Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Spectroscopy

A Renaissance For NMRs, Big And Small

Some nuclear magnetic resonance instruments shrink, even as the more complex ones get larger

by Marc S. Reisch

September 21, 2015

| A version of this story appeared in

Volume 93, Issue 37

In the field of nuclear magnetic resonance (NMR) spectroscopy, bigger and more expensive have always meant better. Although that maxim is still true, a new generation of companies contends that smaller benchtop or even handheld NMRs can do much of the yeoman’s work of identifying molecular structures that room-sized NMRs do.

Makers of the smaller tools—firms such as Magritek; Thermo Fisher Scientific, which purchased start-up picoSpin in 2012; Nanalysis; T2 Biosystems; and WaveGuide—don’t expect their modestly priced machines will replace expensive high-field instruments tricked out with cryo-cooled magnets and separate operator consoles. But aided by modern electronics, improvements in permanent magnet design, and advances in software, compact-NMR makers say their small tools will become more commonplace over the next five years.

What’s more, makers of smaller NMRs say their tools will be accessible to more than just scientists skilled at using the traditional machines. Expect to see the new instruments, they say, in quality-control and teaching applications, under lab hoods monitoring reactions and verifying samples, and in hospitals diagnosing disease.

As for the two surviving makers of the larger, more complex NMRs, Bruker and JEOL, they say modern electronics and magnet design are driving development of their instruments as well. Agilent Technologies shut down its money-losing NMR operation in 2014.

Magnets are at the heart of NMR. Placed in a magnetic field, carbon- and hydrogen-containing samples give up their structural secrets when they are interrogated with pulsed radio frequencies using Fourier transform methods. Pulses of a single radio frequency are used to interrogate molecular structure in time-domain techniques.

Rare-earth-based permanent magnets have made possible compact benchtop NMRs, whereas their larger brethren use powerful helium-cooled magnets to provide more detailed information at higher magnetic fields.

Industry observers see a developing NMR landscape in which large and small machines will coexist. “An application like protein structure determination requires large and expensive high-field NMRs, and therefore they will persist,” says Stan Sýkora, an Italy-based physicist and NMR expert. “But if an application can be handled with a lower-field less costly machine, then why not?

“Simply put, the application is what matters; the instrument is secondary,” Sýkora adds. “If I were to start a company today to build an NMR, I would ask myself ‘What for?’ and not ‘What kind?’ ”

BIG AND SMALL

\

Room-sized and benchtop NMRs each have their own advantages

Large NMR

◾ Cost can exceed $1 million for the highest-resolution instruments

◾ More sensitive, with higher-resolution spectra

◾ Requires helium to cool superconducting magnet

◾ Operated from a large console by an experienced specialist

\

Benchtop NMR

◾ Cost is generally below $100,000

◾ Less sensitive, with lower-resolution spectra

◾ Does not require helium, and uses a permanent magnet at room temperature

◾ Can be operated by a technician using automating software

SOURCE: NMR manufacturers

Many benchtop-NMR makers have already determined that their machines are good for the education market, points out Mark Dixon, a Thermo Fisher product manager. Small NMRs such as the firm’s picoSpin line “are plug-and-play systems for an educator” to help undergraduates get hands-on experience in analyzing samples.

But Dixon sees many other applications that suit small NMRs. A new accessory for the picoSpin line allows academic researchers and small laboratory operators to monitor chemical reactions in real time, he says.

Technology advances have made the new machines possible. “Electronics in cell phones were the inspiration behind benchtop NMRs,” Dixon explains. Whereas the big NMRs are often built with bulky printed circuit boards, the smaller NMRs depend on miniature components such as microchips and flash memory modules, he points out.

Improvements in permanent rare-earth magnets also allow makers of portable NMRs to build compact instruments that don’t have the complex magnet cooling requirements of their larger brethren. But permanent magnets currently remain limited to magnetic fields of less than 100 MHz, Dixon points out. By comparison, big helium-cooled NMRs with fields exceeding 1 GHz are now under development.

Those limitations explain the difference between the benchtop NMRs and the larger instruments. “High-field NMRs are environmentally sensitive, sophisticated to operate, and very expensive,” says Andrew Coy, chief executive officer of New Zealand-based Magritek, which makes the Spinsolve line of benchtop NMRs.

The high-field instruments excel at elucidating the structure of large molecules such as proteins typically exceeding 1,000 daltons, Coy explains. The lower magnetic fields of the smaller instruments make them more suitable to the analysis of molecules of less than 1,000 Da, he says.

Although the big high-field instruments can be set up for many different experiments, the benchtop machines are “more relevant for quick routine measurements,” Coy notes. Simpler design and intuitive software make the benchtop instruments easy to use.

“People will purchase benchtop NMRs to solve two or three specific problems,” Coy predicts.

“The market for NMR is evolving in part because of the benchtop instruments,” says Garett Leskowitz, chief technology officer of the Canadian firm Nanalysis. The education market is the “low-hanging fruit” for simple-to-use NMRs such as Nanalysis’s NMReady line of benchtops, he says.

But quality analysis and control are also developing markets, Leskowitz says. Makers of portable Raman and near-infrared spectrometers “should see us as the new competition,” he says.

NMR users have long had to line up to use high-field instruments at a specialized university center or send samples out to a commercial lab. Such delays now can be avoided, Leskowitz says, by using no-wait benchtop machines for routine analysis. As a bonus, costs to use the benchtops are much lower, he points out.

The benchtops from Thermo Fisher, Magritek, and Nanalysis all use Fourier transform techniques to characterize samples, as do the larger high-field NMRs.

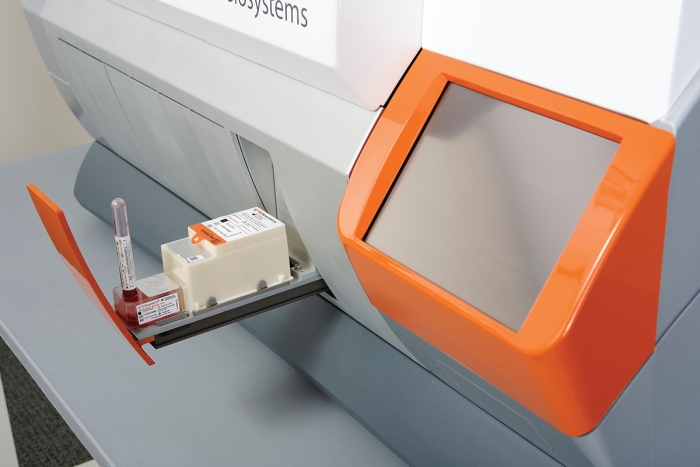

Other benchtops use time-domain techniques, often for specific diagnostic tests. Among them are machines from nine-year-old T2 Biosystems, based in Lexington, Mass., which has developed a Food & Drug Administration-approved NMR diagnostic unit and test for candida fungal infections in the blood. The firm’s technology, developed by scientists at Massachusetts General Hospital and Massachusetts Institute of Technology, including Priestly Medal winner Robert Langer, is based on the activity of water molecules in a magnetic field.

According to Tom Lowery, the firm’s chief scientific officer, magnetic nanoparticles coated with an analyte-specific binding agent are mixed with a blood sample and placed in the firm’s benchtop T2Dx. The particles bind to and cluster around the pathogen, changing the microenvironment of water and altering the magnetic resonance signal. After a three-hour concentration and amplification step, a reading reveals the presence of candida, he says.

An alternative to blood cultures, which take up to five days for results, T2’s test identifies positive results 91% of the time, Lowery says. Blood cultures only do so 50 to 60% of the time, he says. The firm is now selling the system to hospitals.

Enabling the NMR reading, he adds, is a proprietary permanent magnet “about the size of a Rubik’s Cube” producing a field of 23 MHz. In addition, the firm is developing tests for pathogens associated with sepsis and Lyme disease.

Also using time-domain techniques, but for a handheld diagnostic device, is WaveGuide. Like T2 Biosystems, WaveGuide will rely on binder-coated magnetic particles to test for diseases such as tuberculosis in sputum or whole blood, says Nelson Stacks, CEO of the Cambridge, Mass.-based firm. Specifics on how the test will work are not available.

But the technology behind WaveGuide’s device is a tiny chip-based relaxometer, which measures relaxation of nuclear spin, from the lab of Donhee Ham, a Harvard University physics professor.

WaveGuide has so far raised $27 million from angel investors and has created a number of prototypes. The firm plans to hire staff and rent lab space soon to develop them.

Whereas WaveGuide is relatively new to time-domain-enabled NMR, Bruker, more often thought of as a maker of large high-field NMRs, has been active with time-domain-based benchtop NMRs for about 40 years. Many of them are targeted at specific quality-control and analysis applications, says Stefan Jehle, an applications scientist with the firm.

For instance, the firm’s minispec mq Toothpaste Analyzer measures fluorine content in toothpaste. The minispec mq7.5 Large Seed Analyzer characterizes seed oil and moisture content. “A dedicated system is cost-effective and reduces subjectivity while also speeding analysis,” Jehle says.

Bruker says it is developing a line of Fourier-transform-based benchtop NMRs, but they are not yet ready for the market. A spokesman says that “we are interested in new markets and applications.”

And Bruker is certainly interested in expanding its large-NMR offerings. It continues to develop superconducting magnets capable of operating at 1.2 GHz and plans to deliver them to customers starting next year. The largest magnet Bruker has installed to date operates at 1.0 GHz.

Although the government funding to pay for larger systems is in short supply, Clemens Anklin, vice president for NMR applications at Bruker, says they are needed to push advances in materials research, structural biology, and intrinsically disordered proteins.

So the firm has vowed to develop the new high-temperature superconducting wire that will enable higher field systems. Anklin notes that the firm owns a superconducting materials business, allowing it to stay on top of the effort to push ultra-high-field NMR.

Trying a bit of one-upmanship on Bruker, large-NMR competitor JEOL says it has plans for a spectrometer capable of operating at 1.3 GHz. The firm is collaborating on the development of a 1.3-GHz magnet with the Japan Science & Technology Agency, the National Institute for Materials Science of Japan (NIMS), and other partners. In July, the group said it successfully built a 1.02-GHz NMR magnet.

Michael Frey, a product manager for JEOL, says the firm has redesigned the electronics built into its NMRs to include “state-of-the-art digital and radio-frequency designs to greatly improve NMR experiment flexibility and data collection.” The improvements include high-speed signal and pulse generators and receivers, he says.

These advances not only have improved the instruments’ reliability but also have helped shrink the footprint of operator consoles by more than 20%, Frey says. The firm is also offering the upgraded consoles to owners of Agilent and Bruker magnets.

JEOL’s traditional strengths are in small-molecule characterization, Frey says. But the firm is now increasing its efforts “in all areas of NMR, including bio-NMR, real-time NMR, and cold probe development,” he says.

Although JEOL plans to be aggressive in big NMRs, it is leaving the development of benchtop systems to others. But whether for big or small systems, consultant Sýkora says, improvements in NMR electronics, magnets, and software have been profound.

Those improvements are not just enabling bigger and better tools for the high priests of academic science. They are also making possible simple and useful NMR gear for everyday students, bench chemists, and quality-control technicians.

Start-ups

Advances in electronics and nuclear magnetic resonance (NMR) science mean new opportunities for entrepreneurs.

Marcus Semones, one of the people behind NMR start-up WaveGuide, had worked in academia and as a pharmaceutical researcher. After leaving GlaxoSmithKline in 2010, he began visiting university technology transfer offices looking for commercial opportunities.

\

Semones found what he was looking for at Harvard University’s Office of Technology Development: a 2-mm2-microchip-based relaxometer for a miniature NMR that its inventor, Nan Sun, now at the University of Texas, Austin, developed in the lab of Harvard physicist Donhee Ham. The relaxometer measures relaxation of nuclear spin.

Semones licensed the technology in 2012 after four months of talks with the technology office and formed WaveGuide. The chip, he says, should allow his firm to do for NMR what others have done for infrared spectrometry: “turn clunky benchtop scientific instruments into handheld devices.” His goal is to make a handheld NMR that works with nanoparticles to diagnose infectious diseases and cancer.

At first, Semones and partner Nelson Stacks, WaveGuide’s chief executive officer and an entrepreneur and venture capitalist, financed development of the handheld NMR on their own. Earlier this year, they raised $27 million from investors, including Peter Farrell, founder of respiratory disease treatment firm ResMed.

The partners are now on their way to raise an additional $30 million. They plan to hire researchers and set up lab space in Cambridge, Mass., to further develop their handheld device.

Harvard is eager to license out additional NMR technology, says Sam Liss, business development manager at the university’s technology office. Now ready and waiting is a second-generation microchip from Ham’s group that incorporates an NMR transmitter, arbitrary pulse sequencer, and receiver all on a 4-mm2 piece of silicon. The more advanced chip is another step toward compact, low cost NMRs.

“Our goal is to help advance science and ensure new technology is developed and realized as products with impact,” Liss says.

Large, established companies have “deep capabilities and broad distribution channels” to get technology to market, Liss says. “But start-ups move faster and are willing to take greater risk.” At this point, he adds, the jury is still out on the type of business partner best suited to bring the Ham group’s latest microchip design to market.

Like WaveGuide, T2 Biosystems also converted university technology into an NMR-based tool. T2’s benchtop analyzer tests for candida fungal infection in the blood in a matter of hours instead of days. The business got started in 2006 with technology developed at Massachusetts Institute of Technology and Massachusetts General Hospital, says Tom Lowery, T2’s chief scientific officer.

The technology itself arose from a research collaboration among six scientists associated with the two institutions. Among the scientists was Priestley Medalist and serial entrepreneur Robert Langer.

To get its technology off the ground, T2 raised about $100 million over several investment rounds from venture capital firms including Flagship Ventures, Aisling Capital, and Flybridge Capital Partners. In August, the firm went public, raising about $57 million. It recently filed a preliminary prospectus with the Securities & Exchange Commission to sell another $100 million in stock at some point in the future.

But now comes the hard part for T2 and any start-up that has made it as far as T2 has: making money. The firm reported a $22 million loss in the first half of the year.

But that may change, as T2’s sales force is now actively selling its NMR-based T2Dx System to hospitals in the U.S. and Europe, Lowery says. Through the end of June, T2 had secured 10 hospital contracts, he said.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter