Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Inorganics: After A Rough Spell, Steadier Times Lie Ahead

by Michael McCoy

January 10, 2011

| A version of this story appeared in

Volume 89, Issue 2

COVER STORY

Inorganics: After A Rough Spell, Steadier Times Lie Ahead

Dow Chemical and Mitsui & Co. have just finalized a joint venture to build something that once seemed highly unlikely: a world-scale chlor-alkali plant on the U.S. Gulf Coast. The project shows that the U.S. inorganic chemicals sector has emerged from the economic downturn bruised but still very much alive.

The downturn was indeed tough for inorganics, particularly chlorine and caustic soda. The price of 1 ton of chlorine and 1.1 tons of caustic soda—the product of brine electrolysis known as an electrochemical unit—peaked at close to $1,200 in late 2008, only to plummet to about $600 by mid-2009, according to figures from Chemical Market Associates. Prices gradually rose to roughly $700 late last year.

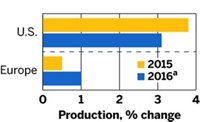

Production also fell—more than 12% to 9.4 million tons in 2009, according to the U.S. Census Bureau. But it rebounded by almost 18% in the first nine months of 2010, the agency reports.

The chlor-alkali industry is closely tied to chlorine’s largest market, polyvinyl chloride, which in turn is synced with the construction materials industry, where PVC is molded into siding, window frames, and pipe. John McIntosh, a senior vice president at Olin, the fourth-largest U.S. chlorine producer, told analysts last fall that U.S. producers are taking advantage of low energy prices to export PVC and PVC intermediates—the market that Mitsui plans to serve through its joint venture. U.S. vinyl demand is still sluggish.

McIntosh and others in the chlor-alkali business are reluctant to make projections about the volatile industry. In a report issued late last year, the credit ratings agency Fitch Ratings ventured that North American chlor-alkali demand will grow at a low single-digit rate in the long term. “The recovery, however, remains slow,” Fitch concluded.

Meanwhile, the outlook for certain other inorganic chemicals is decidedly brighter. D. Michael Wilson, who until recently headed FMC’s industrial chemicals business, says overseas demand for U.S.-made soda ash is “very strong,” leading to sold-out conditions in the industry. “We expect this to continue into 2011,” he says.

Hydrogen peroxide demand rose about 8% in 2010, Wilson says, thanks to a healthy North American pulp industry, peroxide’s largest outlet, and to good business in specialty segments such as food, cosmetics, and electronics. Still, Wilson acknowledges that peroxide demand remains below the heights of 2007 and 2008. He anticipates that demand will mirror GDP growth this year.

Wilson is bullish on sodium bicarbonate, forecasting increasing sales this year for dairy industry and environmental applications. And FMC’s persulfates business is doing well because of high demand from Asian polymer producers and printed circuit board fabricators.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter