Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

The U.S. Methanol Building Boom

Cheap gas and strong demand forge a petrochemical partnership between the U.S. and China

by Alexander H. Tullo

August 11, 2014

| A version of this story appeared in

Volume 92, Issue 32

Every week, someday soon, a chemical tanker more than 800 feet long and carrying up to 80,000 metric tons of methanol will depart from the Columbia River or Puget Sound on the West Coast to make a monthlong voyage across the Pacific Ocean.

The ships will link three new methanol plants—in Washington and Oregon—with the Chinese port of Dalian. There, authorities are building a big new methanol terminal as well as methanol-to-olefins (MTO) units that will consume about one-third of the U.S. plants’ output.

Those are the ambitions, at least, of a consortium, NW Innovation Works, backed by deep-pocketed Chinese investors. They want to spend $5.4 billion building the methanol plants, which together will have 10.5 million metric tons of annual production capacity. And the project isn’t unique. Just last month, two firms backed by Chinese chemical producers announced their intentions to spend nearly $6.4 billion on more than 10 million metric tons per year of methanol capacity in Texas and Louisiana.

All told, nearly a dozen firms plan to build more than 30 million metric tons of methanol capacity in the U.S. over the next decade—more than eight times today’s output.

The commerce is another consequence of low-priced natural gas extracted from shale. Although chemical industry executives have come to think of the “shale gale” as a lift to companies that make ethylene, propylene, and their derivatives, a boom to U.S. methanol production will follow closely behind and could be of a scale that exceeds the olefins buildup.

Methanol is one of the most basic and versatile organic molecules. Its biggest uses in the chemical industry are to make formaldehyde and acetic acid. In a relatively new development that has taken root in China, it can be transformed into ethylene and propylene via the MTO process. Methanol can be used to make the gasoline oxygenate methyl tert-butyl ether (MTBE), or synthesized into dimethyl ether, a substitute for diesel. And in another application particular to China, it is blended in gasoline much like ethanol is in the U.S.

The processes used to make methanol from natural gas vary, but in a typical plant a reformation step converts methane and water into synthesis gas, a mixture of hydrogen, carbon monoxide, and carbon dioxide. These are recombined in a subsequent step into methanol.

This extraordinary expansion of U.S. capacity comes at a time when the world needs more methanol. About 56 million metric tons of methanol were consumed around the world in 2012, according to the consulting group IHS Chemical. By 2022, the world will demand 104 million metric tons, a growth rate that exceeds 6% per year.

China is responsible for nearly 80% of this growth. IHS projects that the country will consume 63 million metric tons by 2022, about two-and-a-half times its 2012 consumption.

More than half of the world’s methanol is also made in China, mostly via coal gasification. However, observers say this production will not be enough to satisfy growing demand, especially now that the MTO route to olefins is taking off in the country.

In China, olefins can be made more economically from methanol than by the traditional cracking of petroleum-derived naphtha, says Mike Nash, global director of syngas chemicals at IHS. U.S. natural gas is so much cheaper than petroleum that even the $50 or so per metric ton it costs to ship methanol to China still “leaves you with a decent cost advantage,” he notes. Methanol sells for about $400 per metric ton.

And in China, methanol imported from the U.S. even has advantages over local coal-derived methanol, which is a reason that MTO plants not tied to coal production are blooming on China’s East Coast, says Marc Laughlin, methanol and acetone consultant for IHS. The coal industry in China, he notes, is largely in the remote West.

“Logistics costs are actually often higher in some cases to get the finished product from inland all the way to the coast versus bringing methanol imported from the Middle East or North America,” Laughlin says. Deriving olefins from coal is also more pollutive and capital-intensive than making it from imported methanol, Nash adds.

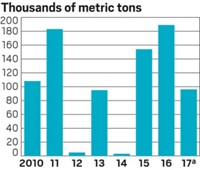

China’s need for methanol is converging with a newfound ability in the U.S. to make it. High natural gas prices, plus ebbing demand for derivatives such as MTBE, crushed the U.S. methanol industry a decade ago. “The U.S. was a leading producer of methanol in the ’80s or ’90s. Then we took a backseat,” Laughlin says. By 2007, U.S. production was down to only 1 million metric tons.

The cost of natural gas is the main variable in making methanol. And thanks to shale, natural gas prices are about half of what they were a decade ago. Last year they averaged $3.70 per million Btu, according to the U.S. Energy Information Administration, and they aren’t expected to pass $5.00 for another 10 years.

So much natural gas is being pulled out of the ground in the U.S. that by 2017, according to EIA, the U.S. will make more gas than it can consume. This is one of the reasons NW Innovation Works chose the location in the Pacific Northwest that it did. There, the company will have access to natural gas, primarily produced in Alberta and British Columbia, that has been pushed out of the U.S. market by U.S. gas production from shale.

“A lot of the gas that we are looking at is really stranded; there’s no market for it,” says Murray Godley, NW Innovation’s president.

On the U.S. Gulf Coast, meanwhile, the atmosphere is nothing short of a gold rush, as a scheme by the methanol producer Methanex illustrates. The company is loading two methanol plants from Chile onto heavy-lift vessels and shipping them to Geismar, La. The first of them will start up at its new home later this year.

And other U.S. companies are finding not only cheap gas but plenty of customers to boot. Celanese is building a plant at its Clear Lake site in Texas with partner Mitsui & Co. A second plant Celanese is planning for Bishop, Texas, could also end up as a joint venture. “We may take a minority position as there are several potential partners that want to take a larger stake in the venture to gain greater access to the methanol produced,” a spokesman says.

Similarly, Valero officials recently told financial analysts they have been approached with joint-venture and offtake offers for the methanol plant they want to build at the firm’s St. Charles, La., refinery.

The Chinese firms with big methanol designs seem to be interested in cutting out middlemen such as Celanese and Valero for methanol destined for China.

The two such projects on the U.S. Gulf Coast are linked to firms that, while little-known in the U.S., have track records of running chemical plants back in China. Fund Connell, which is planning the plant in Texas, is linked to aniline producer Jilin Connell Chemical Industry. Yuhuang Chemical, which plans to build one in Louisiana, has petrochemical sales of about $4 billion in China. The port of Dalian is one of the backers of NW Innovation’s projects in the Northwest.

Will all these U.S. methanol plants—even the ones proposed by the Chinese newcomers—really get built? The past decade shows that anything can happen in the volatile methanol business. But if China will keep buying it, they just might.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter