Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

2015 Marked Record Year For Biotech Investment

Start-Ups: Early-stage companies launched with strong financial backing

by Lisa M. Jarvis

December 7, 2015

| A version of this story appeared in

Volume 93, Issue 48

As innovative science dovetailed with a strong demand for both early- and later-stage drug candidates this year, venture capital funding for biotech firms surged.

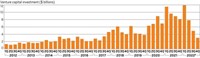

Overall venture capital investment in the biotech sector is set to “blow through the 2014 numbers,” says Greg Vlahos, life sciences partner at PricewaterhouseCoopers.

Vlahos notes that venture capital investment in the biotech industry totaled $6.3 billion in 2014, the largest fund-raising year in history. By the end of the third quarter of 2015, biotech companies had already raked in $5.8 billion, with $2.1 billion of that coming in the third quarter alone.

One driver for the uptick in activity is the good prospects investors have for recouping their cash. Merger and acquisition activity in the life sciences sector “has been running hot,” Vlahos notes. At the same time, young companies are having an easier time listing on public exchanges. “There’s a definite path to liquidity,” he says.

A substantial chunk of the funding has gone to young companies. According to PricewaterhouseCoopers, early-stage funding hit an all-time high in the third quarter, and young companies raised $1.6 billion in the period—more than double the prior year’s quarter.

The flush environment is spawning a wave of well-financed new companies. The most notable debut of the year came from Denali Therapeutics, which launched in May with $217 million in Series A funding, the largest first funding round in biotech history. Led by several former Genentech scientists, Denali is tackling neurodegenerative diseases.

But most of the prominent start-ups unveiled this year are focused on cancer treatments. As evidence mounts that combining drugs that harness the immune system could have a major impact on patient survival, investor appetite for immuno-oncology companies has been particularly strong.

“Very early stage stuff is getting swept out of academic laboratories literally off the bench,” says Paul D. Rennert, head of the consulting firm SugarCone Biotech. “It’s part of a landgrab to get assets early when they’re cheap.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter