Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

European regulators probe Bayer-Monsanto deal

Regulators fret over power the agchem giant would have

by Alexander H. Tullo

August 23, 2017

| A version of this story appeared in

Volume 95, Issue 34

The European Commission is opening an in-depth investigation into Bayer’s planned $66 billion purchase of rival Monsanto. Regulators are concerned about the market heft the two firms would have if they combine businesses in agricultural chemicals, seeds, and crop traits.

Together, Bayer and Monsanto would be the world’s largest supplier of crop protection chemicals. Their nearly $25 billion in annual sales would be ahead of Dow Chemical and DuPont, which are set to complete their own merger at the end of this month.

European commissioner for competition Margrethe Vestager worries that the combined Bayer and Monsanto may be too large. “We need to ensure effective competition so that farmers can have access to innovative products, better quality, and also purchase products at competitive prices,” she says.

Bayer and Monsanto submitted a proposal last month for addressing the EC’s preliminary issues with the merger, but their remedies were apparently insufficient. Bayer says it will work constructively with the EC, which has set a deadline of Jan. 8, 2018, to complete its review.

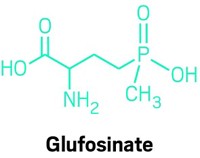

As part of its further investigation, the EC will delve into the two companies’ herbicide units. Monsanto makes glyphosate, used with its Roundup Ready seeds, while Bayer offers glufosinate, used with its special LibertyLink seed. The EC points out that glufosinate is one of the few available alternatives to glyphosate. It also notes that the two companies are among the few researching new active ingredients to combat weed resistance to herbicides.

These concerns do not come out of the blue. In May, Bayer received conditional approval for the merger from South African authorities, provided it divest LibertyLink-related assets.

The EC is also concerned about the overlap the companies would have in seeds. For example, it points out that Monsanto is the European market leader in rape seed and Bayer is the largest supplier globally.

The EC is looking at the merger in the context of a wave of consolidation in agricultural chemicals. In March, the EC cleared the Dow-DuPont deal provided that DuPont sell a portion of its crop protection business. In April, the EC approved ChemChina purchase of Syngenta on the condition that it divest a number of generic pesticides.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter