Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Sales On The Upswing

Forecast: As global chemical use rises, the U.S. will be a major beneficiary

by Marc S. Reisch

December 23, 2013

| A version of this story appeared in

Volume 91, Issue 51

As the global economy improves, U.S. chemical makers are poised to benefit from a combination of low-cost shale-derived raw materials, gains in sales to carmakers and home builders, and rising exports of basic and specialty chemicals.

That’s the forecast for 2014 and beyond from the American Chemistry Council, the U.S. industry’s main trade association. “U.S. chemical makers will be capturing market share from the rest of the world—something they haven’t been able to do since the 1950s and 1960s,” says T. Kevin Swift, ACC’s chief economist. U.S. chemical makers will increase sales to global customers, he adds, particularly in Europe, where energy costs are much higher than in the U.S.

ACC expects the U.S. economy to grow just 2.5% in 2014, weighed down by high taxes, debt, regulatory burdens, and political uncertainty. But the job market is expanding, consumer income is rising, and car sales are increasing, “taking chemical sales up with it,” Swift says.

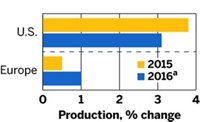

After increasing by 3.2% in 2013, U.S. chemical production will rise only 2.6% in 2014, according to ACC data. However, by 2018, as new shale-driven projects come on-line, the value of industry shipments will jump by nearly 25% to $1 trillion from $788 billion this year. ACC says chemical firms are planning 136 projects costing $91 billion. As they start up, exports will rise.

The U.S. chemical trade balance rose in 2013 to $2.7 billion and will increase to $30 billion by 2018, ACC projects. Industry employment, which fell steadily from 1999 to 2011, grew 1.3% in 2013 to 794,000. ACC forecasts employment will reach 806,000 by 2018.

In contrast to ACC’s bullish assessment, Germany’s chemical industry association says 2013 was not an easy one for that country, the largest chemical producer in Europe. Faced with rising energy costs and stagnant exports, production rose just 1.5%. The industry group expects a 2.0% increase in 2014.

The European Chemical Industry Council, which usually issues an outlook for the European chemical industry in December, did not do so this year. The group did say the region’s chemical production slipped 0.7% during the first nine months of 2013.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter