Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Volatile Time For Chemical Makers

Second-quarter earnings: Diverse conditions across sectors and regions led to ups and downs

by Melody M. Bomgardner

July 29, 2013

| A version of this story appeared in

Volume 91, Issue 30

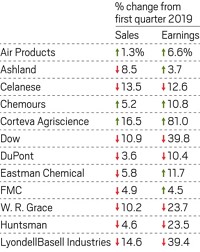

Of a dozen chemical firms that have reported so far for the second quarter, half have hiked earnings compared with the year-ago quarter. Among the firms posting strong results are Dow Chemical, Cytec Industries, and PPG Industries. But supply and demand volatility, along with weak sales in Europe and China, took a bite out of earnings at firms such as DuPont and Albemarle.

In June, DuPont warned that a cold, wet spring would affect its agriculture business, but the segment proved resilient, and sales increased 7%. “While the weather caused us to incur more costs to service our customers … our leading products in both of our ag businesses performed at the top of their industries,” said CEO Ellen J. Kullman in a conference call with analysts.

DuPont increased the volume of chemicals sold by 1% compared with the second quarter of 2012, but lower prices for titanium dioxide dragged down profit margins. In total, its quarterly earnings dropped 16.3% to $1.2 billion. The firm announced that it may sell or spin off its performance chemicals division, which includes TiO2 and fluorochemicals (see page 7).

Volatility was also apparent for firms that sell guar gum, a thickening agent used in food and in gas drilling. Earlier fears of shortages caused suppliers, including DuPont, to stock up on the ingredient. As a result, inventory costs dragged down earnings at DuPont’s usually strong nutrition and health segment. A slowdown in hydraulic fracturing for gas prompted sharply lower guar sales at Ashland, which saw overall earnings fall 19.0%.

On a brighter note, Dow raised quarterly earnings 18.6% to $770 million, just beating analyst expectations. A good crop chemical market helped Dow’s agriculture business boost sales 10% in the quarter. The firm reported that sales of specialty plastics were higher in North America, Latin America, and Asia, more than offsetting lower sales in Europe. Dow applied a $2.2 billion settlement from the failure of a Kuwaiti joint venture directly to its debt.

Other companies gained or suffered during the quarter depending on geography and industry served. Cytec’s sales soared 27.2% on demand for aerospace materials, driven by orders for the Boeing 787, and demand for process separation products used in metal mining. PPG reported higher sales of industrial and automotive coatings in North America and China.

In contrast, Albemarle’s lower quarterly earnings were because of “continued sluggishness across Europe, weak electronics and construction markets, and a much weaker China than most anticipated at the beginning of the year,” said CEO Luke Kissam.

More On This Story: End Of An Era At DuPont

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter