Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

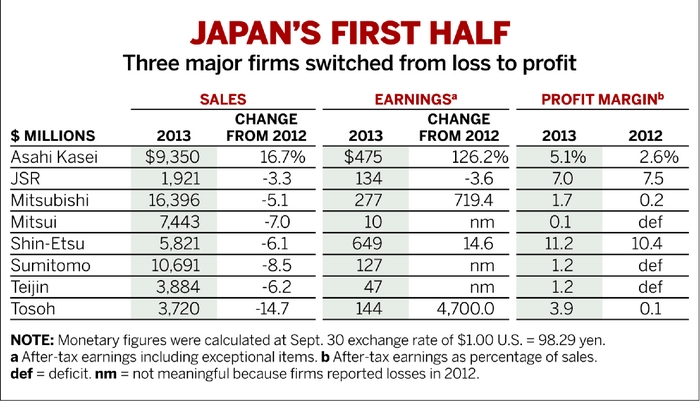

Strong run ends for Japanese chemical firms

First-half results paint mixed picture

by Jean-Francois Tremblay

November 9, 2016

| A version of this story appeared in

Volume 94, Issue 45

Note: Percent change over previous year’s first half.

Source: Companies

Note: Percent change over previous year’s first half.

Source: Companies

In a shift from the past three years, when profits steadily rose at major Japanese chemical companies, the picture was definitely mixed in the first half of the fiscal year that will end on March 31, 2017. Compared with a year ago, profits dropped at more than half of the companies surveyed by C&EN. And some of the ones that increased their net income did so with the help of one-time gains.

Asahi Kasei managed to post a 12% increase in net profit in spite of deterioration in its business. The company’s net income from operations suffered because of reduced styrene shipments and a write-down in goodwill in its lithium-ion battery separators business. The higher net income was thanks to a gain on the sale of securities and a reduction in taxes.

At Sumitomo Chemical, by contrast, such exceptional items caused additional pain. The company posted a net profit that was less than one third what it had been one year ago, partly because of a loss in the value of its stake in an affiliated firm. Operating income in Sumitomo’s petrochemicals business fell, while profit margins in its electronic materials business were wrecked by lower prices for liquid crystal display polarizers.

While most of its peers struggled with profitability, Shin-Etsu Chemical once again increased its net profit, by 14% this time. The firm is the world’s largest manufacturer of both polyvinyl chloride and silicon used in semiconductors.

Although the profitability of Shin-Etsu’s silicon business was unchanged from a year ago, operating income in PVC and chlor-alkali increased by a remarkable 26% because of strong results recorded in the U.S. In addition, Shin-Etsu boosted margins by 21% in its specialty chemical business, which consists largely of cellulose-based materials.

In general, major Japanese companies—Shin-Etsu included—said they were challenged by the rising value of the yen, which reduces the amount of profits they can earn from sales outside Japan. Adverse factors faced by the companies also included lackluster economic conditions in China and Europe.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter