Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

2014 Profits Are Strong For Japan’s Chemical Firms

Finance: Weak yen, low oil prices, and a strong U.S. economy bolstered fiscal 2014 results

by Jean-François Tremblay

May 18, 2015

| A version of this story appeared in

Volume 93, Issue 20

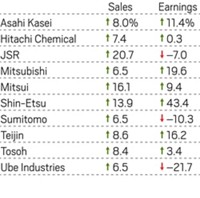

Profitability continued to improve for major Japanese chemical producers in the fiscal year that ended on March 31. The depreciation of the yen, lower oil prices, and a strengthening U.S. economy buoyed companies that a year ago also reported a sharp improvement in profits.

Sumitomo Chemical posted a 41.1% improvement in net earnings, largely on the back of higher margins in its petrochemical, plastics, and crop protection businesses. “The business environment surrounding Sumitomo Chemical was good as a whole, although there were areas with sluggish market conditions and weak shipment volumes,” the company stated. Like its peers, Sumitomo noted that the economies in China and Europe were slow but that the U.S. recovery continued to be solid.

Shin-Etsu Chemical benefited from the U.S. market through its polyvinyl chloride subsidiary Shintech, but the company’s PVC business suffered because of feedstock sourcing issues in Europe. It more than made up for the setback with a 46% increase in earnings for its silicon wafer business. Shin-Etsu is the world’s largest producer of both PVC and semiconductor-grade silicon.

Shin-Etsu and Sumitomo were not alone in raising profitability. The synthetic rubber and electronic materials producer JSR delivered a profit margin of 8.6%, up from 6.4% a year ago. And the normally staid Tosoh more than doubled its profit margin to 9.0%.

Tosoh explained that although its petrochemical business stagnated in 2014, profits for chlor-alkali and PVC more than doubled. In addition, the company’s specialty materials group was 56% more profitable, owing largely to high shipments of ethyleneamines.

After two straight years of impressive profit growth, Japanese chemical makers could well shine less brightly in the near future. The latest business outlook survey by the Bank of Japan indicated that Japanese manufacturers are becoming bearish on the economy in Japan, a market that is obviously a major one for the country’s chemical industry.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter