Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Commodity Glut, Strong Dollar Pressure Chemical Company Earnings

Fourth Quarter: Plans go forward at Dow, DuPont for merger as Dow CEO Liveris plans exit in 2017

by Melody M. Bomgardner

February 8, 2016

| A version of this story appeared in

Volume 94, Issue 6

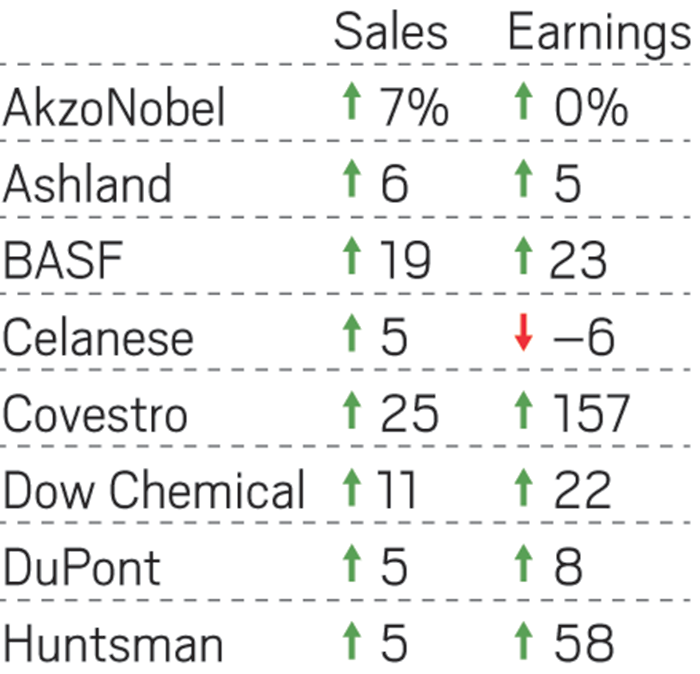

U.S. chemical firms faced a litany of problems in the fourth quarter of 2015: a strong dollar, weak prices in agriculture and petrochemicals, economic turmoil in Latin America, and slow growth in emerging markets. Add them up, and it’s no surprise sales and earnings figures sport a number of minus signs.

Wall Street’s focus was on Dow Chemical and DuPont, which plan to combine in a historic merger. At Dow, strong demand for high-margin products and swift cost-cutting made a silk purse out of an economic pig’s ear. The firm’s adjusted earnings per share of 93 cents beat analyst expectations by 23 cents.

“You can’t put a quarter like that together unless you have a great team aligned to shareholder value focused on margins, on cost, and on productivity and growing that top line based on quality market share,” said Dow CEO Andrew N. Liveris on a call with analysts.

Liveris’s team, which includes newly appointed President and Chief Operating Officer James R. Fitterling and Chief Financial Officer Howard Ungerleider, is also guiding preparations for the big merger. On the call, Liveris disclosed he will leave Dow once the merger is complete and plans are in place for a three-way split of the combined firm. He estimated that will happen by mid-2017.

For the quarter, Dow raised earnings 6.6% compared with last year, though price declines weighed down sales by more than 20%. On average, the firm sold 4% more products than a year ago. In China demand was up 10%.

Consumer spending translated into strong global demand for chemicals used in pharmaceuticals, automobiles, personal care, construction, and semiconductors. Polyurethanes, elastomers, water treatment membranes, and packaging plastics were all top sellers. But Dow faced weak markets for herbicides and products used in oil and gas drilling.

At DuPont, CEO Edward D. Breen focused on $730 million in cost-cutting and restructuring initiatives.

“We took a clean-slate approach to building a right organization for the future,” Breen said in an analyst call. “These efforts are bringing even greater discipline and rigor to the investments we continue to make in the businesses to maintain our competitive advantage.”

Although DuPont’s earnings met analyst expectations, they were down almost 75%. The firm’s nutrition and health segment saw 4% higher volumes compared with a year ago, thanks to sales of probiotics, yogurt cultures, and ingredient systems. Like Dow, DuPont enjoyed strong demand for polymers used in autos but suffered from low ethylene prices.

Demand was 8% lower in electronics because of competition for Solamet solar pastes. Cutbacks in oil and gas hurt demand for DuPont’s Nomex and Kevlar fibers. And the firm’s agriculture business swung to an operating loss.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter