Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

General Electric to exit water treatment by 2017

Proceeds will pay for an enlargement of the firm’s oil services business

by Marc S. Reisch

November 2, 2016

| A version of this story appeared in

Volume 94, Issue 44

General Electric plans to sell its water treatment business by mid-2017 and put the proceeds toward the integration of the oil services firm Baker Hughes. The sale will end a nearly 15-year involvement with water treatment chemicals, equipment, and separation membranes.

The water sale is a coda to a much larger deal in which GE plans to purchase a nearly two-thirds stake in Baker Hughes for $7.4 billion. GE will fold Baker Hughes into its own oil and gas services business to create a behemoth with 70,000 employees and annual revenues of $32 billion.

The acquisition advances GE’s goal of melding digital tools with industrial and infrastructure operations. Baker Hughes brings service capability, whereas GE brings oil and gas equipment technology “with a digital framework,” GE Chairman Jeff Immelt told analysts on an Oct. 31 conference call.

“We have been evaluating the fit of water in our portfolio for quite a period of time,” Jeff Bornstein, GE’s chief financial officer, revealed on the call. GE once heralded water treatment as a global megatrend. But Bornstein says the “fragmentation” of water treatment markets makes it less attractive now. Other firms that have backed away include Ashland, which spun out its water treatment chemicals business in 2014.

GE entered water treatment in 2002 with the $1.8 billion purchase of BetzDearborn from Hercules. In 2006 it enlarged the business with the purchase of separation membrane maker Zenon Environmental for $650 million.

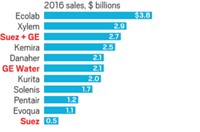

Today, the water business is embedded in GE’s power business, which has $22.5 billion in sales. GE doesn’t disclose the water business’s sales, although Bornstein said it has annual earnings of about $300 million.

The oil business has more upside potential than water treatment, says Ray Will, a director at the consulting firm IHS Markit. However, in making the shift, GE is not abandoning chemicals, Will points out. Baker Hughes is the number two player in oil production chemicals after Nalco.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter