Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Canada: Chemical producers are feeling fine, but they expect near-term pains

by Alexander H. Tullo

January 13, 2014

| A version of this story appeared in

Volume 92, Issue 2

COVER STORY

Canada Chemical producers are feeling fine, but they expect near-term pains

Canadian chemical producers enjoyed a fantastic year in 2013. Sales of industrial chemicals were up 6%, hitting $26.4 billion and tying the high mark set in 2008. Operating profits set a record, hitting $3.5 billion.

“The shale gas phenomenon didn’t end at the 49th parallel,” says David Podruzny, vice president of business and economics for the Chemistry Industry Association of Canada (CIAC). “It continued up here.”

Canada’s largest petrochemical maker, Nova Chemicals, is literally piping ethane feedstock derived from U.S. shale over the border. Its massive complex in Corunna, Ontario, is beginning to receive ethane from Pennsylvania’s Marcellus Shale. By 2018, the company will expand the site by 20% and make improvements at a polyethylene plant. Nova has, however, delayed a new polyethylene unit it was planning for the province or the U.S. Gulf coast.

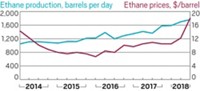

Across the country in Alberta, costs for locally produced ethane are low, but supplies have been dwindling because competition from cheap U.S. shale gas is slowing the province’s production of natural gas—and hence the ethane that it contains.

Nova’s “octopus” strategy of aggregating feedstocks from various sources to make up for the Alberta shortfall is starting to come together. Williams Cos. is opening a plant that will extract ethane from Alberta’s oil sands for Nova’s complex in Joffre, Alberta. Additionally, the recently completed Vantage Pipeline will bring ethane to Joffre from North Dakota.

“With that extra ethane we are able to run our plants at full capacity,” says Chris Bezaire, senior vice president of polyethylene for Nova, something that the company couldn’t do for a decade. As the feedstocks ramp up, the Joffre plant should produce 1 billion lb more ethylene per year. This summer, Nova broke ground on a $1 billion polyethylene plant to soak up that extra production.

Nova isn’t the only Canadian chemical producer to invest heavily. In 2013, companies shelled out $2.0 billion on plants and equipment. According to CIAC’s annual survey of chemical firms, they will shatter that record in 2014 with $2.5 billion in investment.

As bullish as they might be about the long term, Canadian chemical executives are pessimistic about 2014. According to CIAC’s survey, they expect sales to decline by 8% this year. John Margeson, CIAC’s manager of business and economics, says an anticipated 4% reduction in prices explains half the decline.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter