Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical deals to surge

by Marc S. Reisch

March 21, 2016

| A version of this story appeared in

Volume 94, Issue 12

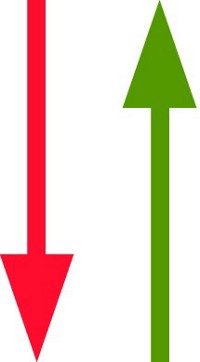

Global chemical industry merger and acquisition activity is surging in 2016 and is likely to outstrip 2015. With the pending combination of Dow Chemical and DuPont and ChemChina’s $43 billion deal to buy Syngenta, 2016 is on track to be a record year, according to a report from management consulting firm A.T. Kearney. The combined value of those two deals alone sets up the industry to surpass 2015 acquisitions totaling $110 billion and top the previous industry peak of $151 billion in 2011. Megadeals, such as last year’s $17 billion acquisition of Sigma-Aldrich by Merck KGaA and ChemChina’s $9 billion purchase of Pirelli, have been driving up overall deal value, but Kearney says deal volume should also increase in 2016. In 2015, 1,003 deals closed, down 3% from 2014. Hedging its bets, investment banking firm Valence Group says 2016 could be close to another record year. Given healthy chemical company balance sheets and limitations on organic growth in the current economy, Valence says many firms will try to expand through acquisition in the months ahead.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter