Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Petrochemicals: The U.S. Will See A Boom As Europe And Asia Struggle

by Alexander H. Tullo

January 14, 2013

| A version of this story appeared in

Volume 91, Issue 2

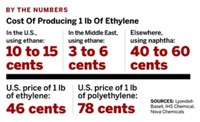

The petrochemical world is split in two. Companies in the U.S. and Middle East are raking in big money converting cheap natural-gas-derived raw materials into ethylene derivatives such as polyethylene and ethylene glycol.

Players in Europe and Asia aren’t so fortunate. High oil prices are driving up costs for the naphtha they use as feedstock, giving them little cushion to fend off less expensive imports. Sluggish growth, particularly in Europe, hasn’t helped matters either in these regions.

“If the economy does not improve, you will see some pressure on those areas,” James R. Fitterling, Dow Chemical’s executive vice president for feedstocks and performance plastics and for Asia and Latin America, told investors last month. High-cost facilities might be shuttered or scaled back. In Northeast Asia, smaller, older ethylene crackers are the most vulnerable, he said. In Europe, facilities that are not integrated with refineries or with aromatic chemical production are in jeopardy.

The situation in the U.S. couldn’t be more different, according to John Stekla, director of ethylene studies at market research firm IHS Chemical. In December, the cost of producing ethylene from ethane was about 10 cents per lb, the lowest level since 1999. The cost of producing it from propane was about 11 cents per lb, the lowest it has been since 2002. Ethylene sells for about 59 cents per lb.

“U.S. producers of ethylene derivatives are really in a great place because they’ve got a strong domestic market that is consuming somewhere between 82 and 85% of the ethylene that is being produced, and yet they have an incredibly low cash cost of production, which supports exports anywhere in the world,” Stekla says.

Stekla sees 3 to 4% growth in ethylene consumption in the U.S. in 2013, an increase from the 2% posted in 2012. U.S. profit margins will be high next year, he expects, but perhaps not as high as they were in 2012.

Last year brought unplanned plant outages that drove up ethylene prices. But this year, companies are adding capacity. Dow, for example, has restarted an ethylene cracker in St. Charles, La., that has been off-line since 2009. Eastman Chemical, LyondellBasell Industries, Williams Cos., and Westlake Chemical are also starting to increase production in incremental amounts.

Assuming that economic growth holds up, conditions for petrochemical producers should improve until the market peaks in 2016, industry watchers expect. Seven companies thus far are planning new U.S. ethylene crackers that will commence operations around that time.

MORE ON THIS STORY

- - World Chemical Outlook

- - Pharmaceuticals: Companies Will Focus On External Partnerships To Improve Productivity

- - U.S.: Domestic Manufacturing Slowdown Will Be Offset By Shale Gas Upside

- - Construction: The Action, Once Again, Is In Developing Countries

- - Europe: Economy And Chemical Industry Are Expected To Stagnate

- - Fine Chemicals: Optimism Prevails Over Uncertainty

- - Asia: Slowdown In China, Although Mild, Is Cause For Concern

- - Petrochemicals: The U.S. Will See A Boom As Europe And Asia Struggle

- - Cleantech: New Funding Will Be Scarce, But Scale-Up Plans Continue

- - Specialties: Growth To Be Fueled By Autos, Electronics

- - Canada: After A So-So 2012, Chemical Firms Prepare For A Brighter Future

- - Instrumentation: Firms Plan For The Long Term Amid Short-Term Uncertainties

- - Middle East: After Years Of Growth, A Profits Squeeze Lies Ahead

- - Advanced Materials: Carbon Fiber, 3-D Printing, Graphene To Make Inroads

- - Latin America: Policymakers, Industry Seek To Boost Competition

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter