Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Earnings Up Amid Weak Economy

As underlying demand wobbled, chemical firms used pricing power to improve finances

by Business Department

July 2, 2012

| A version of this story appeared in

Volume 90, Issue 27

Had chemical industry executives counted on 2011 being a second year of growing demand to improve earnings, they would not have posted the successful financial outcomes that this year's Facts & Figures show.

COVER STORY

Earnings Up Amid Weak Economy

Instead, they put their strategic efforts behind selling new and improved products and selling all goods at higher prices. This strategy provided more than enough additional revenue to make up for tepid demand and to cover increasing energy and raw material costs. In the U.S. and Europe, higher prices boosted earnings considerably, even while production growth stalled over the last three quarters.

Download this article complete with online only tables here.

In the U.S., after a 7.5% increase in 2010, prices for chemicals surged 11.6% in 2011, outpacing the 8.8% hike for all commodities. Prices for industrial chemicals soared by 20.6% last year, and agricultural chemicals, fats and oils, and paint materials also rose above the mean. Similarly, overall chemical prices in Canada climbed by 7.0%.

In the first quarter, the chemical industry was able to complete its long journey back to full production, shrugging off a lingering hangover from the 2008 Great Recession. Demand for chemicals that go into consumer electronics, automobiles, and agriculture and food markets brought early-2011 volume gains, which together with higher prices pushed earnings to new heights.

That strong start to the year propelled notable increases in the annual value of chemical shipments. In Germany, Europe’s largest chemical producer, the value of shipments increased a healthy 7.8%. In the U.S., shipments of all chemicals grew 9.1%—13.5% if pharmaceuticals are excluded. In Canada, chemical shipments, also buoyed by higher prices, increased 7.3%.

But during the rest of 2011, macroeconomic factors such as the European debt crisis, the tsunami in Japan, and slowing growth in developing economies put customers on a cautious footing. The production increases vanished. By the fourth quarter, Cabot, Dow Chemical, DuPont, and Eastman Chemical all saw their earnings retreat.

The European debt crisis was—and remains—a cloud over manufacturers’ business confidence. Yet it did not have a large impact on the full-year results of European chemical firms. Companies were able to make the most of economic growth in other regions such as Asia, the Middle East, and even the U.S.

Only two major chemical firms that have headquarters in Europe—Arkema and Givaudan—saw revenues decline in 2011 compared with 2010. But company earnings showed other signs of weakness. Of the 16 European firms tracked by C&EN, seven posted lower earnings compared with the year-ago period. Among them, Arkema posted a loss for the year.

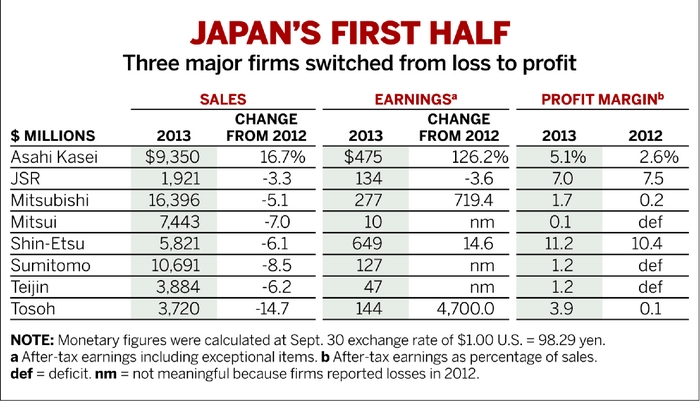

In Japan, only four of 12 firms tracked by C&EN saw earnings increase in 2011, though most on the list remained profitable. Revenues barely budged from 2010. Companies blamed their performance on the weakness in the Japanese and world economies and on the earthquake and tsunami that struck in March 2011. Still, Shin-Etsu Chemical was able to raise profits slightly despite suffering major earthquake damage at polyvinyl chloride and silicon wafer plants.

Meanwhile, pharmaceutical firms in the U.S. and Europe had a mixed, but largely positive, year in 2011. With the exception of Pfizer, U.S. drugmakers saw revenues increase. Earnings were down at Eli Lilly & Co., Johnson & Johnson, and biotech firm Amgen. However, Amgen awarded dividends for the first time. Both Merck & Co. and Pfizer rolled back a portion of R&D spending that they had hiked significantly in 2010.

In Europe, Roche and GlaxoSmithKline reported higher earnings despite lower revenues. Only Novartis posted a decline in profits for the year, and all firms increased dividends.

Although most chemical firms continued to preach the gospel of cost cutting to their recession-weary investors, they did increase capital spending significantly in 2011. U.S. firms increased investments by 21.1%. European firms bested them with a 23.6% hike in capital spending. And in Japan, spending on plants and equipment grew 11.3%.

In contrast, the Japanese firms tracked by C&EN decreased spending on R&D by a combined $113 million. Europe increased R&D spending slightly, with the largest contributions to that increase provided by Merck, BASF, and Syngenta. In the U.S., 17 chemical firms accounted for a combined total increase in R&D spending of $532 million, or 9.2%.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter