Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

BioAmber Files For $150 Million IPO

Renewable Chemicals: Biobased succinic acid maker will have to fend off competitors

by Melody M. Bomgardner

November 15, 2011

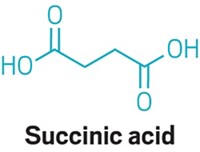

Renewable chemicals start-up BioAmber hopes to raise up to $150 million in an initial public offering (IPO) of stock. The firm’s first product is succinic acid, a fermentation-derived intermediate that is also being pursued by several other companies.

BioAmber says its industrial biotechnology process yields cost-competitive replacements for petroleum-derived chemicals. Succinic acid can be a raw material for plastics, food additives, and personal care ingredients and a building block for other intermediates including 1,4-butanediol (BDO). BioAmber says it is also developing biobased adipic acid and caprolactam, both used in the production of nylon.

In its filing with the Securities & Exchange Commission, BioAmber says it has made 221 metric tons of biobased succinic acid at its facility in Pomacle, France, but has yet to book any sales. Instead, the firm touts its strategic partnerships with potential succinic acid buyers including Mitsubishi Chemical, Lanxess, and Solvay.

To achieve sales, BioAmber will need to rapidly pursue commercial production. It recently formed a joint venture with Mitsui & Co. that will build a facility in Sarnia, Ontario, with an annual capacity of 34,000 metric tons of succinic acid and 23,000 metric tons of BDO. The facility is expected to be operational in 2013. In addition, the joint venture has plans to open larger facilities in Thailand and in either the U.S. or Brazil.

BioAmber’s filing acknowledges that it faces tough competition in the nascent biobased succinic acid market both from start-ups such as Myriant Technologies and from established companies including collaborations between DSM and Roquette and between BASF and Purac. Myriant filed for an IPO in May worth up to $125 million but has not yet gone public.

According to Kathleen S. Smith, principal at IPO watcher Renaissance Capital, newly public renewables firms such as KiOR, Solazyme, and Gevo have experienced wild swings in their stock prices. There is a backlog of firms like Myriant that have filed for IPOs but have not yet gone public because of rocky market conditions, she observes. “This suggests that we could see pockets of activity once the market is able to find some stability,” Smith says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter