressure from raw material swings, potential supply chain disruptions in Asia, and lumpy end-market demand offset benefits from a weaker dollar, strong volumes, and an inflationary pricing environment,” he told clients.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter