Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Environment

India Reaps Benefits Of Carbon Program

Sale of carbon credits is windfall for companies, but heady days are coming to an end

by Amruthanand Nair

June 18, 2012

| A version of this story appeared in

Volume 90, Issue 25

In recent years, Indian companies have discovered a new way of making money. Chemical and other industrial firms running facilities that generate gases with global-warming potential cut back or eliminated the damaging emissions in exchange for credits they then sold to companies in richer countries. The engineering often wasn’t difficult, and the money was good.

Now, the easy money from selling carbon credits is coming to an end. Prices for the credits have dropped precipitously, and trading in credits from the most lucrative projects is set to be shut down. Indian chemical companies haven’t given up on selling carbon credits, but they are resigning themselves to the fact that the credits are no longer a route to riches.

The credits are a result of the 1997 Kyoto protocol, which divided participating nations into industrialized and developing groups. The pact placed the burden of reducing greenhouse gas emissions on the 38 industrialized countries that ratified the protocol, including France, Germany, and the U.K. The U.S. signed the protocol but never ratified it.

Developing countries are not required to reduce greenhouse gases. However, under the protocol’s clean development mechanism (CDM), companies or investors from industrialized nations can help reduce emissions in developing countries via United Nations-approved projects. The participants earn certified emission reduction credits (CERs), which they can use or sell on the international market. One CER is earned for reducing emissions of CO2 or CO2 equivalents by 1 metric ton.

According to the Indian government’s national CDM authority, 16 chemical industry projects have been approved since the program’s inception, and participating companies are set to earn 11 million CERs through 2012. Figures from individual companies imply the earnings have been even higher. Around 522 large-scale projects across all industries were approved during the same time period, according to the CDM authority, netting companies 481 million CERs through 2012.

“For big and small chemical companies in India, this is an important market, since they were the first to realize the potential of carbon credits as compared to any other sector. These companies helped cement the country’s position in the global carbon credits market,” says Paravastu Rambabu, chief executive officer of General Carbon, a carbon management and advisory company.

Laxman Rajasekar, corporate sustainability officer at UltraTech Cement, says CO2 abatement is a common avenue for earning CERs. UltraTech is India’s largest manufacturer of white cement and a member of the Aditya Birla Group, a maker of carbon black and other chemicals that participates in CDM projects. Examples of CO2 abatement methods, Rajasekar says, include energy-efficiency projects, renewable energy and fuel-switching projects, reforestation programs, and green building construction.

But more lucrative is abating output of nitrous oxide (N2O) and trifluoromethane (HFC-23), two powerful greenhouse gases. Companies that generate these gases as a by-product of other manufacturing operations can add catalysts to convert nitrogen oxide into nitrogen and oxygen and thermally destroy HFC-23 produced while making the refrigerant gas HCFC-22.

Indian chemical manufacturers such as SRF, Gujarat Fluorochemicals, Chemplast Sanmar, Herdillia Chemicals, and Navin Fluorine have been able to use the revenues accrued from carbon credits to fund their expansion and diversification into new business activities.

“The carbon credit business effectively ensured that these companies ended up with good balance sheets,” says Deepak Chander, business director at DSM Sinochem Pharmaceuticals and an authority on carbon footprint studies. “Earlier, the fluorochemicals business was not a profit-making venture, and many companies were in the red. When CERs came into the picture, suddenly there was a major windfall.”

For example, Gujarat Fluorochemicals was host to the world’s first CDM project, at an HCFC-22 plant it opened in 1989 in Ranjitnagar, Gujarat. After making a modest investment of $2.3 million in 2005, the company stands to earn $147 million over 10 years assuming an average $5.00 per CER. Similarly, with an initial investment of $2.8 million, SRF stands to earn $190 million over 10 years.

For the fiscal year that ended March 31, 2012, Navin Fluorine reported a net profit of $39 million compared with $12 million in the previous fiscal year. The 2012 results included substantial income from carbon credits. Partha Roy Chowdhury, Navin’s vice president for finance, says the company earns sizable income through foreign trade as a result of large exports of refrigerant gases and specialties and the sale of carbon credits.

Fertilizer producers generating nitrous oxide during the production of nitric acid also implemented profitable projects. Examples include Gujarat Narmada Valley Fertilizer in Bharuch, Gujarat; Deepak Fertilisers & Petrochemicals in Taloja, Maharashtra; and National Fertilizers in Punjab.

For Indian companies without HFC-23 or nitrous oxide to abate, CDM projects don’t always make sense. Solaris ChemTech, part of the $4 billion Avantha Group, decided that the investment required to gain CERs by cutting power consumption at its caustic soda plant in Karwar, Karnataka, would not justify the returns.

“Our business strategy does not allow us to invest money in a project which delivers less than 15% returns,” says Ashok Mam, chief general manager at Solaris ChemTech. “With a four-year time lag, and investment of over $36 million to modify our caustic soda plant, we decided not to go for it.”

Other companies failed to get involved in the early days of the program when credits were favorably priced. Ramachandran Rajagopal, founder and chief coordinating officer at KnowGenix, a business research and growth strategy firm, says some Indian makers of chemicals, steel, and fertilizers took a long time to understand the benefits of trading in carbon credits.

“There was a general lack of awareness on ways to monetize carbon credits, which resulted in many Indian companies losing an opportunity to cash in. However, Chinese and Brazilian companies made hay,” Rajagopal says.

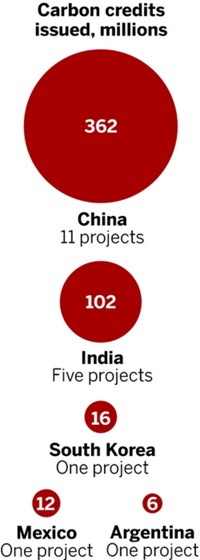

According to Fitch Ratings, as of Oct. 15, 2011, around 21% of overall CDM projects registered were from India, whereas 46% were from China. Together the two countries accounted for around 74% (China 58%, India 16%) of the CERs issued. Fitch estimates that these CERs have added more than $1.2 billion to the overall revenues of Indian companies.

Companies that came to the game later found that prices for CERs had fallen precipitously. Some European buyers that had entered into contracts with Indian CDM projects, especially in the chemical sector, decided to slow down their purchases. Prices fell from about $53 per CER in the early days to $12 to $15 six months ago and less than $4.00 today. One culprit is Europe’s recent economic woes: Companies that have cut back manufacturing operations don’t need to buy as many credits to meet emission reduction targets.

The good times will also soon be over for Indian fluorochemical producers now that the European Union has banned the sale of CERs generated from HFC-23 and adipic acid-related nitrous oxide projects beginning in May 2013. The decision follows accusations by nongovernmental organizations such as the Environmental Investigation Agency that chemical companies in India and China produce HCFC-22 merely to earn the HFC-23 destruction credit. India has lodged a formal protest against the decision with the United Nations Framework Convention on Climate Change Secretariat.

The loss will no doubt hurt Indian fluorochemical producers. “Though these companies have made around $1 billion, if the EU’s new legislation sticks, they face a potential revenue loss of around $1.5 billion,’’ Rambabu says.

Not all is bad for Indian participants in the Indian CER market. V. K. Gulati, former executive director of India’s Gujarat Alkalies & Chemicals and now a consultant, predicts that carbon credit prices will double from the recent lows by March 2013. Many European manufacturing units that used naphtha or natural gas as fuel have switched to coal to cut costs. Given the higher amount of CO2 that is emitted by the burning of coal, Gulati says, companies will be buying more carbon offsets, which should drive up prices.

And projects continue to be announced. Last month, India’s Indofil Industries and China’s Shanghai Baijin Chemical formed a joint venture to build a $40 million carbon disulfide plant in Gujarat. The partners say the venture will use an eco-friendly technology and be entitled to 25,000 CERs per year.

Still, it’s clear that the excesses of the carbon credit era are over. With the doors closing on fluorochemical CERs, Indian chemical companies aren’t going to reap the same giant gains. But greenhouse gases will continue to be cut in the name of profits, and for that Mother Nature will surely be happy.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter