Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Drug Delivery

Rethinking Antibody-Drug Conjugates

Following the recent success of two conjugates, companies are focused on developing the next generation of the cancer technology

by Lisa M. Jarvis

June 18, 2012

| A version of this story appeared in

Volume 90, Issue 25

Not long after Daniel Junius joined ImmunoGen as its head of finance, he came across his employer’s name in a lengthy feature in the New York Times. The 2007 story was about “zombie biotechs,” and it called out ImmunoGen as one of a handful of companies that for decades lurched along, pursuing a single technology without ever getting a product onto the market.

It wasn’t the kind of press a new employee wants to see. But, at the time, the zombie comparison wasn’t so far-fetched. Since 1981, ImmunoGen had been trying to develop antibody-drug conjugates, or ADCs, which use a targeted antibody to deliver potent chemotherapy directly to cancerous cells, sparing healthy ones. The guided-missile approach promised to make cancer treatment safer and more effective. But by the time the article surfaced, more than 25 years had passed and ImmunoGen had yet to get an ADC onto the market. Meanwhile, it had burned through a quarter of a billion dollars developing its technology.

Chasing Technology

Deals involving antibody-drug conjugate (ADC) technology have heated up in the past two years.

March 2012 Mersana Therapeutics teams with Endo Pharmaceuticals to develop ADCs using Mersana’s polymer-linker technology.

March 2012 Celtic Therapeutics, a private equity firm, invests $50 million in the launch of ADC Therapeutics, a biotech firm with 10 ADC candidates.

December 2011 ImmunoGen receives $20 million as part of an ADC pact with Eli Lilly & Co.

June 2011 Synthon acquires Syntarga, a privately held biotech firm with ADC technology.

March 2011 Seattle Genetics gets $8 million as part of an ADC pact with Abbott Laboratories.

January 2011 Seattle Genetics gets $8 million as part of an ADC pact with Pfizer.

January 2011 Spirogen partners with Genentech to develop ADCs with Spirogen’s pyrrolobenzodiazepine payloads.

SOURCE: Companies

A lot has changed since that article came out. Junius is now chief executive officer of ImmunoGen, and the biotech he helms is returning to the realm of the living. Earlier this month, the company’s technology—and ADC technology in general—was the talk of the annual meeting of the American Society of Clinical Oncology, an event akin to the Super Bowl for cancer specialists.

The buzz at the ASCO meeting was around T-DM1, a Genentech breast cancer treatment that uses ImmunoGen’s conjugation technology to connect a cytotoxin to Genentech’s HER2-targeted antibody Herceptin. An early analysis of data from a Phase III trial showed the drug delayed the progression of breast cancer in patients with a mutation in the HER2 receptor by more than three months. Given that all of the patients in the study had already tried other therapies, even a three-month delay is significant.

Furthermore, the women taking T-DM1 experienced significantly fewer side effects from their treatment. Roche, Genentech’s parent, says it will submit T-DM1 to the Food & Drug Administration for approval by the end of this year.

T-DM1 will offer “a very important therapeutic option” for patients with HER2-positive breast cancer, Kimberly Blackwell, a Duke University Medical Center oncologist and lead investigator in the clinical trial, told reporters at the ASCO meeting. “I think it is the first of many antibody-drug conjugates to follow.”

Indeed, the T-DM1 data are yet more good news for ADCs after the approval last year of Adcetris, an ADC for lymphoma developed by Seattle Genetics. “When people see the data on T-DM1, and what Adcetris has been able to accomplish, you see a huge shift in the perspective around the potential for this technology,” Junius says. “Virtually every major oncology company has an initiative on some scale.”

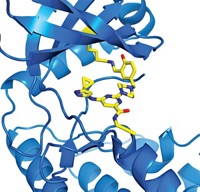

With interest in ADCs reaching fever pitch and dozens of drugs—most based on technology from ImmunoGen or Seattle Genetics—now in early clinical trials, researchers from companies big and small are turning their attention to improving the three main aspects of ADC technology. They want to find new molecules that can tack onto the antibody, expand the array of “linkers” that connect the small molecule to the antibody, and engineer the antibody to control the placement and number of attached small molecules.

At Genentech, for example, eight out of the 20 cancer drugs in the clinic are ADCs. “We’re committed to the idea because it makes so much sense, biologically,” says Ira Mellman, vice president of research oncology at Genentech. If these early-stage therapies—all of which are based on Seattle Genetics’ technology—don’t pan out, it will be a problem of engineering, not biology, he adds.

Pfizer also has made a big investment in the field, says Robert Abraham, chief scientific officer for the firm’s oncology research unit. Naked antibodies “are just challenged,” he says. “An antibody has exquisite specificity for a target but less than optimal cell-killing activity.” And although Abraham doesn’t rule out future successful antibody drugs, Pfizer is focused on ways to enhance antibodies. “We look at ADCs as combining the best of two therapeutic worlds,” Abraham says.

The concept of linking an antibody and a small molecule is not new. Aside from ImmunoGen’s efforts, scientists have been mulling the therapeutic possibilities since the earliest days of the biotech industry. Stephen R. Evans-Freke, founder of the private equity firm Celtic Therapeutics, which recently invested in ADCs, recalls discussing the idea with researchers at Hybritech, San Diego’s first biotech firm.

But if ADCs have been in the scientific imagination for at least three decades, why have they taken so long to be commercialized? “With the knowledge we now have, the early attempts really look kind of silly,” Genentech’s Mellman says. The ADC approach is straightforward, but “that does not at all mean to imply it is simple,” he adds.

Missteps occurred along the way. Instead of small molecules, researchers first tried to attach protein toxins, which are difficult to control, hard to pair with an antibody, and highly immunogenic. In addition, scientists initially targeted their antibodies at proteins that were expressed on both cancer cells and normal cells, defeating the purpose of the technology. On top of that, they underestimated the difficulty of designing a linker.

Mylotarg, the only ADC on the market before Adcetris, fell victim to the technology’s early shortcomings. Developed by Wyeth, which was acquired by Pfizer in 2009, Mylotarg was approved in 2000 to treat a form of leukemia. But the antibody targeted CD33, a receptor found on both tumor and normal cells, and the linker was notoriously unstable, meaning some of the cytotoxic agent was released before it reached cancer cells. Pfizer pulled Mylotarg from the market in 2010 because it failed to prove sufficiently safe or effective.

Seattle Genetics and ImmunoGen have made great progress in overcoming some of the earlier limitations of ADCs, but there’s room for improvement. “There’s still more empiricism in the field than we’d like, although we’re working really hard to establish rules to go into future ADC programs with our eyes much wider open,” Pfizer’s Abraham says.

Each of the three components of an ADC represents a chance to improve the molecule’s performance.

Some researchers feel the small-molecule component represents the biggest opportunity for the field. Although the ADC pipeline has grown substantially in recent years, most compounds in clinical trials deploy one of two payloads—Seattle Genetics’ auristatins or ImmunoGen’s maytansine. Those small molecules inhibit microtubulin, a cellular component that is critical for cell division.

The challenge for ADCs is that the cytotoxin needs to be extraordinarily powerful to have a sufficient cancer-killing effect. “I don’t know how many hundreds of molecules and classes of molecules we’ve looked at over the years,” says Jonathan Drachman, senior vice president of translational medicine and research at Seattle Genetics. “It’s hard to find a drug that’s extremely potent but can be appropriately conjugated and, when it is connected to an antibody and then released, is still active and can kill cells.”

Because manufacturing an ADC produces a heterogeneous mixture with anywhere from one to eight small molecules, researchers look for compounds that don’t clump when put on the antibody. They also can’t be damaged by conjugation. “There are a lot of chemotypes out there that if you touch them, just even tip them a little with a linker, you inactivate them,” says Clay Siegall, Seattle Genetics’ CEO.

Seattle Genetics limits itself to synthesized small molecules to keep the cost of manufacturing the drug-linker unit relatively low, Siegall notes. In its early years the company pursued natural cytotoxins, but it now avoids them because they are challenging and expensive to scale up.

Although auristatins, the microtubulin blockers used in Adcetris and Seattle Genetics’ developmental products, are highly effective, Drachman says the company is exploring cytotoxins that act by a different mechanism of action. Through a collaboration with U.K.-based Spirogen, Seattle Genetics has been working on a class of DNA cross-linking agents called pyrrolobenzodiazepines (PBDs).

Discovered by University College London chemists, PBDs overcome the limitations of other classes of DNA cross-linking agents, including the payload in Mylotarg, says Celtic’s Evans-Freke, who recently created ADC Therapeutics, a biotech firm with a portfolio of 10 ADCs based on the chemistry. Early DNA cross-linking agents were designed to kill cancer cells by inserting themselves into the minor groove of the DNA double helix, but the agents had a fatal flaw: They distorted the helix, and the cells’ repair mechanism kicked in to fix the obstruction. “These new chemistries fit into the minor groove and cross-link without distorting,” Evans-Freke explains.

Genentech, which has chosen auristatin as the payload for all ADCs in clinical development, is working with Spirogen on PBDs for future drugs. The company also has a large in-house effort to understand which drug classes “lend themselves to working as the armament you would put onto an antibody molecule,” Mellman says.

Pfizer, meanwhile, is exploring the world of natural products. “We generally don’t get excited about payloads until we see that their activity in cells is in the low-nanomolar or below range,” Abraham says. “That draws you right into the natural product space.” Many natural products have gone untapped as drugs because they lack the right solubility or pharmacokinetics. “That makes them unappealing as naked drugs,” Abraham notes. “However, when you have a delivery vehicle, all that changes.”

Developing a natural product payload is not easy, Abraham concedes. “It is far from a plug-and-play situation,” he says. Pfizer is developing assays that can help researchers understand when a natural product will be safe and effective as part of an ADC. The company is also using microbial engineering and semisynthetic natural product chemistry to modify promising natural products to accept a linker when they lack a ready site for attachment.

As researchers improve the cytotoxic payloads that can be delivered to cancer cells, they are also expanding the linker toolbox to create variety in how and when the drug is released. “How you connect the chemotherapy to the antibody turns out to be just absolutely critically important for being able to drive therapeutic index”—the amount of drug that can be given before safety is compromised, Genentech’s Mellman points out.

Because the linkers used in Adcetris and T-DM1 are stable, the entire ADC is internalized into the cell before the drug is released. In Adcetris, an enzyme found inside the cancer cell cleaves the cytotoxin; in T-DM1, the antibody is digested in the lysosome, releasing the toxin.

Both of those linkers do their job, but companies are working on linkers that will make ADCs more effective. ImmunoGen, for example, has developed a family of linkers. Some are cleavable, some are noncleavable, and some allow the toxin to migrate through the cell membrane to neighboring cells. The company recently got the green light from FDA to start human tests of IMGN853, an ovarian cancer treatment with a linker that counters the mechanism cells use to pump out drugs before they can do their work.

Once IMGN853 enters the clinic, ImmunoGen will have four different linkers in trials, Junius says. “But people shouldn’t perceive that each linker is an improvement on earlier linkers,” he cautions. Rather, the goal is to find the right properties for a particular ADC, such as how the linker affects the activity of the toxin and how it allows the toxin to be released in the cell.

“We’re learning constantly about what’s a good and what’s a bad linker,” says Hans-Peter Gerber, head of bioconjugate discovery and development in Pfizer’s oncology research unit. “The rule book is not written yet.”

Because an unstable linker contributed to Mylotarg’s failure, researchers have assumed that the small molecule should stay attached to the antibody until it is internalized by the cell. But they are learning that instability can be an advantage. “The type of linker with Mylotarg can be very effective when you put it in the right context with the right target,” Gerber says.

In fact, Pfizer is using Mylotarg’s linker and chemotherapeutic in inotuzumab ozogamicin, an ADC now in a Phase II study as a non-Hodgkin’s lymphoma treatment. But in the newer ADC, the antibody targets CD22, a receptor that is much more specific to cancerous cells than CD33 was.

Mersana Therapeutics is also tackling the linker challenge. The Cambridge, Mass.-based company has developed a polymer-linker system that connects the antibody to the small molecule. However, unlike existing linkers, which attach just one small molecule, a polymer can attach multiple small molecules, in theory dramatically increasing the payload delivered by each antibody.

Advertisement

Drug release is controlled by how the cytotoxin is attached to the polymer linker and could be triggered by pH, an enzyme, or another factor. The polymer itself, a polyacetal, slowly hydrolyzes in an acidic environment.

Using a polymer linker, Mersana says, antibodies can be loaded with a wide range of small molecules. “One of the limitations of ADCs is that the payload is being directly attached to the antibody, and it needs to be done under antibody-friendly conditions,” which means in water, says Timothy B. Lowinger, the biotech firm’s chief scientific officer. Because the polymer linker is soluble in both water and organic solvents, an insoluble kinase inhibitor, for example, can be loaded onto the linker while in an organic solvent and then attached to the antibody in water.

Beyond expanding their small-molecule palettes and improving their linkers, companies are also putting a lot of elbow grease into engineering antibodies to better control how and where a drug is attached.

“What the field is learning through the pioneering work of Seattle Genetics and Genentech is that the chemical details of ADCs are of paramount importance,” says Carolyn R. Bertozzi, a chemistry professor at the University of California, Berkeley, and a Howard Hughes Medical Institute investigator. “That is, not just the nature of the drug, but how and where it is linked to the antibody can have a profound impact on efficacy. This is a big opportunity for chemists to make an impact in a very exciting new area of drug development.”

Current ADC technology uses the amino acids on the surface of an antibody as conjugation sites. ImmunoGen links the small molecule through one of the dozens of lysine residues, whereas Seattle Genetics conjugates through cysteines. However, those methods result in a mixture of ADCs with varying numbers of small molecules attached to each antibody. On average, ADCs made using current technology have three-and-a-half to four cytotoxins, but some have no small molecules and others have up to eight.

That heterogeneity can be a problem. Mylotarg suffered from lack of control over the number of small molecules attached to the protein, says David Rabuka, chief scientific officer of Redwood Bioscience, a biotech company cofounded by Bertozzi to improve drug conjugation. When a protein is overcrowded, especially with hydrophobic compounds, the cytotoxins tend to aggregate and many of those aggregates end up in the liver, causing damage, he explains.

Just as their numbers can vary, the placement of cytotoxins is also variable, Rabuka points out. “There is what I like to call families of conjugates,” he says. Even among antibodies with four cytotoxins attached, some may feature all the toxins clustered in one area, and others may have them spread out.

Redwood’s technology provides control over both the number and placement of the small molecules by inserting aldehyde tags—aldehyde-bearing formylglycine residues—on specific sites on the protein. Aldehyde-specific chemistries can then be performed to create a uniform ADC, Rabuka explains.

One challenge for Redwood was bringing the technology to a point where it was ready for larger-scale manufacturing. “That was a big hurdle for us, and we spent a lot of time engineering our cell lines,” Rabuka says. Now, the firm has several ways to site-specifically conjugate payloads while optimizing yield.

Companies such as Sutro Biopharma, Ambrx, and Allozyne are also working on site-specific conjugation technology. Each biotech is incorporating a nonnatural amino acid into the antibody to allow precise placement of the drug payload.

Ambrx can insert p-acetylphenylalanine onto two sites of the antibody. The phenylalanine derivative has been modified to include a ketone that acts as a functional group for conjugation to the linker and small molecule.

Although Ambrx can attach more than two chemistry “handles” to the antibody, its studies have shown that two small molecules make the most sense. “You really want to be mindful about preserving the native structures and function of the antibody, while trying to optimize therapeutic activity,” says Chief Technology Officer Ho Cho. “The more you stray away from that, the more risks there are in drug development.”

The beauty of site-specific conjugation, researchers say, is that it allows them to methodically determine which ADC variety is the most active. “We can specifically attach whatever payload-linker combo we wish and do quantitative experiments to find out how it works,” Cho says. His team tests biophysical stability, pharmacokinetics, and efficacy to understand how much of the drug can be given before toxicity kicks in.

Pfizer’s Abraham believes site-specific conjugation will be the next major advance on the antibody front. The ability to control how and where the drug is attached “would give us a much more consistent drug product and also allow us to titrate how many payloads per antibody we would want to dial into a given ADC,” he says.

Seattle Genetics also has been working on site-specific conjugation and recently reported a method of adding exactly two drugs to an antibody using engineered-cysteine technology. Control over conjugation could be particularly important when it comes to developing its next class of chemotherapeutics. PBD, the cytotoxin from Spirogen, “is actually somewhat tricky, and it seems to work best when there are two molecules on an antibody,” Drachman says.

Mersana, meanwhile, is looking to link its polymers to antibody fragments to control the size of the ADC. “There’s debate over whether a full-sized antibody is really optimal to penetrate solid tumors,” Lowinger says. By playing with size, the company hopes to find a molecule that is large enough to have good pharmacokinetics and stay out of the kidneys but small enough to penetrate tumors. Mersana has yet to put an ADC into the clinic, although it recently signed a partnership with Endo Pharmaceuticals to develop next-generation ADCs.

A more consistent product, where the safest and most effective ADC has been isolated, could also help bring down ADC costs. When Adcetris was approved, Seattle Genetics said it would cost $13,500 per dose, or more than $100,000 for the average patient. Although development costs are a big factor in how much a company charges for its products, an expensive manufacturing process adds to the ticket.

The matter of price could become significant if, as drug executives predict, ADCs become a major part of the oncology pipeline. ImmunoGen’s Junius says progress in designing ADCs means the chances that a given product will make it to Phase III studies “are much better than five years ago,” when his company was still being called a zombie biotech.

In the next five years, “you’ll see ADCs become fundamental as a therapy in oncology,” Junius predicts. And next year, if T-DM1 gains FDA approval as is expected, ImmunoGen can finally take its place in the land of the living again.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter