Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada: Chemical Firms Look South And Seek Government Incentives For Growth

by Alexander H. Tullo

January 10, 2011

| A version of this story appeared in

Volume 89, Issue 2

After a miserable 2009, Canadian chemical producers saw business turn around in 2010, and they expect modest gains again in 2011. Longer term growth is more elusive, and producers say new ideas are needed to induce them to invest.

COVER STORY

Canada: Chemical Firms Look South And Seek Government Incentives For Growth

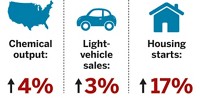

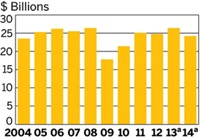

Canadian chemical volumes increased 5% in 2010 after plunging 23% in 2009, according to the Chemistry Industry Association of Canada (CIAC). Sales jumped 14% to $21 billion. Profits increased 73%, hitting $2.3 billion.

A CIAC survey found that companies expect volumes to rise another 5% in 2011. And after declining 33% in 2010, capital spending is expected to increase 11% in 2011.

Chemical producers in Alberta, like those in the U.S., are enjoying an advantaged export position because of low natural gas costs, but they can’t use the advantage to its fullest potential.

Grant Thomson, president of olefins and feedstocks at Canadian petrochemical firm Nova Chemicals, explains that low natural gas prices have put a damper on gas drilling in Alberta. This means less ethane is available for cracking. Although Nova has been able to meet customer requirements, Thomson says, its crackers are running at only 85% of capacity.

The Canadian firm is seeking ways to diversify its feedstock slate. In July, it signed an agreement with oil company Hess and the pipeline firm Mistral Energy to buy the ethane output from Hess’s gas plant in Tioga, N.D., and export it to Alberta.

Similarly, Nova is planning to use ethane derived from Alberta’s oil sands. The company is also exploring shipping shale-based ethane from western Pennsylvania to its cracker in Corunna, Ontario.

Beyond new feedstocks, Canadian chemical makers need more incentives, CIAC maintains. In particular, the trade group has been pressing the Canadian government for an accelerated capital cost allowance that would allow companies to depreciate their assets faster and get a tax break sooner rather than later. “You are taking huge risks these days to build major capital assets,” CIAC President Richard Paton says.

But under Prime Minister Stephen Harper, the government has been reluctant to reduce corporate taxes further. “This government has actually been very sympathetic to business on tax issues,” Paton says. “But on this issue they don’t seem to be interested at all.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter