Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Albemarle To Buy Specialty Chemical Maker Rockwood

Acquisition: Albemarle will gain lithium operations, cash flow, and size

by Melody M. Bomgardner

July 21, 2014

| A version of this story appeared in

Volume 92, Issue 29

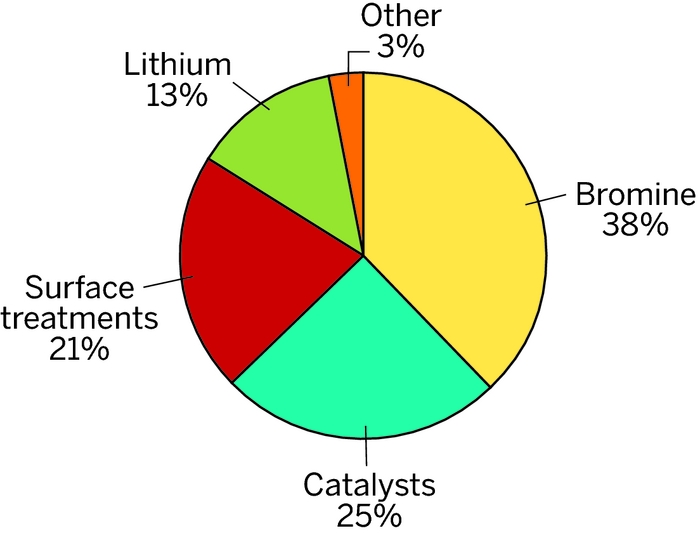

The New Albemarle At A Glance

\

Sales: $4.0 billion

Businesses (% of sales):

R&D spending: $105 million

Employees: 7,731

NOTE: Figures, which are pro forma, are for 2013.

Specialty chemical firm Albemarle has agreed to buy Rockwood Holdings for $6.2 billion in a cash and stock deal. The deal brings scale and product diversity that will be transformative for Albemarle, analysts say, giving the slow-growth firm access to high-growth and high-margin markets.

The deal values Rockwood at $85.53 per share, a 13% premium on its July 14 stock price. It will add $1.4 billion in annual sales of lithium chemicals and surface treatments to Albemarle’s more mature bromine chemicals and catalysts units.

The sale of Rockwood does not come as a surprise. In 2010, then-CEO Seifi Ghasemi told investors that the firm was considering spinning off its lithium operation in four to five years. Last September, it struck a deal to sell its titanium dioxide business to Huntsman Corp. for $1.3 billion. On July 1, Ghasemi left the firm to take the helm of Air Products & Chemicals.

Meanwhile, Albemarle has been eyeing lithium production to gain entry to the growing market for electric vehicle batteries. In 2011, it began a program to extract lithium from brine at its Magnolia, Ark., bromine facility.

The opportunity to add Rockwood’s lithium resources and production to Albemarle’s bromine expertise was a big reason for the deal, according to Luther C. (Luke) Kissam IV, Albemarle’s CEO. In a conference call with analysts, he said lithium would be the fastest growing of his firm’s four major businesses.

The lithium business will also help Albemarle hedge its portfolio risk in a future that may see a move away from gasoline as a transportation fuel, suggests Laurence Alexander, analyst at investment bank Jefferies. In 2013, Albemarle’s catalyst business, which supplies petroleum refiners, was responsible for 40% of its sales.

After the integration, Albemarle will be a $4 billion-per-year chemical company. The firm will use a projected $500 million in annual cash flow and $100 million in operating savings to pay down debt and invest for the future. “We will be in a position to pursue organic growth and other acquisitions,” Kissam said.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter