Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Movers And Shakers

C&EN profiles WuXi AppTec, Chinese contract research giant

Ge Li, founder of world’s largest CRO, claims no interest in launching his own drugs or relisting on a Chinese stock exchange

by Jean-François Tremblay

March 14, 2016

| A version of this story appeared in

Volume 94, Issue 11

If anybody knows what types of drug candidates or research methodologies are likely to be successful, it should be Ge Li, the founder and chief executive officer of WuXi AppTec.

The world’s largest contract research organization, or CRO, WuXi employs 10,000 people who work on behalf of 2,000 customers worldwide, ranging from virtual drug discovery firms to the world’s largest pharmaceutical makers. Yet despite his company’s work on thousands of research programs every year, Li claims no particular insight on what will yield a commercial drug.

“We don’t have a crystal ball to know that this or that program will be successful,” Li says. “If everyone starts focusing on one target, it doesn’t mean that this target will work.” At most, he says, WuXi has an idea of what targets and methodologies are popular among researchers.

WuXi AppTec at a glance

Headquarters: Shanghai

R&D labs: 23 sites; the largest is in Shanghai’s Waigaoqiao Free Trade Zone.

Manufacturing sites: Small molecules: Shanghai’s Jinshan area and Changzhou, China. Biologics: Wuxi, China. Cell therapy: Wuxi and Philadelphia.

Employees: 10,000, including 1,000 in the U.S.

Annual salesa: ~$800 million

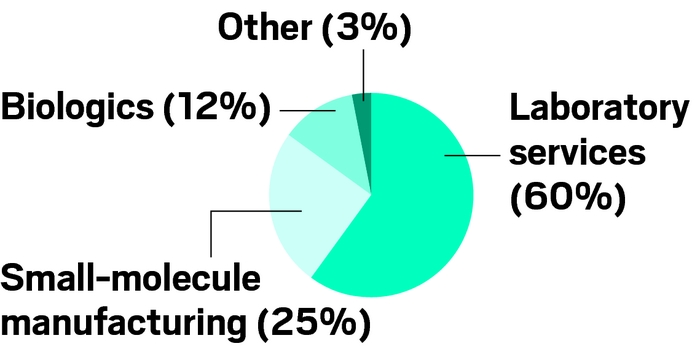

Business segments (% of total sales):

\

a Based on sales of $213 million in third quarter of 2015, before company went private.

Others in the drug industry would say Li is being modest. Considering WuXi’s vast capabilities and drug discovery knowledge, many speculate that he wants to turn the CRO into an innovative drug company trading on a Chinese stock exchange. But that is not the plan, Li insists. The idea behind WuXi, he says, is and has always been to efficiently support the discovery, development, and manufacturing of new drugs.

“A few decades ago, it was costly to start a pharmaceutical company,” Li says. Back then, investors had to set up labs and fill them with researchers. But nowadays, because of service providers like WuXi, entrepreneurs can start a drug company “with a piece of paper, a pencil, and a credit card.” Running a company that lowers the entry barriers to drug discovery is “totally inspiring,” Li says.

Li, who has a Ph.D. in organic chemistry from Columbia University, founded WuXi in 2000. The year before, his employer at the time, Pharmacopeia, had sent him to China to form a joint venture. Motivated by the visit, he left his job, returned to China, and set up his own firm.

At first WuXi offered lab chemistry services to mostly large pharmaceutical companies from the West and Japan. Over the years, the company increased its headcount and expanded its range of services to encompass nearly all areas of drug discovery, development, and manufacturing.

Today, WuXi employs 4,000 chemists, making it the largest employer of chemists in the global pharmaceutical industry—and possibly any industry. About 600 of the company’s staffers in China hold Ph.D.s and have worked in the drug industry outside China, mostly in the U.S.

The past year was busy for WuXi. It acquired the genomics firm NextCode Health and joined a Chinese consortium that bought Ambrx, a California-based developer of antibody-drug conjugates for cancer treatment. In January, WuXi announced plans to spend $120 million on a biologics R&D and production center in Shanghai large enough for 800 scientists. And in May, WuXi launched a service allowing chemists worldwide to order the same lab chemicals that it uses in its own labs.

But WuXi’s biggest move came in December when it delisted from the New York Stock Exchange, where it had begun trading in 2007. Backed by private investors, Li paid $3.3 billion to buy out the firm’s public shareholders. Many market watchers speculate that Li intends to relist the firm in China, where company valuations are generally higher than in the U.S.

Li emphatically denies this. “The arbitrage value between the U.S. and China was totally not the reason,” he maintains.

Li says he made the decision to leave the stock exchange on March 7, 2015, after watching the company’s stock price plummet 20% when it announced fourth-quarter 2014 earnings. Although sales had increased 21% in the quarter, profits had increased by less than 3%.

Prior to the earnings report, WuXi’s managers had been explaining to analysts that the company was investing in new businesses, such as personalized medicine, that have bright prospects. But investors griped that the plan might take months, if not years, to turn a profit, Li recalls.

Investors expected WuXi’s growth to mirror that of an Internet-based company, Li says. “We don’t write an app one day and get 10,000 people the next day, and 100,000 on the third day,” he says.

WuXi’s methods may not have always pleased investors, but they did result in a doubling of the company’s value between 2010 and 2015.

In 2010, the U.S. animal model and clinical services firm Charles River Laboratories offered to buy WuXi for $1.6 billion. Although WuXi accepted the offer, the deal was panned as too risky and too pricey by Charles River’s shareholders. Charles River ultimately dropped it.

Five years later, Li secured investors willing to join him for a deal more than twice as big as the one Charles River rejected. “Jim Foster kept saying that, together, we would have this whole platform, faster than we could build it on our own,” Li recalls, speaking of the Charles River CEO. After the deal was canceled, “we went on to continue to build, and we’ve proven the value of this vision.”

Although Li claims to have no intention of relisting WuXi in China, the piecemeal listing of some of its operations is already happening.

A year ago, WuXi listed Syn-The-All Pharmaceuticals Co., its pharmaceutical chemical manufacturing business, on a Chinese stock market, a move that was explained as a way to award shares to managers. Bloomberg recently reported that WuXi is preparing to raise $1.5 billion on the Stock Exchange of Hong Kong by listing shares of its biologics business. A spokeswoman for WuXi, Hui Cai, declined to comment.

Operating one of the world’s largest drug discovery and development operations, WuXi would seem to be positioned to invent its own drugs. James Ma, president of the smaller contract research firm PepTech, is among those who believe it is part of Li’s master plan. “WuXi will seek the higher market valuations attached to having your own patents,” Ma predicts.

Some recent WuXi announcements imply a move in that direction. Ambrx, the antibody-drug conjugate firm WuXi acquired last year, is a drug developer. In November, WuXi said it was teaming up with Eli Lilly & Co. to develop drugs for the China market. It struck a similar deal in 2012 with AstraZeneca. And WuXi announced in December that it raised $350 million for a private equity fund that invests in innovative start-ups.

WuXi had a frenetic 2015

2000: Launches as purveyor of chemistry services.

2004: Expands into manufacturing with a small facility in Shanghai.

2007: Lists on New York Stock Exchange.

2008: Acquires biological services provider AppTec Laboratory Services in the U.S.

2010: Receives $1.6 billion takeover offer from Charles River Laboratories, but deal flounders a few months later.

2011: Enters biologics business.

2012: Sees a former employee jailed for intellectual property theft.

2014: Begins construction of its second, and much larger, facility for small-molecule manufacturing in Changzhou, China.

2015:

January: Acquires genomics firm NextCode Health.

March: Announces major expansion of its cell therapy operations in Philadelphia.

April: Supports efforts of small-molecule manufacturing subsidiary Syn-The-All Pharmaceutical Co. to list shares in China.

May: With Chinese partners, acquires Ambrx, a U.S. antibody-drug conjugate firm.

May: Launches online platform offering lab chemicals.

August: Announces plan to delist from the New York Stock Exchange and go private in a deal valuing WuXi at $3.3 billion.

December: Raises $350 million for its venture capital fund.

But WuXi has no plans to compete with its customers, Li argues. “From day one, I’ve said that WuXi is not going to become a pharmaceutical company,” he says. “We want to be a platform of technology, science, and capabilities to enable anyone to discover a new health care product to benefit patients.”

If WuXi were to pursue its own programs, it would become just another of the 6,000 pharmaceutical companies that already exist in China, he adds. “Why would we break something that is doing very well?”

The acquisition of Ambrx, Li says, was basically an efficient means to improve WuXi’s technology. As to teaming up with Lilly and AstraZeneca, “they actually use our capabilities to develop their products in China,” he says. Only 30% of all the drugs that the U.S. Food & Drug Administration has approved are available to Chinese patients. WuXi, he says, wants to help foreign companies increase this number.

Rather than moving toward drug discovery, Li says he is turning WuXi into a one-stop shop where other companies can fulfill all of their outsourcing needs.

When an innovative drug firm outsources various stages of an R&D program to different contractors, progress is slowed, Li says. By keeping all the components of a program in one place, a customer can save up to two years of development time. This is especially important for cash-strapped virtual firms and start-ups.

“It’s absolutely correct that a one-stop contractor reduces the cost of capital,” agrees George Baeder, director of China Global Insight, a California-based think tank on Chinese business issues. The delays drug companies incur when passing programs to different organizations are called handoff costs, Baeder explains. And “the big cost in drug development is the elapsed time in getting things done.”

But not every company is willing to take advantage of all that WuXi has to offer, he adds. “Small firms with few in-house capabilities could feel threatened when dealing with a huge firm like WuXi, while some larger biopharma firms are culturally averse to the ‘one-stop shop’ because the use of multiple CROs justifies continued employment of sizable internal R&D teams,” he says.

Another potential pitfall of the one-stop approach, Baeder adds, is trying to be the best at everything. Large pharmaceutical firms tried to do everything, he points out, in the days when they invented, manufactured, and sold every drug themselves. Their inability to excel at all things is what gave rise to pharmaceutical outsourcing in the first place, he points out.

Jay Wu, CEO of VM Discovery, a drug discovery firm in Fremont, Calif., has been working with WuXi since its early days, when Li traveled personally to the U.S. to meet clients. Wu likes Li and respects WuXi, but he still uses several CROs.

VM outsources biology, chemistry, and toxicology, and its managers prefer to work with the contractors they consider best in each field. “Not all of WuXi is good enough for us,” Wu says. VM managers usually get to know the research directors who manage their projects in China. If that director is competent and moves to a competing CRO, “our project follows,” Wu says.

Li maintains that many of WuXi’s clients value the one-stop shop. “Our platform, our capabilities, it’s helping to create a lot of value for our customers,” he says. Li points to Callidus Biopharma. A small company partially funded by WuXi’s venture capital arm, Callidus was acquired by Amicus Therapeutics in late 2013 for $130 million after it developed potential recombinant enzyme replacement therapies for certain rare diseases.

Prior to the acquisition, Callidus had moved “from an idea to a proof of concept in the animal model in 18 months” by relying on WuXi’s research capabilities, Li says. “As a scientist, you can’t have a better way to capitalize on your knowledge and experience than this.”

The rise of WuXi—and drug research outsourcing more broadly—over the past 15 years has coincided with an increase in the number of new drugs approved in the U.S. Compared with a low of 17 drugs in 2007, FDA approved 45 last year. Li could claim that the increase is the result of outsourcing, but he refrains from doing so.

“Science, knowledge, and technology contribute more than outsourcing does, honestly,” Li says. The drug industry, he says, is running many more research programs than it used to, and the challenge is to increase the success rate of those programs.

But, thanks to outsourcing, he does expect the number of new drug approvals to continue to rise. Many scientists who were hired by major firms in the 1980s, the heyday of the pharmaceutical industry, are nearing retirement age. “All those scientists—imagine, over 30 or 35 years, they accumulate a lot of knowledge,” Li says. He expects that, rather than retire, some of them will start their own drug research firms, relying on WuXi and other CROs to do much of the work.

Li may not know who among these scientists will be successful, but he’s confident that some of them will be. “Regardless if it’s about large molecules or small molecules,” he says, “the entry barriers have decreased so much.”

This article has been translated into Chinese and can be found here.

To see all of C&EN’s articles that have been translated into Chinese, visit http://cen.acs.org/cn.html.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter