Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Ex-DuPont CEO's words raise a ruckus

Ellen Kullman says the firm never intended to saddle Chemours with unlimited environmental liabilities

by Marc S. Reisch

October 30, 2019

| A version of this story appeared in

Volume 97, Issue 43

When DuPont’s board approved the terms of Chemours’s spin-off in 2015, it did not intend to impose “unlimited exposure for historical DuPont liabilities” on the newly formed maker of fluorochemicals and titanium dioxide, according to former DuPont CEO Ellen Kullman.

Kullman, who retired shortly after the spin-off, made that claim in documents filed Oct. 18 in a Delaware state court. Kullman also said the separation agreement was “not the product of negotiation between DuPont and Chemours” and that “DuPont unilaterally determined the terms of the Separation Agreement.”

Her affidavit could support a lawsuit that Chemours filed in May charging DuPont with unfairly burdening the spin-off with unlimited environmental liabilities.

DuPont, not surprisingly, takes issue with its former CEO. “Kullman’s assertions are entirely inconsistent with the facts as reflected in documents from the time and do not accurately reflect the process in which she directly participated in her role as Chair of the Board and CEO,” the firm says in a statement.

Chemours contends in the May lawsuit that DuPont grossly underestimated environmental liabilities Chemours was obligated to assume in the separation agreement. Because costs have greatly exceeded DuPont’s estimates, Chemours argues, DuPont should help pay the bills as it did two years ago.

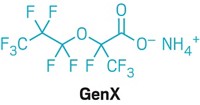

In 2017, DuPont kicked in $335 million to pay half the cost of a settlement with 3,500 people who claimed that exposure to perfluorooctanoic acid (PFOA) from a West Virginia fluorochemical plant made them ill. However, Chemours says the separation agreement saddles it with “uncapped” liabilities for a host of other environmental problems inherited from DuPont, including pollution claimed by the state of New Jersey and by drinking water customers in North Carolina.

DuPont contends that “allocating liabilities to Chemours was conducted as part of a standard spin-off practice.” In a statement it made about the dispute at the end of June, DuPont insisted Chemours should remain on the hook for liabilities it inherited. “We have no reason to believe Chemours is insolvent or otherwise unable to manage the liabilities allocated to it in the Separation Agreement.”

CORRECTION

This story was updated on Nov. 1, 2019, to add two words that were left out of DuPont statements.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter