Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Mainstreaming Biobased Plastics

Conference attendees mull steps needed to bring biobased materials to consumer product markets

by Marc S. Reisch

April 23, 2012

| A version of this story appeared in

Volume 90, Issue 17

Chemical and industrial biotech company researchers at the BioPlastek Forum in Arlington, Va., last month heard many reasons why demand for biobased plastics—made in whole or part from plant-based materials—is likely to grow significantly in the next few years. Two reasons stood out.

First, biobased feedstocks for traditional plastics are increasingly available. And second, major consumer product organizations such as Coca-Cola, Colgate-Palmolive, and H.J. Heinz are pushing hard for biobased beverage, shampoo, and condiment bottles as part of their sustainability initiatives.

Not all of the 170 conference attendees bought into the growth scenario. One skeptic was meeting organizer Ronald S. Schotland, who heads an eponymous plastics and packaging conference management firm.

“Sustainability is like motherhood; everybody is for it,” he remarked as he opened the conference. Companies may have any number of reasons for taking up the cause, Schotland observed. But he raised questions about the seriousness of the brand-name firms’ commitment to biobased packaging.

As cheap shale gas comes on the market with promises of plentiful supplies of low-cost petrochemical feedstocks for decades to come, Schotland wondered whether companies like Coca-Cola and Heinz will follow through on their commitment to use entirely plant-based bottles in the future. He also wondered whether their ultimate motive is to improve their public image, increase their market share, or both.

Shell Huang, packaging research fellow at Coca-Cola, asserted that her firm’s 30% plant-based polyethylene terephthalate (PET) bottle isn’t a marketing gimmick but rather an important part of a “sustainable future.” She explained that Coca-Cola now sells 1.7 billion beverage servings every day. By 2020, the company plans to be selling 3 billion beverage servings a day.

“You can’t do that just by doubling your footprint,” Huang said, noting that fossil feedstocks are ultimately a limited and nonrenewable resource. Since launching its biomaterials-based bottle in 2009, the firm has filled more than 10 billion of the so-called PlantBottles, she said. By 2020, the firm expects all of its bottles to be made with 100% plant-based plastics. “The PlantBottle is a trend you can’t stop,” she said.

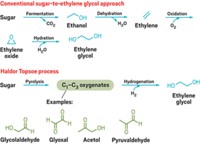

The polymer used in beverage bottles is created by reacting ethylene glycol and purified terephthalic acid (PTA). For the PlantBottle, the ethylene glycol is currently made from sugar by a firm in India. The PTA comes from a petrochemical source. Last December, Coca-Cola formed a collaboration with biorefinery developers Gevo and Virent to advance development of bioderived p-xylene, which can then be converted through conventional means to PTA.

William L. Tittle, director of strategy for consulting firm Nexant, says Virent and Gevo are among the leading contenders to successfully make biobased p-xylene. Virent’s catalytic process turns sugars into a variety of aromatic chemicals including p-xylene. Gevo ferments sugars to isobutyl alcohol, followed by a three-step process to yield p-xylene.

Gevo and Virent have yet to produce p-xylene at a commercial scale. But representatives for both firms said at the conference they plan to sell the intermediate at competitive prices and without a “green premium.”

Tittle said that on the basis of cost information from Virent and Gevo, they will need to make additional process improvements to be competitive. What is certain, he said, is oil prices continuing at $100 per barrel or more. Shale oil and gas notwithstanding, “oil is still a depleting resource, and we still need to come up with a solution,” he said.

The consultant set annual bioplastics demand today at 2 million metric tons, rising to 15 million metric tons by 2020. At that point, Tittle predicted, bioplastics will satisfy 3% of polyolefin demand and 10% of both PET packaging demand and engineering thermoplastics demand. Bioplastics and petrochemical-based plastics will likely coexist for a very long time, he said.

Ron Cascone, Tittle’s colleague at Nexant, expressed optimism about the growing number of raw materials available for the emerging bioplastics business. They include ethylene from sugar-based ethanol by Braskem, India Glycols, and others to be used as a PET or polyethylene feedstock; glucose-derived propanediol from DuPont Tate & Lyle for the production of polytrimethylene terephthalate; and epichlorohydrin from glycerin by Dow Chemical and Solvay for epoxy production.

Cascone estimated the current size of the biobased chemicals market at 2 million metric tons per year, growing to 4 million metric tons, or 1% of global chemical production, by 2015. By 2032, he predicted, biobased chemicals will be anywhere from 20 to 40% of the chemical market.

Adding to the enthusiasm for biomaterials at the conference, some attendees reported on progress in the development of biobased drop-ins for existing petrochemicals. E. William Radany, chief executive officer of Verdezyne, said his company has engineered yeast to make dicarboxylic acids such as adipic acid. The yeast now generate the nylon feedstock from vegetable-oil-processing wastes.

Verdezyne, which is backed by BP and Dutch nylon maker DSM, produces adipic acid at the pilot scale, Radany said. In the future, the company hopes to license the process to other firms rather than build its own plant. “We are not planning on putting steel in the ground,” he said.

Other efforts to develop biobased substitutes for petrochemicals are in their infancy. David Nielsen, an assistant chemical engineering professor at Arizona State University, outlined research to develop renewable styrene. So far, Nielsen said, he has achieved a 27% theoretical yield of styrene from sugars by using engineered Escherichia coli. The biostyrene could be used as a feedstock for acrylonitrile-butadiene-styrene and polystyrene plastics.

Andrew Soare, an analyst with business research firm Lux Research, pointed out that just because a company produces a bioplastic or a biochemical does not mean consumers will accept it in the name of sustainability.

Two years ago, consumers rejected plant-derived polylactic acid bags for Frito-Lay’s Sun Chips because they made too much noise, Soare said. More recently, Archer Daniels Midland cited tenuous demand when it ended a joint venture with Metabolix to make the bioplastic polyhydroxyalkanoate.

Although ADM said financial returns from the venture were too uncertain, Soare suggested the venture ended because Metabolix didn’t market its product well. For both Frito-Lay and ADM, the problem was bioplastics that didn’t have the performance or shelf life of traditional polymers.

Soare is more optimistic about making traditional plastics such as PET and polyethylene with plant-derived feedstocks because these products can simply be dropped in for their petrochemical counterparts. Over the next few years, he said, their growth is likely to be “explosive.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter