Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Earnings Fall For A Third Quarter

Chemical firms outline restructurings and layoffs, as they report ongoing weakness in earnings

by Melody M. Bomgardner

November 12, 2012

| A version of this story appeared in

Volume 90, Issue 46

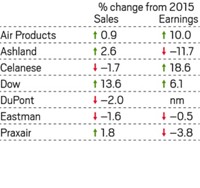

Against the backdrop of a slowly strengthening U.S. economy, chemical firms saw earnings slide again in the third quarter, in large part because of rapidly declining prices. Out of 21 firms tracked by C&EN, Dow Chemical, DuPont, and eight other companies reported lower sales and earnings in the quarter compared with last year.

The results prompted promises by chief executive officers to heighten the cost-cutting moves they have been implementing throughout the postrecession recovery. As they announced financial results, Dow CEO Andrew N. Liveris and DuPont CEO Ellen J. Kullman unveiled additional restructuring plans, including layoffs, to be implemented in the fourth quarter and beyond (C&EN, Oct. 29, page 7). Then, one week after Dow’s Oct. 23 announcement, the company amended its tally of layoffs, saying it will cut 3,000 positions in the next two years, an increase of 600 from the original statement and equal to 6.3% of the firm’s workforce.

Dow found buyers for the output of most of its businesses in the third quarter. The firm reported that overall volumes were essentially flat, as were its plant operating rates. But prices fell 9% on average across the company’s businesses.

“Price was a large negative driver in our results, with broad-based declines driven by weak market conditions, significant downward movements in raw material costs, and currency headwinds, particularly in Europe,” Liveris told analysts in a conference call. Most firms reported that the strong dollar relative to the euro reversed the recent trend of price increases.

Both prices and volumes declined for Dow’s businesses in electronic chemicals, functional materials, construction chemicals, and water treatment and process chemicals. But demand was strong for industrial coatings, crop protection products, as well as seeds, genetic traits, and seed oils.

Dow’s overall earnings of $497 million were off 31.8% from last year’s third quarter. Still, Dow’s third-quarter earnings per share of 42 cents beat analysts’ expectations by a nickel. Those same analysts didn’t give Liveris a pat on the back, however. They instead cited concerns about how he will grow Dow in the future.

“While we give Dow credit for spotting the slowdown early on and expanding cost-cutting efforts, long-term investors are looking for organic top-line growth from innovation,” wrote P. J. Juvekar, a chemicals analyst at Citigroup, in a note to investors.

But for the moment, Dow is focusing on shrinking its footprint. In addition to affecting its workforce, the company’s restructuring will result in the shutdown of approximately 20 facilities, including a polyethylene plant in Tessenderlo, Belgium; a diesel particulate filter facility in Midland, Mich.; and formulated systems plants in Spain, England, and Ohio.

Dow will also write down the value of capital assets related to its majority share in advanced battery maker Dow Kokam. Automakers have not yet amped up production of plug-in hybrids that require the batteries produced at the company’s facility in Midland. In total, Dow expects the restructuring to require a pretax charge in the fourth quarter of $900 million to $1.1 billion.

At DuPont, prices fell 4%, primarily because of the impact of currency exchange rates. Volumes were lower by 5% on average, resulting in 9.2% lower sales in the quarter. Poor demand for DuPont’s profitable titanium dioxide pigment contributed to a 47.8% drop in earnings compared with last year’s third quarter. In a call with investors, Kullman blamed weaker economic conditions, particularly in China and Europe, for slowing construction and infrastructure spending.

At 32 cents, DuPont’s earnings per share from continuing operations were 8 cents below the estimate of David Begleiter, research analyst at Deutsche Bank. “The shortfall was due to weak demand in TiO2 and lower photovoltaic sales,” Begleiter wrote in a note to investors. Volumes for TiO2 shrank by 18%, and electronic chemicals were off by 20% from the year-ago period. “With the exception of agriculture and performance materials, all divisions missed expectations due to broad-based demand weakness and unfavorable currency effects,” he said.

Kullman led off her comments to analysts with a discussion of new cost and productivity programs. DuPont will cut 1,500 positions in the next 12 to 18 months. About half of the $450 million in savings will come from streamlining corporate overhead following the company’s divestiture of its coatings business to the Carlyle Group for $4.9 billion.

Problems in electronics, specifically the photovoltaics business, hurt Ferro even more than it did Dow and DuPont. Ferro reported that contraction in the industry and poor progress in getting its conductive paste products qualified by large solar-cell producers led to an overall 24.0% sales decline compared with the year-ago quarter and a net loss of $2 million. The firm says it is looking for a buyer for the solar pastes business. In addition, the company plans to lay off 10% of its workforce, or approximately 500 employees, over the next two years.

Meanwhile, FMC Corp. shared the success of Dow and DuPont in selling its agriculture products to farmers in North and South America. Overall, FMC raised earnings 10.1% to $109 million. The firm’s good fortune in agriculture more than outweighed the weakness in its industrial and specialty chemical businesses.

For Ashland, Cytec Industries, and Eastman Chemical, major acquisitions proved a good way to keep earnings moving in a positive direction. Ashland, which acquired International Specialty Products in early 2011, benefited from its increased focus on specialty chemicals for personal care and pharmaceutical applications. In contrast, the firm reported weak demand for water treatment technologies and elastomers.

Cytec doubled down on its high-tech materials offerings by acquiring Umeco, a maker of advanced composite materials. That addition was completed in July and helped the firm increase earnings to $43 million, a 65.4% jump from the 2011 third quarter. Then, on Oct. 8, Cytec announced it will divest its coatings business to private equity firm Advent International for just over $1 billion.

Eastman’s absorption of Solutia made a notable difference in its financial picture. In the second quarter, the specialty chemical maker reported lower sales and earnings. But in the third quarter, Eastman told investors that earnings increased 37.4% to $246 million on a 24.7% increase in sales. Like Dow and DuPont, however, the company also faced lower selling prices.

“Our record performance after the Solutia acquisition reaffirms our confidence that we will continue to deliver year-over-year earnings growth,” said Eastman CEO James P. Rogers in a report to investors. “Results were solid throughout the company, demonstrating the strength and diversity of our businesses in what remains a challenging global economic environment.”

Aside from Rogers, chemical executives mainly shied away from commenting on their expectations for improvements in 2013—other than to say they don’t expect any. In the third quarter, only agriculture and some packaging markets brought significant growth for the chemical industry. Still, DuPont’s Kullman named a few markets she’d like her firm to invest in, including industrial biotechnology, organic light-emitting diodes, and new materials for the auto industry.

In contrast, Dow’s Liveris suggested to analysts that his plan is to do less with less. “We have announced significant steps to reduce capital spending in 2013, to dial back new business growth investments, and to further curtail discretionary spending,” he said.

“We are far from a reasonable, normalized world,” Liveris intoned in response to an analyst’s question about earnings growth targets. “We are a slow-growth world.”

Corporate and industry economists surveyed by the National Association for Business Economics seem to agree. In an October survey, two-thirds of 67 economists said they expect weak annualized gross domestic product (GDP) growth of 1.1 to 2.0% in the U.S. through the third quarter of 2013. Almost all of the respondents said they expect the European financial crisis will lead to flat or lower earnings over the next six months.

The American Chemistry Council, a trade group for U.S. chemical manufacturers, found some good news in October, however. ACC’s leading U.S. economic indicator, called the Chemical Activity Barometer, showed a “strong” 0.6% growth over September. The CAB’s three-month moving average of 90.7, compared to 100 for the base year of 2007, suggested steady but slow growth prospects into 2013.

The uptick was driven in particular by rising activity in construction-related plastic resins, coatings, pigments, and other chemicals.

But ACC warned that the threat of worsening conditions in Europe and China poses risks to a U.S. economic recovery. In 2011 China’s GDP grew by a blistering 9.2%, but it slowed to 7.7% in the first three quarters of 2012. PricewaterhouseCoopers, a consulting firm, projects China’s economy will grow 7.8% in 2013.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter