Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Petrochemicals: North American Firms Are Pleasantly Surprised By A Robust Market

by Alexander H. Tullo

January 10, 2011

| A version of this story appeared in

Volume 89, Issue 2

A year ago, as North American petrochemical producers struggled with poor demand at home, cheap natural gas feedstocks kept costs low enough for regional producers that they could export record volumes, primarily to China. Observers thought the party would soon end after about 10 million metric tons of new ethylene capacity started up in the Middle East and Asia.

COVER STORY

Petrochemicals: North American Firms Are Pleasantly Surprised By A Robust Market

The capacity came as expected, but it turned out that North American firms didn’t need to subsist on exports to Asia. John Stekla, director of ethylene studies at Chemical Market Associates, says production outages took 10–15% of ethylene capacity off-line early in the year, making markets for ethylene derivatives such as polyethylene tight and profitable. Strong U.S. demand—a 9% increase versus 2009—was another surprise, Stekla says, and allowed North American producers to keep more of their output home.

“The North American ethylene business from a producer’s perspective was beautifully efficient in 2010,” Stekla says. “They had a robustly growing domestic market and a low-cost position that enabled them to export as much product as they needed to.” Regional producers enjoyed record effective plant operating rates of 96%.

Oil prices averaged about $80 per barrel in 2010. But thanks to an upswing of supply from shale, natural gas prices averaged roughly $4 per million Btu. When the ratio of oil to natural gas prices climbs above eight, lighter natural-gas-based feedstocks such as ethane have an advantage over oil-derived raw materials such as naphtha.

With ethylene producers favoring lighter feeds, propylene and butadiene, which aren’t big coproducts of ethane cracking, have been in short supply. “You ended up with pretty good margins on those products in 2010,” says Grant Thomson, president of olefins and feedstock at Nova Chemicals.

But that doesn’t mean the pendulum is swinging back to heavier feedstocks. Stekla says petrochemical makers are only cracking naphtha and other heavy feeds if they need the coproducts, are integrated with a refinery, or can’t run their plants without some heavy feeds.

Over the next five years, growth in the U.S. ethylene industry will dip closer to GDP growth rates of 2.0–2.5% per year, Stekla says. And as more Middle Eastern production hits the market this year, competition in the international arena will be tougher. Still, he says, 2011 will likely be another strong year.

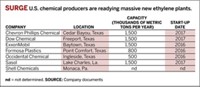

In fact, with an expected continued windfall of low-cost shale natural gas, North America might again become a place to invest in petrochemicals. “Five years ago, everybody was talking about the demise of the North American petrochemical industry,” Thomson says. “At that point, we didn’t know about the shale gas.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter