Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Custom Chemical Firms Expand Into Formulation

Suppliers see opportunities in formulation development to grow their businesses by addressing drug delivery challenges

by Ann M. Thayer

February 11, 2013

| A version of this story appeared in

Volume 91, Issue 6

To win at the drug development game, it’s not enough to show up with a great molecule. Many compounds would stall at the discovery stage without effective ways to get them inside patients. But the days of simple, easy-to-make pills are gone and the endgame now is about shaping uncooperative compounds into well-behaved medicines.

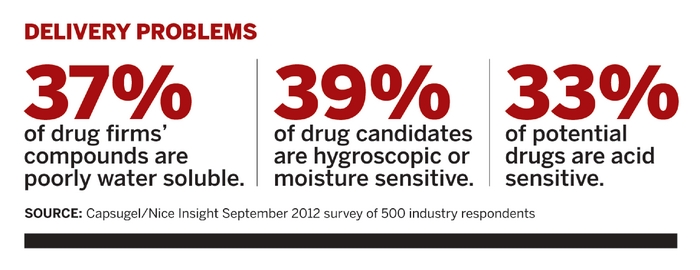

More than half of new pharmaceutical compounds moving into development have tricky physical properties that call for some kind of special science and engineering, says Rod Ray, chief executive officer of Bend Research, an Oregon-based drug formulation specialist. Crafted for their therapeutic merits, up to 40% of drug candidates are poorly soluble, overly reactive, not bioavailable, or a confounding combination of such problems.

COVER STORY

Custom Chemicals Go Further

Consequently, pharmaceutical companies that want to advance all of their clinical candidates have no option but to try to solve physical form and delivery problems. The drug industry has an anemic new-product pipeline, so many big pharma firms are willing to spend money and effort on formulations and dosage forms to turn the compounds they’ve discovered into viable drugs. “Fewer molecules are being brought forward but with more firepower behind them,” Ray says.

That willingness to spend is an opportunity for formulation specialists and contract manufacturing organizations (CMOs). In a late-2012 survey conducted by the market research firm Nice Insight, 82% of drug industry respondents said they believe that innovative dosage forms are required to meet the needs of pharma R&D. Capsugel, a drug delivery and capsule specialist that Pfizer sold to private investors in 2011, commissioned the survey.

The survey brought other welcome news for drug formulation service providers from their potential customers. About 58% of drug firms polled said they outsource dosage-form development, and 56% reported that they spend $10 million to $50 million on it annually. Biotech and virtual companies that lack in-house formulation capabilities have long been key formulation customers, suppliers say. More recently, they add, business is on the rise from mid- and large-sized firms that have been cutting back on internal R&D.

To meet demand from such firms, manufacturers of drug active ingredients have been moving downstream into formulation and dosage-form creation through investments, acquisitions, and partnerships to add technical capabilities and production capacity.

To succeed, these CMOs realize, they must play at the same high level as formulation specialists like Bend, which has been working on drug formulation development for more than 25 years. A decade of that, up to 2008, was exclusively with Pfizer. Playing the game well requires being able to understand drug biology and chemistry, engineer crystal or particle forms, and develop technologies to make problematic compounds workable. Building this expertise and gaining experience with customers will take time, insiders say.

To demonstrate value to clients, CMOs “are likely to continue focusing on strategic relationships and promoting more services such as formulation improvements, alternative dose forms, real-time order tracking, and logistics support,” says Jesse Sullivan, an analyst with Frost & Sullivan who covers the outsourcing market.

Many established formulation specialists, like Bend, have been at it for a long time. Bend boasts that it has worked with 76 customers on more than 700 compounds in formulation development and manufacturing. Given this broad experience, Ray says, the company has “approaches to handle most everything.” Its lead technologies include spray drying and hot-melt extrusion, both of which yield amorphous solid dispersions with improved solubility (C&EN, May 31, 2010, page 13). The spray method—which mixes a drug compound with a polymer and solvent—allows it to be dried into a powder. The other approach, melting the drug with a polymer, allows for extruding it as a solid. Either dispersion form can then be processed, along with excipients and other formulation aids, into a final dosage or delivery form.

Bend, like many formulation developers, has been collaborating with other suppliers to extend its reach. Its own capabilities support customers through Phase III of the drug development process. It has joined with the CMO Hovione for large-scale spray drying and with formulation specialist Catalent Pharma Solutions for multiparticulate oral controlled-release drug products. “These relationships are about having a clear commercial pathway for our customers,” Ray says.

Bend has already transferred several products to Hovione for scale-up. That Portugal-based company took a big step in the formulation world in 2009 when it acquired a very large-scale pharmaceutical spray dryer, barely used, as part of its purchase of Pfizer’s Cork, Ireland, plant. As of late 2012, Hovione was making five commercial products there and had two more soon to come on-line.

It makes more sense for a CMO to amass specialized formulation-related services than for a drug firm to invest in expensive or untested technology to make a single product, argues Hovione CEO Guy Villax. “A CMO is a more elegant model to invest in specialized technology because we can handle compounds for anyone when they need the technology,” he says. With these economies of scale, Hovione has seen a 10-fold expansion

Hovione’s combined active pharmaceutical ingredient (API) manufacturing and particle design business grew about 15% annually over the past five years to reach about $180 million in 2012. This year, it will handle more than 75 compounds in various stages of clinical development. After 2015, Villax expects, formulation development will be the main driver of the company’s growth.

In June 2012, Hovione began working with Switzerland’s Solvias, a solid-state chemistry and analytical services firm. The collaboration gives Hovione access to Solvias’ expertise in making pharmaceutical cocrystals as a means of overcoming poor bioavailability and other drug delivery issues. In 2011, Hovione partnered with Bethlehem, Pa.-based Particle Sciences, a drug delivery technology firm.

With these partnerships lined up, Hovione launched an expanded particle design solutions business in late 2012. “We recognize that solid dispersions are growing, but they are not the solution for everything, so we are offering a comprehensive portfolio of technologies most likely to solve problems,” Villax says. Along with methods for making amorphous solid dispersions, the business offers commercial-scale crystal design and particle-size control capabilities, supported by formulation development and dosage manufacturing that can assist customers through Phase II of clinical trials.

Similarly, Catalent, which has its headquarters in Somerset, N.J., has increased its focus on advanced drug formulation and final-dosage-form manufacturing. Catalent has been a stand-alone pharmaceutical services company since 2007 when Cardinal Health sold the now-$1.7 billion-per-year business to private investors.

One area of focus is its softgel gelatin capsule technology, which originated within R. P. Scherer Corp., a company Cardinal acquired in 1998. Catalent has expanded this offering with a plant-polysaccharide-based capsule that can encapsulate high-melting-point formulations. It also has developed a fast-dissolve technology, called Zydis, for making freeze-dried tablets that disintegrate in the mouth within seconds.

In the modified-release area, Catalent has licensed technology from Japan’s Sanwa Kagaku Kenkyusho for use outside much of Asia. With the technology, Catalent can make tablets with cores of various shapes, sizes, and placements. This flexibility of design allows for different drug, dosage, and release profiles in a single tablet. “We are in the early phases of working on feasibility with two major customers,” says Will Downie, Catalent’s senior vice president for sales and marketing.

For preformulation studies, Catalent acquired a solid-state API structure screening and optimization platform from GlaxoSmithKline. In recent years, Catalent has also expanded its analytical labs and production facilities. Just last month, it announced plans to spend $20 million to expand inhalation drug manufacturing at its Research Triangle Park, N.C., site.

For almost a year, Catalent has had an alliance with the chemical giant BASF. The pact combines BASF’s expertise in developing solubilizers and polymeric excipients with Catalent’s formulation approaches, in particular its hot-melt extrusion capabilities. Similarly, Bend has set up a collaboration with Dow Chemical to develop polymers for improved drug solubility and use in spray-dried dispersions.

Eager to foster more ideas, last October Catalent launched the Catalent Applied Drug Delivery Institute with the goal of encouraging an exchange of information between academia and industry. “A lot of great work is being done in the academic community that often is fundamental to understanding drug delivery and solving problems,” says Ian Muir, Catalent’s president for modified-release technologies. Owing to R&D cutbacks within many drug companies, he adds, “it’s research that just isn’t getting done as often as it used to be.”

The institute is supporting education and training, student competitions and internships, and publications and communications to promote formulation and drug delivery science more widely.

Similarly, England’s Aesica Pharmaceuticals has created the Aesica Innovation Board to help find academic and small-company technology partners, says Paul Titley, business development director of Aesica’s formulation development business. Aesica was formed in 2004 to buy the unwanted manufacturing plants of big drug companies. Although Aesica started by pursuing both API and formulation assets, formulation is the majority of its business today.

When visiting conferences and trade shows, Titley is on the lookout for “anything interesting related to pharma processing, either at the API or dosage-form level.”

By keeping his eyes and ears open, he has found success by looking in Aesica’s own backyard. Since 2008, the company has worked with Upperton, a spray-drying and formulation firm in Nottingham, England, where Aesica has a facility. “Together we now have at least three compounds in Phase II development for customers.” he says. In 2011, it began collaborating with EmulTech, a Dutch firm that develops drug delivery systems around microparticulates.

Such combinations can bring nascent technologies up to a level appropriate for clinical use and for attracting pharma companies. Although an enormous amount of invention takes place in universities and small companies, most of it occurs in facilities that do not comply with the current Good Manufacturing Practices (cGMP) required to make clinical and commercial drugs, Titley explains. Aesica can provide cGMP-compliant manufacturing, as well as quality control, analytical chemistry, documentation, and other regulatory support.

Aesica recently established a partnership with the Centre for Pharmaceutical Engineering Science, an arm of England’s University of Bradford that works with hot-melt extrusion, supercritical fluids, and nanomilling. “It is an Aladdin’s cave of different technologies,” Titley says. Aesica has gained access to new formulation development research and in exchange has helped train Bradford staff in process scale-up under cGMP conditions. Aesica also provides cGMP manufacturing services to six other universities.

Although Aesica is keen on hot-melt extrusion methods, it doesn’t yet have any commercial-scale capabilities. “We are committed to new technologies, but we probably share the rationale with most CMOs that we will invest at the point a product needs a significant scale of manufacture,” Titley says.

Aesica isn’t shy about investing in infrastructure. In the formulation area alone it purchased Abbott Laboratories’ Queenborough, England, site in 2007 and Nottingham-based R5 Pharmaceuticals in 2010, four years after Titley had founded it. Aesica also acquired German and Italian sites from the Belgian firm UCB in 2011. Aesica added capacity in Nottingham in 2011 and is expanding the Queenborough site.

Like Aesica, Hovione, and others, Northern Ireland’s Almac offers pharmaceutical customers a range of services from API synthesis through formulation development, clinical supply, and commercial dosage manufacturing.

The formulation landscape is becoming more crowded, acknowledges John McQuaid, Almac’s vice president for technical operations, and many types of firms are jockeying for competitive position. The advantage of small or niche companies may be an ability to offer deep expertise in a specific formulation technology. But the disadvantage is that if a customer wants to try other approaches or outgrows the small firm’s capacity, that customer often must look elsewhere.

Advertisement

On the other hand, many large CMOs strive to be one-stop shops with a breadth of technologies and more vertical integration. “Bigger players with a broad service offering can look for strategic or preferred-provider relationships with clients,” McQuaid explains. Although these relationships are desirable, they also raise the bar. “Customers ultimately will want ‘best in class’ in each of the different areas,” he adds.

Almac can handle a variety of dosage forms in the early stages of drug development, but it focuses primarily on formulation development and manufacturing of solid oral forms from early development through commercialization, McQuaid says. The company recently spent $10 million to double its dosage-form drug development capacity by adding a non-cGMP facility and two additional analytical labs at its Craigavon headquarters.

Almac’s existing cGMP facility will support drug product manufacturing from Phase I through registration and commercialization, whereas the non-cGMP operation will handle lab-scale work up to about 15 kg. To transition processes seamlessly, the new facility operates under the same principles and technical standards as the existing one, but without the paperwork, material control, and cleaning required for cGMP.

“We can move faster and be more flexible when not having to work under cGMP conditions,” McQuaid says. In the new facility, Almac will manufacture prototype formulations, batches for stability studies, and products for any testing that does not involve humans. As customers implement quality-by-design approaches relying on statistically designed experiments, the non-cGMP lab can support the need for more lab-scale batches, he adds.

Ready to go with new facilities and partnerships developed in the past couple years, CMOs still must get customers through the door. Understanding when drugmakers want to begin formulation development is one challenge in attracting them. For drug companies focused on discovering and developing therapeutic molecules, “it can be a long way off before they think about where they would even consider doing commercial production of the dosage form,” Aesica’s Titley says.

Many big pharma companies have formulation development groups and may show up with an approach already in mind, he says. Some customers will arrive to talk about formulation with their API in hand, although not always in the best form for processing. And then there are those firms that have outsourced API production and know nothing about their compound’s physical properties.

Titley believes in getting the customer to “think first about who is actually going to use the drug and how, and then work back from that to how we are going to physically convert it into a usable dosage form.”

Traditionally, pharmaceutical companies first try to find the most soluble API form by screening for a salt, Catalent’s Muir says. If that doesn’t work, it’s good to have other drug delivery options available to move compounds forward. “You have to find which option is the best scientifically, commercially, and from a regulatory point of view,” he adds.

With compounds that need help, finding a formulation up front can be critical to making the drug behave its best in clinical trials. “Everybody wants to try to compress the development and regulatory path, and so choosing an approach early and then progressing it all the way through is the most efficient,” Muir says. Changing midstream and having to repeat studies is to be avoided, he adds.

Bend’s Ray agrees that it’s important to get things right from the start. Luckily, he says, it can usually be done. “We can usually formulate for first-in-human studies with a formulation that is pretty close to what the commercial one is going to be,” he says. “And we have figured out how to do it fast and cheap enough so that it is not really an extra investment.” Bend has “bulk sparing” methods, such as spray drying at the milligram scale, that allow it to develop a formulation when the amount of API is limited.

Although specialists argue for early action on drug formulation, not all drug developers are concerned. Only about half of respondents in the Nice Insight survey said it would be valuable or extremely valuable to use the same delivery form throughout clinical development and commercialization.

Hoping to conserve funds and time, some drug developers want to hold off on formulation until after Phase I or II proof-of-concept studies. According to a 2012 industry survey by Catalent and the market research firm PharmSource, about 40% of companies make the decision on formulation route and form after Phase I.

Instead, for early clinical work, drug developers may look for a first-generation, or “fit for purpose,” formulation, Almac’s McQuaid says. If done with enough rigor behind it, this initial form can be a good starting point for the final product.

To get in the clinic even faster and cheaper, some companies use extremely simple delivery approaches. One that has grown in popularity in recent years involves putting small quantities of API without excipients into a capsule, such as with automated Xcelodose systems sold by Capsugel.

This “drug in capsule” route works well when only limited amounts of API are available, McQuaid explains. It also has advantages for potent drugs for which the volumes are small and the production system can help contain the API. However, he points out, it’s not a good strategy for poorly soluble compounds that need some type of formulation development.

“There isn’t a one-size-fits-all approach; you have to look at the properties of the drug substance” to avoid going down the wrong path, McQuaid says. “We spend a lot of time with our clients up front trying to understand the attributes of their drug substance and what the appropriate formulation strategy is for them.”

The amount of guidance needed differs, however. “Large pharma has a pretty deep understanding of what is available and often has experience with a number of different technologies, either in-house or externally,” Muir says. But the same is not true for many specialty or virtual companies, Catalent found from its industry survey. As a result, suppliers are trying to educate potential customers about the pros and cons of different formulation options to address drug delivery problems, he suggests.

The learning curve notwithstanding, drug formulation providers expect their businesses to grow, driven by the pharmaceutical industry’s need for problem solving and some recent marketplace successes. A dozen or more approved products—from the likes of Pfizer, Novartis, Abbott, Vertex Pharmaceuticals, and others—have been successfully formulated and are being manufactured at large scale using once-exotic techniques such as spray drying and hot-melt extrusion. Getting these points on the board gives confidence to both specialists and CMOs now entering the formulation field that they are on the right track.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter