Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical industry slams Trump steel tariffs

Industry says moves to protect the U.S. steel and aluminum industries will hurt chemical makers

by Alexander H. Tullo

March 8, 2018

| A version of this story appeared in

Volume 96, Issue 11

The Trump administration’s decision to impose tariffs on imported steel and aluminum is unpopular with many industries, including the chemical sector. The U.S. industry’s leading trade group, the American Chemistry Council (ACC), is condemning the measure, saying it will hurt industry competitiveness.

In a White House ceremony before steel and aluminum industry workers on March 8, President Donald J. Trump signed a proclamation imposing a 25% tariff on imported steel and a 10% duty on aluminum. Trump left the door open to trading partners Canada and Mexico, as well as military allies, being exempt from the measures.

“Steel is steel,” Trump said. “If you don’t have steel, you don’t have a country.”

The administration has grown increasingly concerned about steel. Last month, the Commerce Department issued a report calling for the U.S. to reduce steel imports. Imports grew at double-digit rates in 2017, the report noted, and the U.S. now imports more than 30% of the steel it consumes.

Because of foreign competition, the Commerce Department said, the U.S. steel industry has closed six oxygen furnace facilities and idled another four since 2000, representing more than half of such plants in the U.S. “Domestic steel production is vital to national security,” it said.

But the Trump administration doesn’t speak with one mind on trade. Trump’s chief economic adviser, Gary Cohn, is resigning, reportedly because of his oppositions to the tariffs.

The ACC has asked Trump to reconsider the tariffs because they will drive up the cost of building chemical plants in the U.S.

“For a chemical manufacturing industry that has invested $185 billion in new factories, expansions, and restarts of facilities around the country, President Trump’s announcement comes at the worst possible time,” ACC said. “More than half of these investment projects are still in the planning stage, and market shifts caused by tariff increases may convince investors to do business elsewhere.”

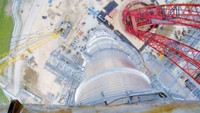

Petrochemical plants use a lot of steel. For example, Sasol estimates that the $11 billion ethylene cracker and downstream chemical complex it is erecting in Lake Charles, La., will require 58,400 metric tons of the metal.

Dow Chemical says steel accounted for roughly 20% of the cost of the $6 billion in petrochemical projects it has completed on the Gulf Coast. It agrees with ACC that the tariffs will be harmful to competitiveness.

Chemical firms are currently building eight major ethylene projects in the U.S., meant to take advantage of cheap ethane feedstock extracted from shale. Two projects were completed last year. Several more are under consideration.

And beyond construction costs, the chemical industry could be a casualty in any trade war that results from the tariffs, says Kevin W. McCarthy, a stock analyst with Vertical Research Partners. “The U.S. industry is a large net exporter and thus vulnerable to potential retaliatory trade actions,” he wrote to clients. “Indeed, new shale-gas-inspired projects along the U.S. Gulf Coast will render U.S. commodity chemical producers increasingly reliant upon export markets over the next three to five years.”

In a report, Goldman Sachs economist Jeffrey Currie warned about harmful impacts on the broader economy. “Industries that are net consumers of steel and aluminum in the U.S. now face cost disadvantages relative to their international competitors, especially at a time when the labor market is tight and wage inflation is picking up,” he wrote.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter