Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

The Hunt Is On For Hydrochloric Acid

Buyers and sellers react to supply shortfall for key industrial commodity

by Michael McCoy

February 6, 2012

| A version of this story appeared in

Volume 90, Issue 6

Hydrochloric acid is one of those chemical commodities that, without much attention, lubricate the American industrial economy day in and day out. That is, until supplies run short.

Since last fall, when an unwelcome convergence of output limitations and rising consumption crimped supplies, HCl consumers across a range of industries have been scrambling to get the acid they need to keep their operations going. New production capacity is being developed, but the market is expected to remain tight well into this year.

Along with commodities such as chlorine, caustic soda, and sulfuric acid, HCl is one of the top-volume inorganic chemicals made in the U.S. Production in 2010 was 4.1 million tons, according to the U.S. Census Bureau.

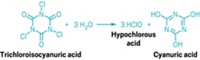

But HCl differs from other inorganics in that most of it is made as a by-product of other chemical manufacturing processes. Only about 30% of the HCl made in the U.S. is produced on purpose, via the burning of elemental chlorine. The rest is generated during the manufacture of isocyanates, fluorocarbons, and other chemicals. The result is that HCl supplies depend largely on the health of other industries.

Today’s situation can be traced back to the second half of 2010, according to Steve Brien, global practice leader for chlor-alkali and vinyls at the consulting firm IHS Chemical. At the time, Brien says, producers of isocyanates and other HCl-generating chemicals were roaring out of the recession and making lots of by-product.

But in the spring of 2011 the economy started to sputter again. Demand faltered and inventories of isocyanates, fluorocarbons, and the like began to pile up. Plant managers responded by ratchetting down production, curtailing output of HCl in the process.

The story was different on the supply side of the equation, as a December report from the procurement intelligence firm Beroe makes clear. Beroe published the report on behalf of Rx-360, a pharmaceutical supply chain consortium that is concerned about the impact of the HCl shortage on its members. Drug companies use HCl as a catalyst, for pH control, for water deionization, and as a reducing agent.

Beroe reported that almost 30% of the HCl generated in the U.S. last year was consumed in oil- and gas-well acidizing, a technique in which HCl is pumped down wells and into rock pores to dissolve sediment and stimulate the flow of hydrocarbons. This process frequently accompanies the hydraulic fracturing of shale, a new and fast-growing drilling technique.

Thanks to the exploitation of shale oil deposits, the oil-well-acidizing market is expected to expand about 2.5% annually in coming years, according to the Beroe report. Growth was particularly strong in late 2010 and the first half of 2011, according to IHS’s Brien, pulling HCl consumption along with it.

The convergence of rising demand and falling supply was “a perfect storm,” Brien says. “The two lines crossed paths, and there wasn’t enough acid to go around.”

The supply shortage reached its apex late last year. Brien says he heard tales, possibly apocryphal, of drums of HCl being imported from China and delivered to oil rigs. Prices for bulk material tripled from $100 to $120 per ton in late 2010 for 22° Baumé acid—a 35% solution—to more than $300 per ton today for some customers.

The shortage has created upheaval among both buyers and sellers. Trent Watkins, chief executive officer of Cimarron Acid Service, an oil-well-stimulation firm in Fairview, Okla., tells C&EN that he was unable to get the HCl he needed to complete jobs for some hydraulic fracturing customers last fall.

Steel pickling companies use HCl to remove stains and other contaminants from giant coils of steel. WorldClass Processing, a steel pickler in Ambridge, Pa., has found the acid it needs, thanks to some creative delivery scheduling, according to Purchasing Manager Roger Preston. However, prices jumped in 2012, Preston says, and he’s concerned about future price increases as the oil and gas industry buys up supplies.

Meanwhile, the phones have been ringing at Detrex Chemicals, which produces HCl on purpose via the chlorine burning process. Detrex calls its plant in Ashtabula, Ohio, one of the largest U.S. producers of high-purity reagent, food, pharmaceutical, and semiconductor grades of HCl.

But beginning in the fourth quarter of last year, industrial companies that normally use technical-grade acid approached Detrex and said they would buy the higher purity grades because they weren’t able to get enough of the technical product, says Les Scripa, Detrex’ business manager for chemicals. The company increased production to accommodate the new customers.

“I’ve been shipping several loads a week to customers requiring tech grade,” Scripa says. “We don’t know how long this supply-demand imbalance will continue, but we will try to help out for as long as possible.”

Canexus, a Canadian producer of chlorine and other inorganic chemicals, responded to the supply shortfall by announcing in December that it will spend $25 million to increase the capacity of its on-purpose HCl facility in North Vancouver, British Columbia, by 75%. The project will be complete in the first quarter of 2013, and the firm is considering a second expansion as well.

“Hydrochloric acid demand has grown quickly in western Canada as a result of new drilling and fracturing technologies and higher oil prices,” the firm said in announcing the expansion. “At the same time, supply has been constrained due to lower by-product acid production.” The result, Canexus says, has been “rapid escalation of acid prices,” which it expects to persist through 2012.

With HCl demand from oil-well drillers expected to be strong throughout 2012, healthy supplies will be key to the market this year, IHS’s Brien says. Although he has no statistics yet, Brien says his sense is that HCl-generating industries notched up their operating rates in January. “That may be just enough acid in the market to alleviate some of the extreme tightness that we’ve been experiencing,” he says.

At Cimarron, Watkins says HCl finally became more available toward the end of 2011 when well-drilling activity slowed. Still, prices are almost triple what they were a year ago, and he’s concerned about the coming months. Watkins expects oil and gas drilling to pick up in March, and he’s not sure if there will be enough acid to go around.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter