Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Gain Steam

As the economy heats up, demand for chemicals spreads to all regions and sectors

by Melody M.Bomgardner

February 28, 2011

| A version of this story appeared in

Volume 89, Issue 9

Helped by the return of consumer spending, the chemical industry was at the leading edge of the strengthening economic recovery in the fourth quarter. Company earnings reflected broad-based demand for chemicals across all regions and sectors. For 21 companies tracked by C&EN, sales increased 13.1% and earnings soared 40.0% compared with the year-ago quarter.

As the depths of the recession fade into memory, it becomes more difficult for companies to post huge gains compared with year-earlier quarters. Even with this handicap, 11 companies, or more than half of those surveyed, raised quarterly earnings by more than 20%.

Dow Chemical posted 2010 fourth-quarter numbers that particularly impressed stock analysts. Its integration of Rohm and Haas, acquired in 2009, helped the firm on the earnings side. Dow saw earnings soar 118.5% to $625 million on an increase in sales of 10.5%. Its earnings per share of 47 cents beat consensus expectations by 12 cents.

“The beat came from solid operating performance,” explained John McNulty, a stock analyst at Credit Suisse, in a note to investors. Higher production volumes and pricing across the commodity and performance segments helped Dow exceed “our estimates despite the difficult raw material environment for the performance segments.”

Andrew N. Liveris, Dow’s chief executive officer, attributed the strong quarter to “significant efforts to reduce our cost structure and shift our portfolio.” More specifically, he told analysts in a conference call, “Our operating segments demonstrated their earnings strength. Most notably, health and agricultural sciences delivered record fourth-quarter sales. Our electronic and specialty materials segment posted its sixth consecutive quarter of greater than 30% earnings margin.”

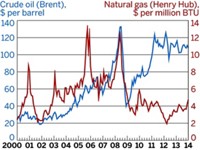

But Liveris’ report was not without complaints. He told analysts that the company had to work hard to raise prices to offset a nearly $700 million increase in feedstock and energy costs.

Liveris downplayed the impact of the reviving economy on the company’s results. “The recovery in the global economy certainly helps,” he said. “But as we all know, that alone is not sufficient.” Still, Dow’s results show a remarkable turnaround in demand for the company’s products, especially in North America. Sales in the region shot up 16% compared with the 2009 quarter.

In the U.S., it was the return of consumer spending, dormant during the recession and early days of the recovery, that sparked demand for chemicals, economists say. According to the Bureau of Economic Analysis, real personal consumption expenditures increased 4.4% in the fourth quarter, compared with an increase of 2.4% in the third quarter. Spending on durable goods, which require large amounts of chemical industry output to produce, shot up 21.6% compared with the year-ago quarter.

“While the economy is still not firing on all cylinders, the return of consumer spending in the fourth quarter was one of the biggest surprises,” remarked Ryan Sweet, senior economist at Moody’s Analytics, an economics research firm. That spending is why manufacturers performed particularly well, he said.

In contrast to Liveris, DuPont CEO Ellen J. Kullman outlined for analysts the many ways the recovery boosted DuPont’s results in the latter part of 2010. “We delivered outstanding growth as certain businesses benefited from early recovery and restocking—such as titanium dioxide, electronics, parts of our chemical businesses, and polymers.” She noted as an example, “We were prepared when auto builds recovered more than twice as fast as expected last year.”

Overall, DuPont raised its earnings 15.2% to $463 million for the quarter. “Growth in sales was broad-based across segments and regions, with particularly strong growth in electronics and communications and performance chemicals,” the company said in its report to investors.

Consumer spending helped Celanese increase sales of high-performance polymers, which in turn contributed to a 14.6% rise in revenues in its advanced engineered materials business. However, the bump did not increase the segment’s operating profit because of increased raw materials costs and a plant turnaround project the firm undertook in North America.

Similarly, strengthened end-user demand for specialty packaging, consumer goods, and durable goods helped boost sales and earnings at Eastman Chemical, particularly in its specialty plastics segment. Eastman also saw sales of its performance chemicals and intermediates rise 31% because of increased volumes and prices. It reported that the higher volumes were primarily due to growth in plasticizer products, whereas higher prices mainly affected the firm’s olefin-based products.

Meanwhile, emerging markets were the driving force in improving sales at water treatment chemicals firm Nalco. “Water scarcity challenges intersect with high industrial growth in these geographies, creating significant opportunities for Nalco to add value by deploying our proprietary technologies and services,” reported CEO J. Erik Fyrwald. The company raised sales by 11.0% and earnings by 41.5% compared with last year’s fourth quarter. Sales in Asia increased 20%, Fyrwald noted.

Asian business also benefited Air Products & Chemicals. Sales in its largest segment, merchant gases, approached $1.0 billion during the quarter, a 6% increase over the fourth quarter of 2009. The uptick was “primarily driven by Asia, which saw its highest increase in sales and volumes in recent history,” according to the company. Overall, the industrial gas firm saw sales grow 10.0% to $2.4 billion and earnings jump 28.2% to $323 million.

Air Products spent all of 2010 in an unsuccessful effort to acquire rival Airgas. But according to chemicals analyst Laurence Alexander of Jefferies & Co., the dropped bid will not hinder Air Products’ future earnings. “We believe the industrial gas companies are in the sweet spot of the business cycle, where customer capital expenditure budgets are ratcheting higher, and higher energy prices make customers more interested in investing in the energy-efficiency process solutions the industrial gas companies have to offer,” he wrote in a note to investors.

Fertilizer maker Mosaic is also in a sweet spot, in the agriculture business cycle. Fourth-quarter sales of phosphates and potash soared 56.4% compared with the 2009 fourth quarter. Looking ahead, the company says volume and prices will continue to increase as a result of profitable farm economics worldwide and record low producer inventories. “Prices for a wide array of agricultural commodities from grains and oilseeds to fruits and vegetables are trading at extraordinarily high levels by historic standards,” Mosaic told investors.

In their earnings reports, chemical company CEOs said they expect more vigorous economic growth in 2011 and acceleration in sales growth globally. But weak spots in demand persist. For example, PPG Industries reported that sales of architectural coatings continued to erode in the fourth quarter.

In the U.S., the poor housing market and high unemployment will continue to hamper the magnitude of the recovery, warned Federal Reserve Chairman Ben S. Bernanke in his Feb. 9 testimony before the House of Representatives. “With output growth likely to be moderate for a while and with employers reportedly still reluctant to add to their payrolls, it will be several years before the unemployment rate has returned to a more normal level. Until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established,” Bernanke said.

Dow’s Liveris was both optimistic and cautious in his outlook for 2011. “Looking ahead, we expect growth will continue, driven by a broad range of leading end-markets in emerging geographies such as China, India, Eastern Europe, and Brazil,” he said. Developed markets will also see continued growth, he added. Still, the recovery is fragile. “With inflation concerns in emerging geographies, lingering unemployment issues in the U.S., and sovereign debt issues in Europe, we remain prepared for a reversal in momentum,” Liveris cautioned.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter