Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Oil Price Decline Hitting U.S. Chemical Makers

Feedstocks: A sharp decline in petroleum could cause trouble for U.S. chemical producers

by Alexander H. Tullo

December 8, 2014

| A version of this story appeared in

Volume 92, Issue 49

For the past several years, U.S. petrochemical producers have held that one of the biggest threats to their shale gas raw material advantage would be a sharp decline in oil prices. Now, these fears are materializing, thanks to a glut in world oil supplies and the refusal by oil-exporting countries to cut production.

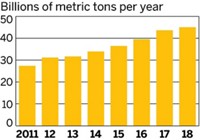

Since reaching a peak of $107.26 per barrel in June, prices for the U.S. benchmark crude—West Texas Intermediate—have fallen to below $70. The global oil market is being oversupplied to the tune of 700,000 bbl per day over demand of about 93.2 million bbl per day, according to Citigroup analyst Edward L. Morse.

The oversupply problem came to a head on Thanksgiving Day, when the Organization of the Petroleum Exporting Countries (OPEC) announced it wouldn’t cut production. Analysts think Saudi Arabia is trying to force higher-cost players, namely North American producers, out of the market. The following day saw a 10% drop in oil prices to their lowest levels since 2009, in the midst of the financial crisis.

The lower oil prices are bad news for U.S. chemical producers, which predominantly make chemicals from natural gas, but good news for competitors in Asia and Europe, which use petroleum-based raw materials.

The U.S. still has a petrochemical competitive advantage over other regions, notes Stephen Zinger, head of chemicals in the Americas for the consulting firm Wood Mackenzie, but the edge is half what it was a year ago. U.S. costs would reach parity with other regions if oil prices sink to $40 to $50 per bbl. “Sustained this way for several years, this could change the investment outlook for some producers,” Zinger says.

Tom Kloza, founder of Oil Price Information Service, says oil prices should stabilize soon because of winter demand. However, by next summer, daily oversupply could reach 1.5 million bbl. “We could see dramatically lower prices for oil,” he says, possibly between $50 and $60 per bbl.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter