Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Drug company earnings outlook bolstered by tax cuts and repatriated cash

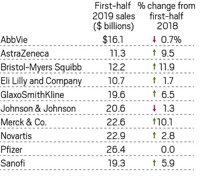

Big pharma and biotech companies’ sales continue to rise, and investors hold out for more M&A activity in wake of tax reform

by Ryan Cross

February 8, 2018

| A version of this story appeared in

Volume 96, Issue 7

The big drug and biotech companies had a rough start to 2017 when President Donald J. Trump accused them of “getting away with murder.” But as fears of a crackdown on drug prices dissipated, stock prices rebounded.

Now, as companies report full-year financial results, it’s clear that sales for most of them rose quite nicely.

Looking ahead, companies are adjusting their 2018 forecasts to account for the long-awaited U.S. tax reform—the Tax Cuts & Jobs Act—which slashes corporate tax rates and encourages the repatriation of company cash stored overseas.

In a call with investors to discuss fourth-quarter earnings, Pfizer CEO Ian C. Read said U.S. companies have long been at a “competitive disadvantage” to international firms. “The new tax code addresses these issues and helps level the playing field to make U.S. companies more competitive,” Read said.

Tax break

Many drug companies anticipate paying less taxes this year, thanks to the recently signed Tax Cuts & Jobs Act.

| COMPANY | 2017 TAX RATE | 2018 ANTICIPATED TAX RATE |

|---|---|---|

| AbbVie | 18.9% | 9% |

| Amgen | 18 | 14–15 |

| Biogen | 25 | 22.5–23.5 |

| Bristol-Myers Squibb | 21 | 20–21 |

| Eli Lilly & Co. | 20.5 | 18 |

| Gilead Sciences | 24.5 | 21–23 |

| GlaxoSmithKline | 21 | 19–20 |

| Johnson & Johnson | 17.2 | 16.5–18 |

| Merck & Co. | 19.1 | 19–20 |

| Pfizer | 20 | 17 |

Note: Select effective tax rate information based on 2017 company earnings reports and presentations.

AbbVie, maker of the blockbuster arthritis drug Humira, made the most aggressive tax prediction: The firm expects its 2017 tax rate of 18.9% to cannonball to 9% in 2018. AbbVie says that number will rise to 13% over five years, still well below the industry average. Humira sales increased 14% to more than $18 billion in 2017, composing over half the firm’s $28 billion in revenues.

Sales of once-hyped hepatitis C drugs from Gilead Sciences plummeted over 50% between the fourth quarters of 2016 and 2017. The drop was partly due to competition from AbbVie’s less-expensive product and partly because Gilead’s sofosbuvir-containing drugs are so effective at curing the disease that the patient population is shrinking.

Acknowledging its declining hepatitis C drug sales, Gilead made clear that it would add to its recent acquisitions in CAR T-cell immunotherapy. In an investor call, Gilead’s vice president of R&D, Norbert W. Bischofberger, hinted that the firm is in talks for collaborations with gene-editing companies, which will be an important part of developing CAR-T therapies for solid tumors.

Companies were mum on any merger and acquisition plans. In January, Sanofi and Celgene announced plans to acquire two companies each, and analysts are forecasting a heavier M&A season for 2018, though companies are not yet tying tax savings to M&A announcements.

Some companies reported large fourth-quarter losses due to a one-time tax for bringing cash stored overseas back to the U.S. Gilead said it expects to bring $28 billion home this year. Eli Lilly & Co. may tap up to $9 billion in repatriated cash, and Pfizer up to $24 billion.

Some of this cash will go to expanding in the U.S. Amgen will announce a new biomanufacturing plant this year. AbbVie and Pfizer plan to pour $2.5 billion and $5 billion, respectively, into U.S. capital projects. Employees are seeing some of the extra money too as firms add to pension plans and, in a few cases, dole out bonuses for nonexecutive workers.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter