Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Amazing Women

Ilham Kadri is reshaping Solvay

The first female CEO of a European chemical major begins a financial, social, and environmental overhaul of one of the oldest chemical firms

by Alex Scott

March 22, 2020

| A version of this story appeared in

Volume 98, Issue 11

Ilham Kadri became Solvay’s CEO and chairman on March 1, 2019. With her new role she broke the glass ceiling to become the first woman to lead a major European chemical company. Kadri, who has a PhD in macromolecular physical chemistry and was formerly a research chemist, gave an assured performance at her first annual Solvay financial results briefing last month, hinting at her broader business savvy.

Solvay’s revamp by the numbers

▸ $385 million: Annual cost savings by 2024 targeted by the restructuring

▸ 350: Number of staffers to be cut

▸ 26%: Share of the firm’s 2018 greenhouse gas emissions it plans to cut by 2030

▸ 2035: Year Solvay expects 50% of its managers to be women

▸ 65%: Share of Solvay’s products to be classified as sustainable by 2030

Already, Kadri has used her time in office to tighten management of the Belgian firm’s finances. Her big plans—which she is now beginning to implement—involve a shift in Solvay’s portfolio toward more profitable products, a step change in its environmental performance, and a social program that aims to get the best out of staff, especially women.

A French Moroccan, Kadri was born in Morocco and earned her PhD at Louis Pasteur University. She came to Solvay after a 22-year career with a number of chemical and manufacturing multinational companies.

At the briefing, she said she’s proud to be only the fourth non–family member to lead Solvay in its 156-year history. “It’s good to see people of different backgrounds supporting the company to be better,” she said.

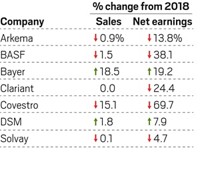

Kadri’s first year as CEO, though, coincided with challenging economic conditions for Solvay. The firm’s 2019 financial results were down slightly, with sales excluding currency fluctuations off by 2.2% to $11.5 billion and pretax profits for ongoing businesses down 2.8% to $2.6 billion.

Analysts have largely welcomed Kadri’s arrival and especially her tightening of controls on cash flow to place the firm on a more secure financial footing. “This is the first time in recent years when we can remember underlying free cash flow being anything better than a tight squeeze at Solvay,” Berenberg stock analyst Sebastian Bray told clients in a recent note. “Cost management has likewise outperformed expectations.”

Solvay’s tighter financial discipline is timely. Kadri is expecting that plant shutdowns in China during the first quarter as a result of the SARS-CoV-2 outbreak will reduce pretax profits by about $27 million.

The firm also faces a $33 million–$44 million cut in pretax profits because of reduced sales of carbon fiber composites and other materials for the 737 Max. Boeing is expected to reduce production of the plane from almost 600 in 2019 to 200 in 2020. “While we are working hard to mitigate the impact, it will be another tough year,” Kadri told analysts during the event.

At the same time that Kadri wrestles with such near-term issues, she has started to roll out a company-wide restructuring designed to improve Solvay’s underlying financial performance. At the heart of her approach is a reallocation of resources away from poorly performing businesses to more profitable ones.

Kadri has realigned Solvay into three divisions. The newly formed Materials division houses the firm’s specialty polymer and composite materials businesses, which Solvay is prioritizing for increased investment. A division named Solutions, featuring businesses operating in diverse, niche markets, will also be given more financial resources.

In contrast, Solvay will “selectively invest” in its third division, Chemicals, which features more traditional businesses, including soda ash, peroxides, and silica. Solvay plans to work Chemicals division assets as hard as it can in order to deliver cash for the more favored divisions.

Under Kadri’s new operating model, individual businesses have been given distinct mandates to cut costs and target spending. Kadri expects the strategy will deliver annual cost savings of at least $385 million by 2024 and generate substantial additional cash flow.

Kadri signaled the beginning of this process at the February briefing when she announced she is cutting 500 jobs from a company total of about 24,100. Some positions to go will be those of senior managers to “delayer” the company and streamline decision-making.

Kadri is also introducing 150 new jobs in more profitable businesses. The new positions will be in a range of roles, including R&D. The restructuring will not affect the company’s overall R&D spending of 3.3% of sales.

A second pillar of the new structure involves shifting Solvay onto a more environmentally sustainable footing via a new program called Solvay One Planet. The program is also intended to promote inclusion and diversity across the company.

Solvay One Planet features 10 targets, including a 26% reduction in greenhouse gas emissions by 2030 compared with 2018. Kadri said the reduction would enable Solvay to do its part to meet the 2015 Paris Agreement’s goal of limiting the global temperature increase to less than 2 °C above preindustrial levels.

Among its other targets for 2030, Solvay wants to increase the proportion of products it classifies as sustainable from 50% to 65% and reduce its 2018 consumption of fresh water by 25%. “What is different from the past is that this is a holistic approach. We are really going beyond only climate change,” Kadri said at the press briefing.

Kadri rejects the assertion that the firm should be targeting zero greenhouse gas emissions by some date far in the future. “I don’t like to commit without knowing,” she said.

Mostly no nonsense, Kadri revealed a little of her personality and management style during her briefing to journalists. “I am a ‘three things’ lady,” she said. “For projects, I ask, ‘Is it real? Can we win? Is it worth it?’ If I can answer yes, yes, yes, there is a 90% chance I will say yes.”

She demurred when asked about her unique role as a woman leading a European chemical company, pointing instead to her goal of increasing the percentage of middle and senior managers at Solvay who are women from 24% today to 50% by 2035. Kadri also seeks to make Solvay more inclusive when it comes to race, culture, and color, although she has no specific targets in this area.

Kadri estimates that implementing the new sustainability and social program will cost less than 10% of the company’s annual capital expenditure. And it will have a return on investment of between 8 and 10%, she said. “One Planet has to be good for the people, for the planet, and for the pocket—so this is not a charity plan. It’s part of our reallocation-of-resources plan.”

Once Solvay has finalized discussions with unions and other affected partners, it will accelerate the restructuring. Kadri expects to complete the program by the end of 2021. She said, “2020 is a year of transition. Remember my words.”

In this transition year, Kadri expects profits will be flat at best, with the potential to drop by 3%. “We are preparing for an even tougher 2020,” she said. Even if the novel coronavirus doesn’t hit the global economy hard, Solvay expects demand for its products from customer segments including aerospace, automotive, and oil and gas to weaken in the first half of 2020. Right now, Solvay expects the second half of the year will be better than the first half.

Should the market situation deteriorate further, though, “we can put a mitigation plan in place and execute flawlessly against it,” Kadri said. “If it is raining cats and dogs, we will be ready,” she said.

If Kadri’s confident showing at her first annual financial results briefing is anything to go by, she will take any kind of downpour in stride.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter