Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Policy

Hedge Funds Target Patents

Congress: Drug companies cry foul and seek relief in legislation

by Glenn Hess

July 6, 2015

| A version of this story appeared in

Volume 93, Issue 27

Drugmakers are asking Congress to revise the system that the U.S. Patent & Trademark Office (PTO) uses to determine whether existing patents are valid. The three-year-old process, they say, is being abused by hedge funds and other speculators. These investors are filing petitions with PTO in attempts to manipulate the stock prices of patent owners for financial gain, companies contend.

Activist investor J. Kyle Bass, head of Dallas-based Hayman Capital Management, has set off alarms in the pharmaceutical and biotechnology industries. Earlier this year, he pledged to challenge the legitimacy of patents on numerous medications as a way of reducing prices for consumers and growing his fund.

Bass accused the drugmakers of misusing the patent system to protect against generics competition. In the U.S., brand-name drugs generally have a 20-year period of market exclusivity from the date of patent filing before lower-priced generics can enter the market.

“The companies that are expanding patents by simply changing the dosage or the way they are packaging something are going to get kneecapped,” Bass told investors at a meeting in Oslo, Norway, in January. Invalidating weak patents, he declared, “is going to lower drug prices for Medicare and for everyone.”

Bass launched his campaign in February, filing two petitions with PTO challenging the validity of Acorda Therapeutics’ patent claims covering Ampyra, a multiple sclerosis drug. The price of Acorda’s stock dropped 10% after the first petition was filed and 5% more after the second petition.

Over the past several months, Bass’s firm has also filed petitions that seek to invalidate patents on Celgene’s cancer drug Revlimid, Biogen’s multiple sclerosis treatment Tecfidera, Shire’s colitis drug Lialda, and Jazz Pharmaceuticals’ narcolepsy drug Xyrem. Each petition asserts that the patents do not cover new inventions and should be revoked.

Another hedge fund, New York City-based Ferrum Ferro Capital, has made an even bolder move. It is asking PTO to review a patent on Allergan’s glaucoma drug Combigan that has already survived a lengthy court challenge.

PTO hasn’t decided whether it will review the petitions, and it’s unclear whether the challenges will succeed.

Bass says his firm is targeting “specific patents that we believe, unlike the vast majority of legitimate patents, do not represent true innovation or invention.”

A small number of drug companies, he contends, are “abusing the patent system to sustain invalid patents that contain no meaningful innovations but serve to maintain their own anticompetitive, high-price monopoly, harming Americans suffering from illnesses.”

Drugmakers and other critics say Bass’s real motive is to make money. They believe his hedge fund bets against, or shorts, the shares of the companies that own the challenged patents and thus profits if their stock prices drop.

“The mere filing of the petition can drive down the patent owner’s stock price and allow a hedge fund that shorted the stock before filing the petition to profit from this scheme,” says Kevin H. Rhodes, chairman of the Coalition for 21st Century Patent Reform. That lobbying group’s members include pharma giants AstraZeneca, Bristol-Myers Squibb, Eli Lilly & Co., and Pfizer.

Congress never intended for the patent challenge system to be “utilized by those attempting to profit from the confusion the current system creates,” adds James C. Greenwood, chief executive officer of the Biotechnology Industry Organization, a biotech trade association. “Such efforts not only damage the value of companies working on cures but hurt patients and their families who are eager for cures,” he says.

This PTO process—known as inter partes review (IPR)—began in 2012 under a law Congress passed to overhaul the U.S. patent system. Legislators hoped to reduce the number of patent infringement lawsuits by giving patent holders and challengers a quicker and less expensive way to resolve their disputes than trials in federal courts. On average, an IPR can cost about $300,000 and take up to 18 months. In comparison, litigation in federal court may cost a patent challenger $3 million or more and take several years to complete.

The IPR process allows a third party to challenge one or more claims of a patent only on the grounds that the claims are not novel or were obvious and only on the basis of prior art—prior patents or previously issued printed publications.

The petitions for review are evaluated by the Patent Trial & Appeal Board (PTAB), a panel of administrative judges who use a much broader set of criteria than trial courts in determining whether a patent should be invalidated. Experts say this makes it relatively easy to strike down patents and has led to a high rate of cancellation.

The appeals board has nixed so many patent claims that some attorneys call the board a “death squad.” An analysis published last year in the University of Chicago Law Review found that PTAB has invalidated at least one claim in about 77% of the patents it has ruled on.

For companies challenging patents, the IPR system has worked. A coalition of technology companies and retailers argues that the reviews weed out bad patents by allowing the agency to scrutinize its original work and correct errors. “Although only three years old, the IPR process has already proven to be successful in its goal of improving patent quality by authorizing PTO to determine when, in its expert view, patent claims should never have been granted by PTO in the first place,” the coalition wrote in a letter last month to key congressional leaders.

But drugmakers say the IPR process is heavily stacked against patent owners and is encouraging abusive practices. Allowing the patent challenge process to be “misused” by hedge funds and other speculators will ultimately “discourage the investment needed to develop new treatments and cures for patients,” says Robert Zirkelbach, senior vice president of communications with the Pharmaceutical Research & Manufacturers of America, the brand-name drug industry’s lobbying group.

“That is why more than 90 patient advocacy organizations recently wrote to Congress noting the critical importance of passing legislation to address abuses at PTO,” Zirkelbach says.

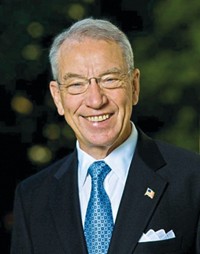

Lawmakers are assessing whether to intercede as they work to develop broader patent reform legislation aimed at curbing frivolous lawsuits. “Our goal is to strike the right balance in a way that doesn’t gut the patent office proceedings” but addresses charges of bias, says Sen. Charles E. Grassley (R-Iowa), chairman of the Senate Judiciary Committee.

In response to lobbying by the pharma sector, the Senate panel has agreed to make several changes to its version of the legislation (S. 1137) that would make it more difficult for PTAB to invalidate patents during the review process.

One new provision would require the board to use the same stringent legal standard as federal trial courts do in litigation for interpreting the scope of a patent claim. Currently, PTAB reads a patent claim as broadly as it thinks it reasonably can. This, attorneys say, makes it easier to challenge patent validity.

The Senate bill would also make explicit that, similar to federal trial courts, PTAB must presume patents to be valid from the outset of proceedings. In addition, the revised legislation would give the PTO director broad power to reject petitions “in the interest of justice”—which could be used to stop hedge funds from using IPR petitions to move stock prices.

The pharma sector is pushing for more changes in S. 1137 and in a related measure (H.R. 9) sponsored by Rep. Robert W. Goodlatte (R-Va.), chairman of the Judiciary Committee in the House of Representatives. Both bills are likely to see floor action later this year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter