Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Air Liquide To Buy Airgas

Acquisitions: Purchase will create world’s largest industrial gases company

by Alexander H. Tullo

November 19, 2015

| A version of this story appeared in

Volume 93, Issue 46

In a move that will make it the world’s largest industrial gas supplier and augment its U.S. presence, Air Liquide has agreed to purchase its smaller rival Airgas in a deal worth $13.4 billion.

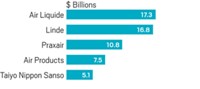

SOURCES: Company reports for most recent fiscal year

SOURCES: Company reports for most recent fiscal year

Air Liquide is the world’s second-largest industrial gas company, just behind Germany’s Linde. The French firm had $20.4 billion in overall sales in 2014 and $3.5 billion in operating profits. Airgas had sales of $5.3 billion and operating profits of $641 million in its past fiscal year.

Air Liquide is a large-scale industrial gases firm with global operations. It operates big air separation plants and supplies bulk quantities of oxygen and other gases by pipe or tanker truck to large customers such as chemical plants and hospitals.

Airgas, in contrast, is U.S.-focused and specializes in the “packaged” gas business. Its strength is delivering cylinders of gases to customers such as welders.

In a conference call with analysts, Airgas’s executive chairman and founder, Peter McCausland, said the merger talks with Air Liquide sprang from discussions over regular commercial transactions such as gas contracts and swaps. “During the course of these discussions, I think we came to the conclusion our two companies make great partners,” he said.

Air Liquide is paying top dollar for its smaller rival. The $143.00 per share it has offered is a more-than-50% premium to Airgas’s average stock price during the month before the deal was announced.

It is also more than twice what Air Products & Chemicals offered for Airgas in a failed hostile takeover bid back in 2011. At the time, McCausland said Air Products’ $70.00-per-share offer undervalued his firm.

Analyst commentary about the deal noted the ample price Air Liquide is paying. The offer “has triggered some negative commentary today that they may be overpaying,” noted Liberum Capital’s Adam Collins. “We are more positive,” he said, pointing to synergies between the two firms.

The planned acquisition is the second recent restructuring move in the industrial gas industry. In September, Air Products announced it will spin off its chemical business to focus on gases.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter