Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

U.S. Weak Domestic Demand Will Be Offset By Strong Exports, Low Natural Gas Prices

by Melody M. Bomgardner

January 10, 2011

| A version of this story appeared in

Volume 89, Issue 2

The U.S. chemical industry will have to go beyond restocking its customers’ inventories to experience growth in 2011. The sales bump that began in mid-2009, when manufacturers replaced stockpiles whittled down during the recession, has faded. In its place, according to the American Chemistry Council, will be strong export demand, especially from emerging markets.

COVER STORY

U.S. Weak Domestic Demand Will Be Offset By Strong Exports, Low Natural Gas Prices

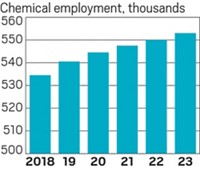

U.S. production of all chemicals is expected to rise by 3.0% in 2011, ACC reports, or by 2.7% if pharmaceuticals are excluded. Last year’s increase in total chemical output was similar at 3.1%; but production excluding pharmaceuticals rose 5.2%.

Most chemical markets have recovered steam, except building and construction. Demand for construction materials continues to be weighed down by low housing starts and won’t fully recover until 2012, ACC economist T. Kevin Swift predicts. In the U.S., long-running high unemployment will hamper the growth of consumer spending on durable goods.

Despite these headwinds, many chemical firms are signaling that they expect a strong 2011. At a December 2010 investor presentation, DuPont CEO Ellen J. Kullman forecast that earnings per share would reach $3.30 to $3.60 this year, compared with an expected $3.10 in 2010. Demand for food by the world’s growing population will bring 8–10% growth to DuPont’s agriculture segment, she reported.

The Society of Chemical Manufacturers & Affiliates asked its members, mostly small-scale specialties makers, about their expectations for sales this year. SOCMA CEO Lawrence D. Sloan said most responded with cautious optimism. They are observing some growth in domestic sales, but firms that do business in Asia are seeing a stronger upswing.

For example, privately held intermediates maker Dixie Chemical projects “2011 should see further increases, especially in our monomers and additives businesses. The weakening of the dollar may help export sales, but Asian competition may offset these potential gains.”

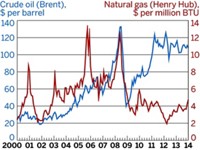

In basic chemicals, the availability of low-cost natural gas from shale deposits will bring favorable conditions for U.S. producers. Dow Chemical, for example, recently said it plans to increase its ethane-cracking capabilities by 20–30% over the next two to three years. “We expect several such projects to be announced in 2011–12 as chemical companies capitalize on structurally lower U.S. ethane prices,” says Laurence Alexander, chemicals analyst at Jefferies & Co.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter